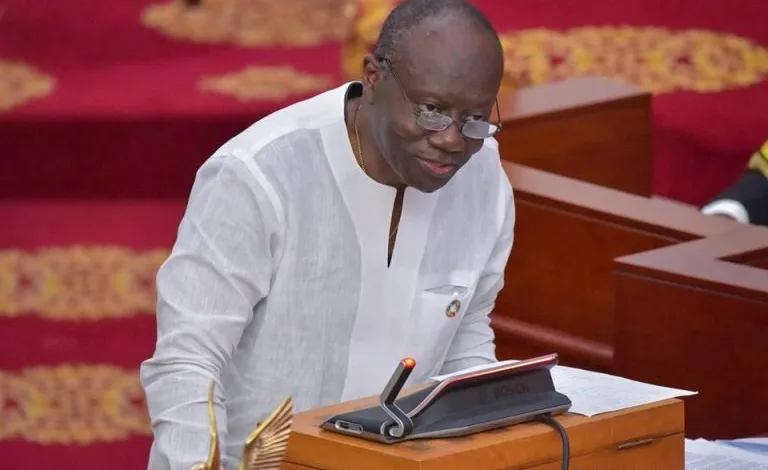

In his presentation of the 2024 Budget Statement and Economic Policy to Parliament on November 15, 2023, Finance Minister Ken Ofori-Atta asserted that Ghana had “turned the corner.”

Citing robust real GDP growth, significant disinflation, and currency stability, Ofori-Atta painted an optimistic picture. However, a cautious perspective is warranted.

Acknowledging the positive indicators, PricewaterhouseCoopers International Limited (PwC) remained cautiously optimistic, emphasizing that the finish line is still distant. The 2024 budget introduced socio-economic development programs, including investments in Planting for Food and Jobs Phase II (PFJ 2.0). While these initiatives could yield positive outcomes, the impending election year poses challenges to disciplined budget execution.

“At PwC, we accept that we might be turning the corner…Our advice to the Government is to adopt sound project selection and implementation approaches that will lead to producing commercial scale models/ pilots that would serve as effective anchors for driving the sector-wide transformation envisaged for the priority sectors listed in the medium-term growth strategy.”

PwC 2024 Budget Digest Report

Thus, PwC suggested to the government to be very prudent and not fall for the temptation of appealing to the masses.

“Specifically, we urge the Government to avoid the temptation to be overly generous in its application of “social protection and poverty reduction principles” during the 14-month first phase of the five-year Growth Strategy. Such social protection principles are likely to have populist appeal but would simply dissipate scarce financial resources in arrangements where project beneficiaries consider them as “handouts” and do not have sufficient incentive to generate results that could be self-sustaining and eventually grow to support an ever-increasing number of beneficiaries.”

PwC 2024 Budget Digest Report

Real GDP growth, averaging 3.2% in the first two quarters, surpassed the earlier conservative forecast of 1.5%. Headline inflation witnessed a notable decline, decreasing 1,890 basis points to 35.2%, approaching the 2023 end-of-year target of 31.3%. The Ghana Cedi displayed relative stability against convertible currencies, depreciating by 6.4% from February 2023, a considerable improvement from the 53.9% depreciation in the same period in 2022.

However, PwC advised the government to adopt sound project selection and implementation approaches, particularly in programs like PFJ 2.0. Emphasizing the importance of producing commercial-scale models to drive sector-wide transformation, PwC re-cautioned against the overly generous application of social protection principles that may lead to resource dissipation without sustainable results.

The 2024 budget set ambitious targets, such as a total revenue and grants goal of GH¢176.4 billion (16.8% of GDP) and a primary balance of 0.5% of GDP. While ambitious, PwC sees tangible promise in the budget but calls for innovation, discipline, widespread consultation, and transparent accountability in dealings with stakeholders.

“But to realize that promise, the Government needs to be innovative, have discipline, consult widely and sincerely, and be transparent and accountable in its dealings with its stakeholders.”

PwC 2024 Budget Digest Report

PwC underscored the critical role of Public Financial Management (PFM) reforms in ineffective budget execution. Encouraging the government to fully implement these reforms, PwC offers its knowledge and experience to support the Ministry in executing the PFM reforms agenda.

As Ghana navigates the path ahead, the 2024 budget presents opportunities for growth and stability. However, careful management, innovative strategies, and a commitment to fiscal discipline will be essential to overcome challenges and realize the promises embedded in the budget’s ambitious targets.

Macroeconomic Recovery At A Cost

According to PwC, Ghana’s Minister of Finance painted an optimistic picture of the economy’s nine-month performance, contrasting with a more subdued mid-year review in July. The provisional data however indicated an average real GDP growth of 3.2% in H1 2023, prompting a revision of the 2023 growth forecast to 2.3%, up from the mid-year projection of 1.5%. Notable achievements include a disinflationary trajectory, with headline inflation dropping by nearly 1900 basis points to 35.2%, a stable currency, improved international reserves, and fiscal consolidation.

However, PwC suggested that these gains have come at a significant cost to households and businesses. Interventions, such as a debt standstill, have alleviated immediate pressures but may lead to challenges if negotiations with external creditors stall. The microeconomic perspective reveals less glamorous images, with the banking industry reporting profits of GH¢6.2 billion, accompanied by a contraction in private sector credit and a rise in non-performing loans, signalling increased risk aversion.

PwC underscores the risk to the government’s macroeconomic growth targets in the current high-interest rate environment, potentially weakening the earning power of businesses and households.

READ ALSO: Speaker Defends Ghana’s Sovereign Against IMF Pressures