Economist Prof. Godfred Bokpin has called for a reassessment of the government’s methods for raising revenue, warning that the current approach is worsening inequality across the population.

Addressing attendees at the 6th International Research Conference of The College of Humanities at the University of Ghana, Prof. Bokpin stressed the need to rethink fiscal policies to address inequality, with a focus on tax strategies.

During a discussion with journalists at the event in Accra, Prof. Bokpin highlighted the critical role of fiscal measures in narrowing economic disparities.

He expressed concern that the current tax system disproportionately affects marginalized communities, contributing to the widening wealth gap.

Prof. Bokpin emphasized the importance of developing policies that promote fairness and equity in revenue generation to foster a more inclusive society.

“Unfortunately, Ghana has chosen a path that is of waste is inequality, because of consumption-based taxes that we are focusing on that affect the poor and the marginalized and institutionally excluded more compared to the rich,” he said on Thursday, May 16, 2024.

Highlighting the potential of taxing high-net-worth individuals, Prof Bokpin revealed that Ghana could raise over $500 million from the super-rich within the country.

“For instance, if you look at Ghana’s personal income tax, and how much we are making from there, we are not [not making much] at all. In fact, when we did some work about two and a half years ago, we realized that if we had some progress in taxing high-net-worth individuals in this country.

“We would be able to raise more than $500 million from the super-rich in this country. This country has a number of super-rich Ghanaians.”

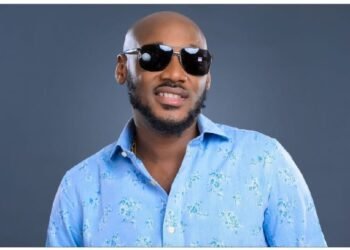

Prof. Godfred Bokpin

However, Professor Bokpin also criticized Ghana’s tax system for its inefficiency, highlighting the low revenue generated from personal income taxes. He also emphasized the critical role of effective public spending in tackling inequality.

He stressed the importance of thoughtful consideration in revenue generation and expenditure, as ineffective use of funds can exacerbate inequality despite substantial nominal spending.

Tax Evasion Tactics and Progressive Solutions

Professor Godfred Bokpin’s assessment followed a presentation by Anthony Kamande, Inequality Research Coordinator for Oxfam International, who discussed methods for combating inequality through progressive taxation.

During the session on taxation, the Oxfam official detailed ways in which wealthy individuals evade taxes.

He highlighted several strategies used by the wealthy to avoid paying taxes, including the “Buy-borrow-die” approach, utilizing tax havens, lobbying for tax exemptions, and engaging in tax evasion.

Mr. Kamande proposed stricter measures on property taxes, inheritance taxes, and the net wealth of millionaires and billionaires above a certain threshold.

However, he emphasized that simply collecting these resources is not enough; they must be effectively utilized for public benefit.

The conference, themed ‘Addressing Inequalities: Building Socio-economic and Environmental Resilience for Sustainable Development,’ convened faculty members, students, experts, media, and other stakeholders for three days of discussions.

The event facilitated debates on theoretical frameworks, innovative initiatives, and practical strategies to combat global inequalities, offering insights into solutions aimed at fostering sustainable development.

Some of these strategies include strengthening tax enforcement through increased audits and investigations targeting high-net-worth individuals.

Also, implementing transparency measures that require public disclosure of asset ownership can help curb the use of tax havens.

Additionally, revising tax laws to close loopholes and limit excessive exemptions will create a fairer tax system.

Collaborating with international partners to combat cross-border tax evasion and improving public awareness about the impacts of tax evasion are also vital steps.

These efforts will enhance Ghana’s tax system, ensuring greater equity and generating essential revenue for public services while reducing inequality.

READ ALSO: Sarkodie Announces Partnership To Offer Fans Shares In His Music