The government is formulating new regulations to introduce a “limited tax amnesty” targeting non-resident defaulting taxpayers and some domestic individual defaulters.

This initiative is intended to provide these defaulters with an opportunity to clear their outstanding tax obligations without incurring penalties and additional charges.

The measure is part of the government’s broader effort to enhance tax compliance and will eventually be expanded to cover all taxpayers within the year.

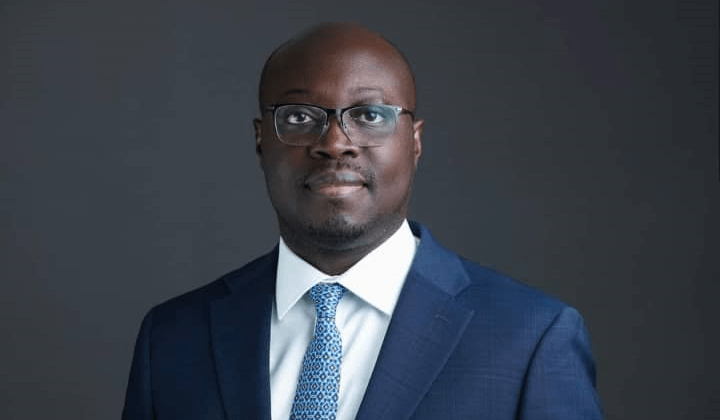

During a virtual post-budget forum organized by LIMA Partners, the Director of Revenue Policy at the Ministry of Finance, Daniel Nuer, elaborated on the tax policy measures outlined in the 2025 Budget. He emphasized that the introduction of a limited tax amnesty program is aimed at encouraging voluntary compliance among taxpayers.

“In line with the new approach, we’re looking at a programme to create what we termed as a limited amnesty in the sense that anybody who voluntarily walks to the Ghana Revenue Authority to pay tax has the opportunity to get a relief in terms of waiver of penalties on the outstanding payments.”

Daniel Nuer

According to him, the initiative has been extended further this year, with new legislation being drafted to offer additional relief beyond penalties.

“This has been expanded a bit more this year and there will be a legislation to support the initiative where now it’s not going to be just on the penalties but including interests. So the opportunity is given to individuals with foreign accounts but have not filed to come forward to do so by filling and there will not be any penalty or interests applied but they will only pay the taxes.”

Daniel Nuer

This means that individuals who have not declared their foreign earnings will have the chance to fulfill their tax obligations without facing interest or penalty charges.

Impact on Businesses and the Economy

The tax amnesty initiative is expected to provide relief to many taxpayers while boosting revenue collection. By allowing defaulters to settle their tax obligations without additional financial burden, the government aims to widen the tax net and enhance voluntary compliance.

Experts believe that the move will encourage businesses and individuals who have defaulted on their taxes to rectify their tax status without fear of severe financial consequences.

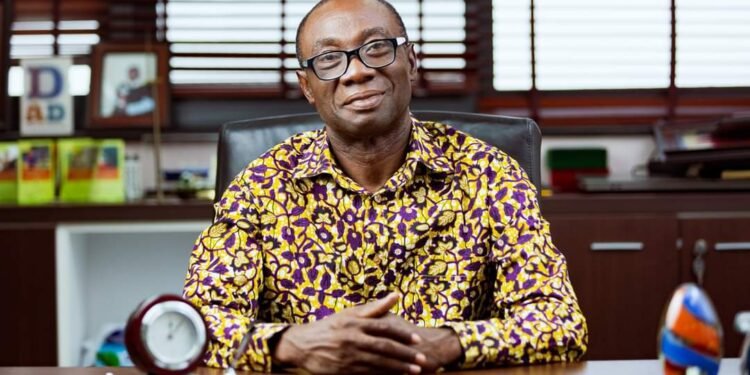

At the LIMA Partners Post Budget Forum, Senior Partner Kwame Ampofo underscored the importance of understanding tax policies and their implications for businesses. He urged stakeholders to take advantage of the forum and similar engagements to gain insights into government policies.

The forum, which was themed “Navigating Tax Policies and Business Impact,” served as a platform for discussing the economic and fiscal policies outlined in the 2025 Budget.

While the limited tax amnesty initiative is expected to drive compliance, it also raises questions about long-term tax discipline. Some experts argue that frequent tax amnesty programs could create a culture where taxpayers delay compliance in anticipation of future waivers.

To address this concern, the government will likely implement stricter measures post-amnesty to ensure sustained compliance. By complementing the amnesty with enhanced tax enforcement and digitalization efforts, authorities hope to build a more robust tax system that minimizes defaults in the future.

As the initiative rolls out, businesses and individual taxpayers are encouraged to take advantage of the amnesty period to regularize their tax affairs, ensuring they remain in good standing with the Ghana Revenue Authority.

READ ALSO: Minority Raises Alarm Over Unlawful Raids on Political Opponents