Ecobank Transnational Incorporated (ETI), the parent company of the Ecobank Group, has made the difficult decision not to declare dividends for its 2024 financial performance, despite recording outstanding results across all business segments.

This decision was announced at the company’s Annual General Meeting (AGM) and Extraordinary General Meeting (EGM) held in Lomé, Togo.

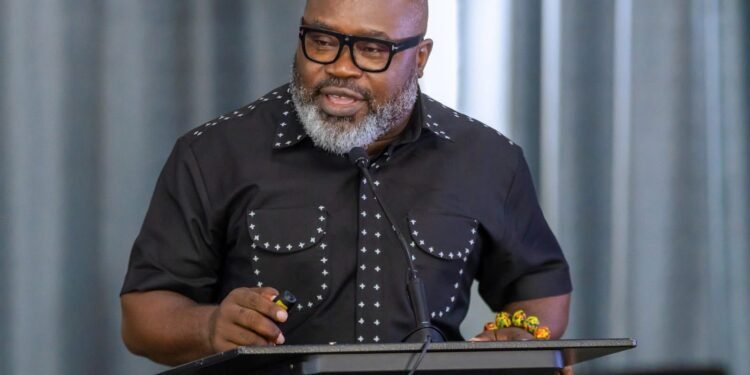

Addressing shareholders at the AGM, Board Chairman Papa Madiaw Ndiaye acknowledged the emotional and financial impact of the decision, particularly on the majority of shareholders who depend on dividend income. “Of the 641,000 shareholders of ETI, about 600,000 own fewer than 10,000 units and rely on dividend payments,” Mr. Ndiaye said.

He emphasized that the decision was not taken lightly, describing it as “very difficult” but necessary for the bank’s long-term sustainability.

“We wanted to strengthen the balance sheet to pave the way for accelerated growth. We faced the difficult decision of either servicing the debt and complying with existing debt covenants or paying dividends.”

Papa Madiaw Ndiaye

Ndiaye admitted the disappointment many shareholders would feel, but stressed the importance of positioning the bank for future gains. “Not paying dividends again is disappointing, and explaining our reasoning is crucial,” he added.

Robust Financial Results in 2024

ETI’s decision comes in the wake of a record-breaking financial year. For the second consecutive year, the group surpassed $2 billion in revenue. Profit attributable to shareholders reached $333 million, reflecting a 45% increase at constant exchange rates. Profit Before Tax (PBT) rose to $658 million—a 33% year-on-year jump after adjusting for currency fluctuations.

The bank posted a return on equity (ROE) of 32.7%, its highest ever, showcasing the effectiveness of its growth strategies. Customer deposits stood at $20.4 billion, while total assets reached $28 billion.

All three of ETI’s core business segments posted strong growth in 2024: Corporate & Investment Banking led the way with $1.1 billion in revenue, driven by trade finance, payments, and cash management solutions.

Consumer Banking reported a 15% increase in revenue and onboarded over 1 million new customers, indicating strong market penetration and product relevance.

Commercial Banking experienced 12% growth, propelled by improved lending activities and transaction banking services.

These numbers reflect the bank’s solid operational execution and expanding customer base across its pan-African footprint.

Shareholder Support Amid Concerns

Despite initial concerns, shareholders overwhelmingly supported all the resolutions presented at the AGM. These included the approval of 2024’s financial statements and appropriation of profits, appointment of an additional auditor, re-election and renewal of board member mandates, and the authorization to raise additional funds and amend the company’s Articles of Association.

The broad shareholder backing indicates a recognition of the bank’s long-term strategy, even amidst the disappointment over dividend suspension.

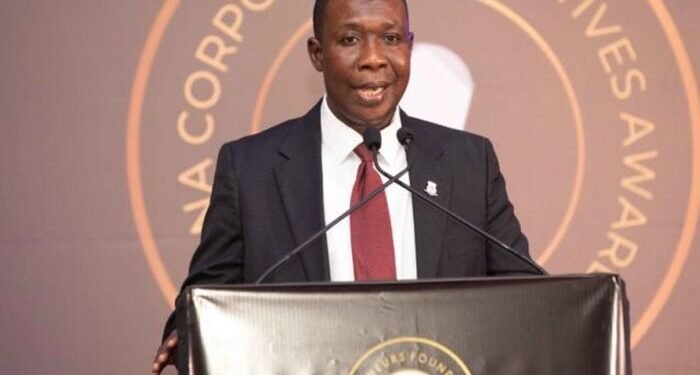

Group Chief Executive Officer Jeremy Awori provided assurance that the bank’s long-term vision remains intact and highly strategic. Outlining plans to enhance customer experiences, Awori promised expanded access to savings and investment products, quicker and more affordable money transfers, and innovative financial planning tools such as mortgages and wealth management services.

“In 2024, we began reorienting the Bank to achieve these goals, while always remembering that long-term revenue growth remains the key driver of value and sustainably high returns on equity.”

Jeremy Awori

He further highlighted an encouraging first quarter for 2025, marked by a rising return on equity, lower cost-to-income ratios, and significant gains from ongoing digital transformation initiatives. Awori reiterated that strengthening the balance sheet remains central to unlocking the next phase of growth.

While the absence of dividends in 2024 is understandably disappointing to many shareholders, ETI’s leadership has set a clear course aimed at ensuring long-term profitability and shareholder value. The bank’s strong financials, growth in core segments, and strategic investments in digital and customer-centric solutions are positioning it to become even more competitive across Africa.

As the Group continues to navigate complex economic conditions and regulatory landscapes, its focus on debt management and capital adequacy may well prove to be a prudent move—paving the way for more sustainable dividends and stronger performance in the years to come.

READ ALSO: IMANI: Ghana’s Green Businesses Are Being Held Back