The rise in currency issuance and maintenance expenses further lends support to calls for Ghana to consider issuing a digital currency. Ghana spends a total of GH¢1,145,506,000 on currency and issue expenses between 2011 and 2019, according to Bank of Ghana annual reports.

This means that on average, government spent GH¢127,278, 000 on printing new currency and meeting other currency-related expenses each year. Some of these expenses Include agency fees, Note printing, coin minting, and other currency expenses.

“They print and charge in British pounds …because each banknote costs a lot of money. Think of it; the paper, the security features and the ink. A lot goes into it”, said Retired Deputy Governor of the Bank of Ghana (BoG), Mr Emmanuel Asiedu-Mante.

According to Mr.Asiedu-Mante, De La Rue, a security printing firm based in the United Kingdom prints the Ghana Cedi. This means that Ghana may even be paying more than this due to currency instability. A depreciation of the Cedi against the British Pound Sterling has been increasing the cost of printing the money.

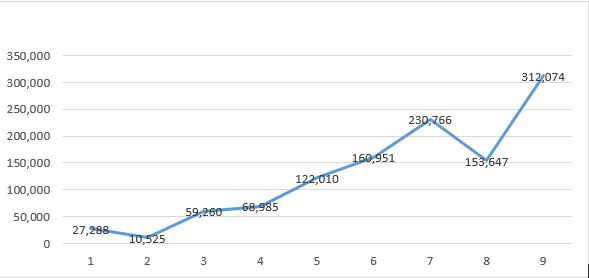

Trends in currency Issuance

Figure 1 shows that the currency issuance expenses rose from GH¢27,288, 000 in 2011 to GH¢ 312,074,000 in 2019. Even though this may look small, it should be a major concern to the state especially at this time when more resources are needed to fight the pandemic and save lives and livelihoods.

Figure 1: Currency and Issuance Expenses (GH¢’000)

Source: Bank of Ghana

In the interim, more education is required on the proper handling of the currency. However, it is now evident that the physical currency will soon pave the way for a digital currency sooner than later. With plans of going cashless, the digital currency could be one of the options the Central Bank of Ghana could explore.

Earlier this month, Dr. Ernest Addison, Governor of the Bank of Ghana said “I think there is a lot more emphasis on looking at digital money which is backed by the state, backed by the central banks”. This could possibly mean that Ghana is considering the introduction of a digital currency. But, how soon will this be?

Already, many countries in the world are exploring the possibilities of rolling out a digital currency. For instance, the Central Bank of Nigeria (CBN) has hinted of a pilot for the introduction of digital currency into the nation’s financial ecosystem. Tanzania’s President has also made some comments that show it may consider introducing a digital currency soon.

Going Cashless

Recently, the CEO of the Ghana Interbank Payment and Settlement Systems (GhIPSS), Archie Hesse, called for the need to make cash transaction more expensive in the country as a way of encouraging people to embrace electronic payment systems.

Whilst going cashless has been a dream for many economies, the outbreak of the pandemic has made cashless transactions a necessity rather than just a government policy option. Moreover, the recent attacks on bullion vans in the country raises concern as to how safe and secured handling psychical cash has become.

A cashless economy comes with several advantages if well implemented and accepted by all. A reduction in organized crimes is one of such advantages. For instance, research show that crime rate dropped by 9.8% in Missouri when the state introduced an Electronic Benefit Transfer (EBT) cards to replace cash welfare payments.

Meanwhile, the outbreak of the COVID-19 has taught us that currency notes can be a medium of transmission of bacteria and viruses. Therefore, a digital currency could further cushion the cashless economy agenda whilst safeguarding the health of citizens. However, government must not also rush into introducing a digital currency into the economy.