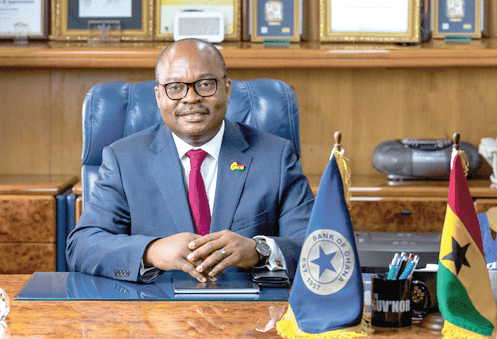

Dr. Ernest Addison, Governor of the Bank of Ghana (BoG), will proceed on terminal leave starting Monday, February 3, 2025, as he prepares for his official retirement on March 28, 2025.

This transition marks the end of his two-term tenure, which began in April 2017. Sources within the central bank have confirmed that his leave is in line with the provisions of the Bank of Ghana Act, 2002 (Act 612), as amended, and has received approval from President John Dramani Mahama.

Dr. Addison’s tenure as Governor has been characterized by decisive reforms and policies that have shaped Ghana’s financial sector. When he assumed office in 2017, the country’s banking sector was in distress, plagued by insolvency issues and weak regulatory compliance. Under his leadership, the BoG implemented a bold banking sector cleanup, revoking licenses of undercapitalized financial institutions and enforcing stringent regulatory measures. This exercise restored stability to the sector, strengthened investor confidence, and ensured depositors’ funds were protected.

Beyond the banking reforms, Dr. Addison played a key role in maintaining macroeconomic stability. He championed monetary policies that helped keep inflation within target, stabilized the Ghanaian cedi, and ensured prudent management of the country’s foreign exchange reserves. His administration prioritized inflation-targeting measures that contributed to a steady reduction in inflation rates, despite economic shocks such as the COVID-19 pandemic and global financial volatility.

Strengthening Monetary Policy and Exchange Rate Stability

Throughout his tenure, Dr. Addison remained committed to ensuring monetary policy discipline. Under his stewardship, the Monetary Policy Committee (MPC) made strategic decisions to control inflation while fostering economic growth. The central bank employed a mix of interest rate adjustments and forex market interventions to stabilize the local currency. This helped to reduce exchange rate volatility, making Ghana’s economy more resilient against external shocks.

His leadership also saw a focus on building Ghana’s foreign exchange reserves to support the country’s external trade needs. The BoG’s interventions in the forex market helped cushion the cedi against excessive depreciation, ensuring greater stability for businesses and investors.

One of Dr. Addison’s defining achievements has been his commitment to digital transformation in Ghana’s financial sector. Recognizing the growing role of technology in financial services, he led the BoG’s push for innovations that enhanced financial inclusion and improved payment systems. His administration oversaw the introduction of the eCedi, Ghana’s central bank digital currency (CBDC), which was piloted to assess its feasibility in improving digital payments and financial access.

In addition to the eCedi initiative, Dr. Addison worked to create a regulatory environment that encouraged fintech growth while ensuring financial stability. His tenure saw significant advancements in mobile money interoperability, allowing seamless transactions across different financial service providers. These initiatives have played a key role in expanding access to financial services, particularly in rural and underserved communities.

Dr. Addison’s decision to proceed on terminal leave is in line with standard governance procedures at the BoG. His departure has been endorsed by President John Dramani Mahama, setting the stage for a leadership transition at the central bank. As he prepares to exit, attention now shifts to the appointment of his successor, who will be tasked with continuing the bank’s monetary policy agenda and addressing economic challenges facing the country.

With Ghana still navigating post-pandemic economic recovery, exchange rate fluctuations, and inflationary pressures, the next BoG Governor will inherit a complex financial problem. The successor will be expected to consolidate the gains made under Dr. Addison, strengthen financial regulation, and explore new strategies for maintaining economic stability.

READ ALSO: Vice President Calls for Strong Commitment to AfCFTA Implementation