The IHS Markit Ghana Purchasing Managers’ Index (PMI) inched down to 52.5 in November from 53.1 in October.

However, the index remained above the neutral 50-threshold that separates improving from deteriorating conditions in the private sector economy compared to the prior month.

This is according to a recent survey conducted by IHS Markit for November 2020.

IHS Markit stated that the downtick midway through the final quarter of the year came on the back of a slightly softer increase in new orders, leading firms to onboard more staff and increase business activity. Moreover, backlogs of work continued to build albeit at a softer pace.

Turning to prices, the survey found that input costs rose partly on the back of greater staff costs, while raw material shortages also drove input prices up. Some firms linked greater input costs to currency weakness. Higher costs were partly passed on to clients, with output prices rising for the seventh month running. Lastly, business confidence remained stronger than the series average on hopes of an end to the pandemic and restrictive measures.

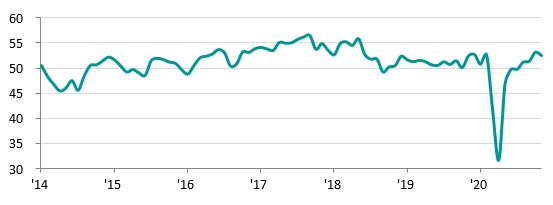

Figure 1: Ghana PMI

Source: HIS Markit.

Although easing from October’s 28-month high, the rate of growth was solid. Some respondents indicated that new business had risen ahead of the upcoming elections. With new orders increasing, companies also expanded their business activity and took on extra staff. In both cases, growth was recorded for the fourth month running.

While activity increased at a solid pace, the rate of job creation was only marginal and insufficient to prevent a further build-up of outstanding business. That said, the latest rise in backlogs was the slowest in four months as some firms reported having been able to successfully deplete work-in-hand.

In line with ongoing job creation, companies also signaled a modest increase in staff costs. Purchase price inflation continued to run at a higher rate than seen for staff costs, despite the latest rise being the softest since June.

Raw material shortages reportedly led suppliers to increase their prices, while some companies linked inflation to currency weakness. Difficulties securing materials were also behind a further lengthening of suppliers’ delivery times, with vendor performance worsening for the ninth month running.

These delays prevented firms from raising stocks of purchases despite a solid increase in input buying. Inventories were unchanged in November, having risen marginally during October. The passing on of higher input costs to customers resulted in a seventh consecutive increase in selling prices. That said, the rate of inflation was slight, having eased from that seen in the previous month.

Firms generally expect the COVID-19 pandemic to have passed by this time next year, leading to a reduction in restrictions and improving business activity. Sentiment remained stronger than the series average, despite moderating slightly from October.

Around three-quarters of respondents predicted a rise in output over the coming year, with just 3% pessimistic regarding the outlook.

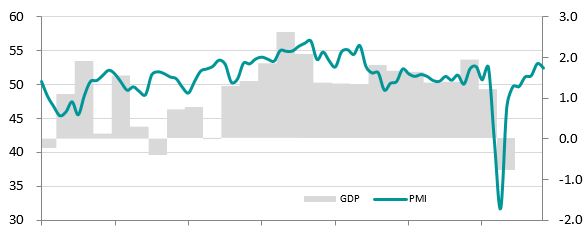

Ghana PMI Output Index Gross domestic product (GDP)

Sources: IHS Markit, Ghana Statistical Service.

Andrew Harker, Economics Director at IHS Markit, said: “The latest PMI data points to a sustained recovery in Ghana’s private sector, with the economy on course to end a difficult year positively. Hopes are also high heading into 2021, with companies generally expecting the COVID-19 pandemic to become a thing of the past. IHS Markit is forecasting a rise in GDP of 1.5% next year.

“One aspect potentially holding the recovery back at present is access to materials. Firms reported that supply shortages affected purchase prices, their ability to secure inputs on time, and inventory levels.”

IHS Markit is a world leader in critical information, analytics, and solutions for the major industries and markets that drive economies worldwide.

The IHS Markit Ghana PMI is compiled by IHS Markit from responses to questionnaires sent to purchasing managers in a panel of around 400 private sector companies. The panel is stratified by detailed sector and company workforce size, based on contributions to GDP. The sectors covered by the survey include agriculture, mining, manufacturing, construction, wholesale, retail, and services. November data were collected 12-26 November 2020.

The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease.

The indices are then seasonally adjusted. The headline figure is the Purchasing Managers’ Index (PMI). The PMI is a weighted average of the following five indices: New Orders (30%), Output (25%), Employment (20%), Suppliers’ Delivery Times (15%), and Stocks of Purchases (10%). For the PMI calculation, the Suppliers’ Delivery Times Index is inverted so that it moves in a comparable direction to the other indices.