The interest rate at which banks lend to individuals and the private sector has eased significantly to 21.3 percent by the end of October 2020 from 24 percent in October 2019, indicating a year-on-year decline of approximately 2.7 percent.

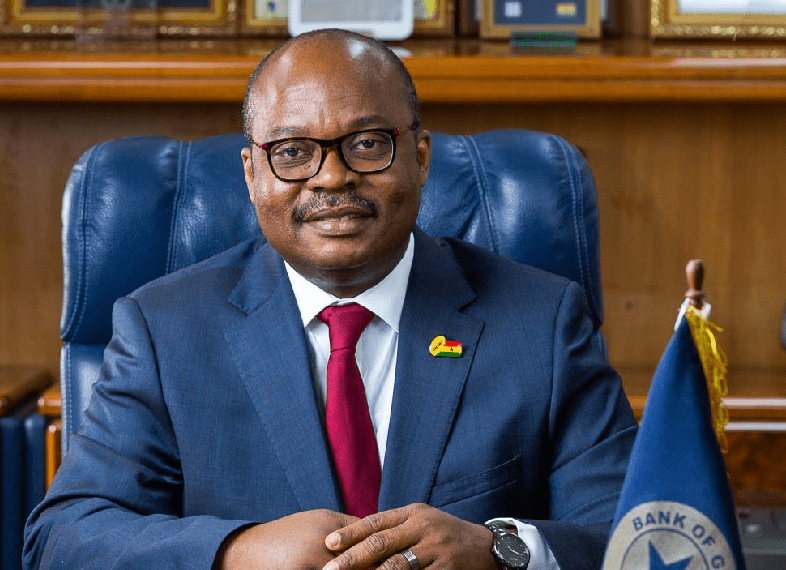

Speaking at the 97th MPC press conference, the Governor of the Bank of Ghana, Dr. Ernest Addison, said the drop in interest rates was on the back of the “cut in the monetary policy rate in March 2020” to 14.5 percent from 16 percent and has since been kept as such for the rest of the year.

The downward adjustment of the monetary policy rate impacted “the weighted average interbank lending rate, that is the rate at which banks lend to each other,” causing it to decline to 13.6 percent in October 2020 from 15.2 percent same period last year, Dr Addison remarked.

This means banks can borrow from their counterpart and the Central Bank at a lower interest rate and also individuals and the private sector can have access to loans at a cheaper interest costhence, doing business becomes much easier and confirms what was said at the previous MPC meeting that “while the pandemic has increased the industry’s cost of operations, banks have not passed on the associated costs to consumers through higher interest margins.”

“Net outstanding claims on the private sector, which also captures repayments to the banking sector, show some moderation since the beginning of the year. With respect to new advances, the data shows that cumulatively from the beginning of the year, new loans to support economic activity stands at GH¢27.4 billion compared with GH¢21.3 billion for the same period of last year”.

At the previous MPC meeting, the Governor of the Bank of Ghana intimated that although a survey carried out in August 2020 depicted a net tightening in the overall credit stance on loans to enterprises, as result of a boost in economic activities and the optimism that there will be a spontaneous demand for credit by households and firms, banks have suggested a net easing of loans given out to enterprises in the months ahead.

Indeed Dr. Ernest Addison affirms that “the latest credit conditions survey conducted in October 2020 show a net easing in overall credit stance on loans to enterprises and households. The survey results showed that with the recovery in economic activities underway, demand for loans over the next two months is also expected to rise”.

Despite contractions experienced in the year amid the coronavirus pandemic, there are signs of recuperation in economic activities. The MPC said “the latest Bank surveys conducted in October 2020 point to improvements in both consumer and business confidence” asserting that improved macroeconomic conditions, exchange stability and moderation of lending rates had resulted in strong optimism among majority of businesses.

“Consumer confidence was firmly above pre-lockdown levels supported by rebounding economic activity following gradual relaxation of COVID-restrictions. Though below pre-lockdown levels, business confidence has shown a steady and gradual recovery supported by improved company prospects and steady demand for goods and services,” the Governor added.

.

The committee finally came to the conclusion that the corrective policies introduced by the Bank of Ghana have gone a long way to improve the economic situation of the country.

“On the Ghanaian economy, evidence from high frequency indicators – the CIEA outturn for October 2020, improved consumer and business confidence, and strong liquidity flows – have helped to deliver a faster than expected recovery in economic activity

“These flows include payments to contractors, SDI depositors, clients of SEC licenced fund managers, micro and small business loans provided by government through the National Board for Small Scale Industries, and the policy and regulatory reliefs to banks and SDIs. Based on these observations, the Bank maintains that growth will perform better than earlier projected”.