The Ghanaian payment system is recovering very steadily from the fallout of the coronavirus pandemic just as well as the economy is.

The Governor of the Bank of Ghana, Dr. Ernest Addison, stated last month that Ghana’s economy is rebounding faster than expected. With the positive signs of a rebound, the central bank is predicting 2% to 2.5% growth this year, compared with earlier estimates of 0.9%.

The Bank of Ghana pointed out that it has monitored high-frequency economic indicators that have all gained some traction due to supportive fiscal and monetary policies and the easing of COVID restrictions.

After contracting in March, April, and May, the real Composite Index of Economic Activity (CIEA) recorded an annual growth of 10.5 percent in September 2020, compared with 4.2 percent growth a year ago.

Also, IHS Markit stated in its latest Purchasing Managers’ Index (PMI) report on Ghana that growth was sustained in Ghana’s private sector midway through the final quarter of the year as the economy’s recovery from the coronavirus disease 2019 (COVID-19) downturn continued.

“The latest PMI data points to a sustained recovery in Ghana’s private sector, with the economy on course to end a difficult year positively. Hopes are also high heading into 2021, with companies generally expecting the COVID-19 pandemic to become a thing of the past. IHS Markit is forecasting a rise in GDP of 1.5% next year”, said Andrew Harker, Economics Director at IHS Markit.

Recent Macroeconomic and Financial Data from the central bank shows that the renewed optimism in the economy has filtered into the payment systems.

Chart 1 shows that the total value of Mobile Money transactions has increased from GH¢33.8 billion in March to GH¢58.0 billion in October 2020. This corresponds to the increment in the total number of transactions from 205million in March to 278 million in October 2020. Registered mobile money accounts have also seen a rise in post lockdown era from 34.3million in March to 36.9 million in October

Figure 1 total value of mobile money transactions (GH¢ ‘billion)

Source: Bank of Ghana

Similarly, the total value of E- zwich transactions increased to GH¢872.0 million in October 2020 from GH¢814.1 million recorded in March. Further analysis of the data revealed that the total number of transactions which stands at 613 thousand in October is yet to reach pre-COVID levels of 957 thousand in January 2020.

Figure 2 total value of E- zwich transactions (GH¢ ‘million)

Source: Bank of Ghana

Between September and October 2020, E-zwich transactions went up by GH¢218 million which culminated in a month-on-month growth of 33.3%. The total value of E-zwich transactions was GH¢654.0 million in September 2020.

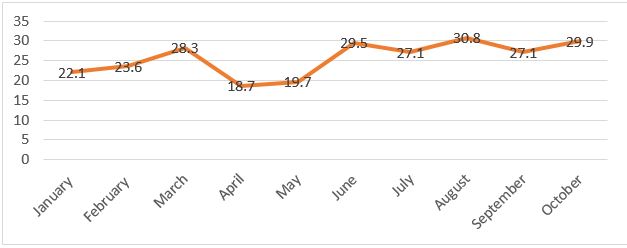

Furthermore, the total value of Gh-link transactions increased from GH¢22.1million in January 2020 to GH¢29.9 million in October 2020. The total number of transactions has also increased from 62 thousand in January to 71 thousand in October 2020.

Figure 3 total value of Gh-link transactions (GH¢ ‘million)

Source: Bank of Ghana

Total Transaction Value of Ghipss Instant Pay (GIP) has also increased from GH¢299.1 million in January 2020 to GH¢1071.1 million in October 2020. The total number of transactions has also increased to 748 thousand in October 2020 from 301 thousand in January.

Figure 4 total value of GIP transactions (GH¢ ‘million)

Source: Bank of Ghana

The value of Mobile Money Interoperability (MMI) has increased from GH¢129.9 million in January 2020 to GH¢785.7 million in October.

The total number of MMI transactions has also increased from 1.6 million in January 2020 to 5.1 million in October 2020. In October 2019, the number of MMI transactions was 1.3 million. This indicates that the total number of MMI transactions have increased by 3.8 million within the past year.