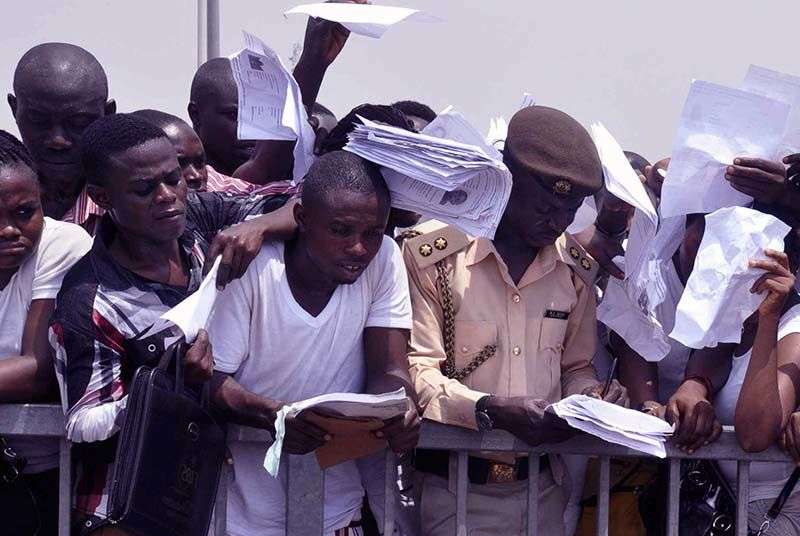

Fitch Solutions, a leading provider of credit intelligence and the primary distributor of Fitch Ratings contents, in its Ghana Consumer Outlook Report, has forecast the country’s unemployment (as a percentage of the labour force) to worsen by the end of the year 2023

According to Fitch Solutions, Ghana’s unemployment rate is expected to tick slightly higher to 4.0% at the end of 2023 from the 3.9% recorded in 2022.

However, in 2024, it forecasts unemployment to hold at 4.0%, and if accompanied by easing inflation, will see a rise in real wages for many households. While this marginal rise may not have a substantial bearing on consumer incomes, it is a real concern for the teeming youthful population. This is because the unemployment rate has been rising since 2017 and is expected to continue on this path over the medium term and beyond.

Fitch indicated that the size of the country’s labour force is reduced by low life expectancy at around 64.3 years of age, which is itself a result of the low level of government expenditure on healthcare and the prevalence of water-borne diseases and chronic illnesses such as HIV/AIDS.

The report further noted that, a shortage of highly skilled workers also means that employers have to import workers from abroad to fill the gaps in the domestic workforce.

Meanwhile, Fitch Solutions further stipulated that while the rate of price changes (inflation) is slowing, it remains higher than central banks’ targets and higher than what consumers have grown accustomed to, especially over the past decade.

The Impact of Inflation

The impact of inflation it says, will not be spread evenly across the different consumer spending segments, with the prices of some components, such as rent; services; and some food items (e.g. meat and poultry), remaining stickier and elevated over H223.

“If nominal wages cannot keep up with these high rates of inflation, consumers will continue to see erosions in their purchasing power. The uneven nature of price increases will mean that consumers will have to increasingly allocate more of their disposable income towards meeting basic necessities.

Over 2024, many markets will report significantly lower rates of inflation, as base effects play a role. If nominal wage growth continues to struggle to keep pace with inflation, household purchasing power will remain weak over 2024.”

Fitch Solutions

Ghana’s consumer price inflation came in at 43.1% y-o-y in July 2023 while food price inflation at 54.2% y-o-y, after having seemingly been on a downtrend since January 2023. This is significantly higher than what Ghanaian consumers are used to, where over 2015-2019, inflation averaged just 12.4% y-o-y.

Such high levels of inflation are creating substantial downward pressure on both real spending growth, but also on consumer and business sentiments. The recent reacceleration of inflation poses both risks to consumer purchasing power and also to interest rate cuts from the Bank of Ghana, which will keep the costs of debt servicing high for consumers, greatly discouraging any new consumer credit.

“We forecast inflation to end 2023 at 25.2% y-o-y, however, should inflation remain sticky over H223, it will substantially weaken our consumer outlook into 2024. Over 2024, we forecast inflation to average 18.2% y-o-y, which will allow consumers to start prioritising more non-essential categories. The slowing of food inflation will be particularly beneficial for consumer spending on other goods and services given that food and non-alcoholic drinks account for more than 40% of total household spending in Ghana.”

Fitch Solutions

Meanwhile, if this trend of rising unemployment rate is not reversed, it has the tendency of disrupting the peace of the country as in the case of Arab Spring.

READ ALSO: Animal Spirit Returns to Ghana Stock Market- Analyst