The Bank of Ghana (BoG) has urged the banking community to always look out for debits on their accounts and report any suspicious or unapproved charges/debits to their financial institutions.

According to the Regulator, it has abolished “unfair fees” and “charges” by financial institutions in the country. BoG therefore, warned financial institutions that continue to charge maintenance fees on savings account to desist from that act because it is “prohibited by the Bank of Ghana”.

As part of its financial literacy education, BoG in its latest slides, provided a detailed education on the Abolition of Unfair Fees, Charges and Other Practices.

The Central Bank cautioned customers to “Beware!” Because additional services such as transaction alert and internet banking provided by financial institutions may attract fees and charges on their accounts. “Always assess your needs before subscribing”, the Bank of Ghana urged customers of financial institutions.

BoG further issued a warning concerning the unlawful charges regarding over the counter cheques and requests for bank account balances by customers of financial institutions.

“Financial Institutions are not allowed to charge any penal charge when you walk into the banking hall to withdraw funds from your own account over the counter. Your request for your account balance from the Banking Hall of your financial institution should not attract any fee or penalty. Always insist on your rights and report any breach to the Bank of Ghana”.

Bank of Ghana

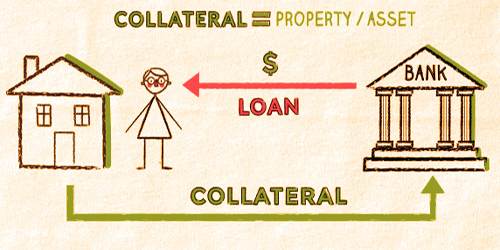

Unlawful change in legal title of assets

The BoG, providing clarifications on collaterals, stated that it is unlawful for a financial institution to effect a change in legal title of assets (vehicle, landed property etc.) used as collateral into the joint names of the financial institution and customers or into the name of the financial institution or any third party. Customers were urged to report any breach to the Bank of Ghana.

Furthermore, BoG advised customers to always demand the Annualized Percentage Rate (APR) on loans from their financial institutions prior to acceptance of a loan facility.

According to the BoG, this will help customers know how much the loan will cost them after the duration of the loan. “It is a legal requirement for your financial institution to provide you this information before you sign on your loan contract”, BoG disclosed.

“If you do not pay your loan on time, you may be subject to pay Penal Charges. You shall however, pay any Penal Charge only on the amount you delayed in paying and not on the total outstanding loan amount. Late payment of a loan instalment could affect your credit risk profile, as it is required to be reported to a credit bureau licensed by Bank of Ghana”.

Bank of Ghana

According to BoG, it is unlawful for a financial institution to quote its interest rate on a monthly, daily or other basis apart from annual. As such, it urged customers to report any breach to the Bank of Ghana.

BoG further stated that customers will be required by financial institutions to provide personal details (name, address, ID information and telephone numbers) any time they make a deposit into or withdrawal from an account on behalf of another person.

READ ALSO: Gov’t To Continue To Support GSS To Provide Quality Statistics