Dr. Ernest Addison, Governor of the Bank of Ghana (BoG) has stated that a strong fiscal consolidation is needed to reduce the high cost of borrowing in the country. According to him, the strong demand from the side of the budget is one of the lingering problems that the country faces in its attempt to reduce the lending rates in the country.

The Governor however, assured that the government is working assiduously to bring down the budget deficit which would complement the efforts of the Central Bank to reduce the cost of borrowing in the country.

“If we were seeing greater fiscal consolidation, the demand for loans or demand for bonds from the banks would be going down, and you would expect that the lending rates would also follow.

“Therefore, the issue of fiscal consolidation is also key in addressing this concern of high lending rates. We are working at it and government is working, doing their part by bringing down the budget deficit. It is not easy but they are pushing at it”.

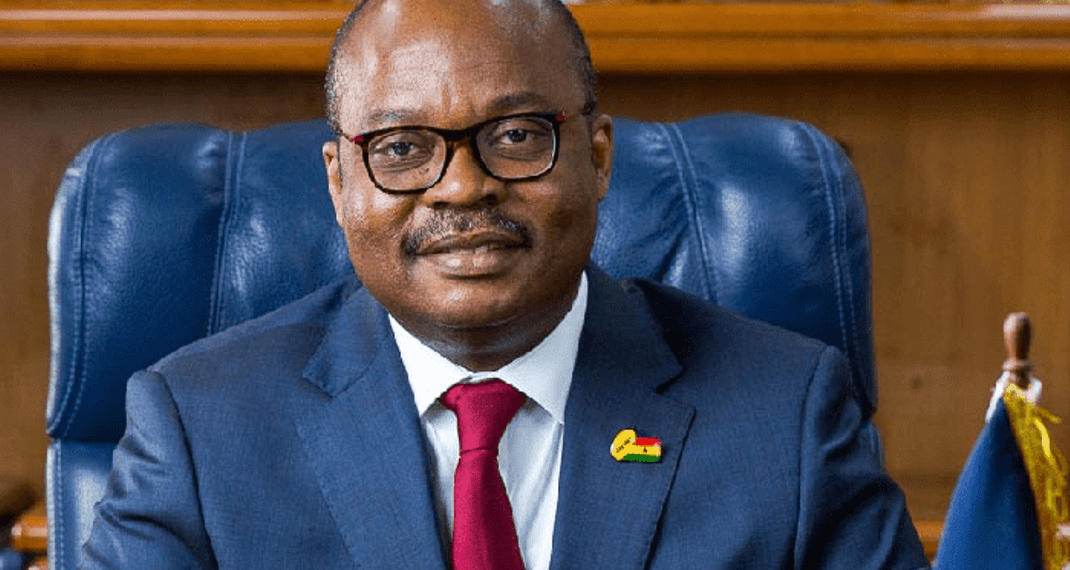

Dr. Ernest Addison

The Governor highlighted that Ghana has, however, made significant strides in reducing lending rates over the years. Dr. Addison stated that lending rates have declined from around 26 to 27 percent since 2016, and currently hovering around 20 percent. This, he said, “is more than 600, 700 basis points reduction over the past four years. This means there has been significant improvements”.

Varied reasons for high lending rates

In the quest to reduce the high costs of borrowing in the country, Dr. Addison highlighted the need to understand the factors that drive the country’s lending rates. The BoG Boss stressed two main factors, saying, “the macro conditions contribute to it, and the banking sector contributes to it”.

He highlighted the significance of running a balanced budget and its implications on lending rates in the country.

“If we run a balanced budget in Ghana, that is, our revenues equals to our expenditure, the banks are holding 80 billion Ghana Cedis in government bonds, where do you think that money would be and what do you think would happen to interest rates in that context?”

Dr. Ernest Addison

Rationale for raising the capital requirement for banks

In terms of the efficiencies of the banks, the Governor underscored that his outfit increased the capital requirement for banks which led to some mergers and acquisitions. He explained that because of the economies of scale that comes with larger banks, the expectation is that the unit cost of banking would go down and when that occurs, the gains will reflect in lower lending rates.

“This is the thinking behind raising the capital requirements, which shows some progress in trying to address this question of lending rates. We are working to ensure that the banks are becoming more efficient so that some of the efficiency gains will translate into lower lending rates.

“We have also put in place the credit infrastructure to help so that the banks would use them. The credit reporting systems and collateral arrangements are all supposed to help reduce the risks associated with lending and all of those measures should help bring lending rates down”.

Dr. Ernest Addison

Dr. Addison made these clarifications whilst responding to questions on the specific steps the BoG is taking to ensure that the gap between the policy rates and the lending rates is closed. The issue of the wide gap between lending rates and the policy rates has once again become topical with the President tasking the newly inaugurated Board of the Bank of Ghana to work to close the gap.

READ ALSO: EU and Ghana Have Good Relations in The Agriculture Sector – Ministry of Agriculture