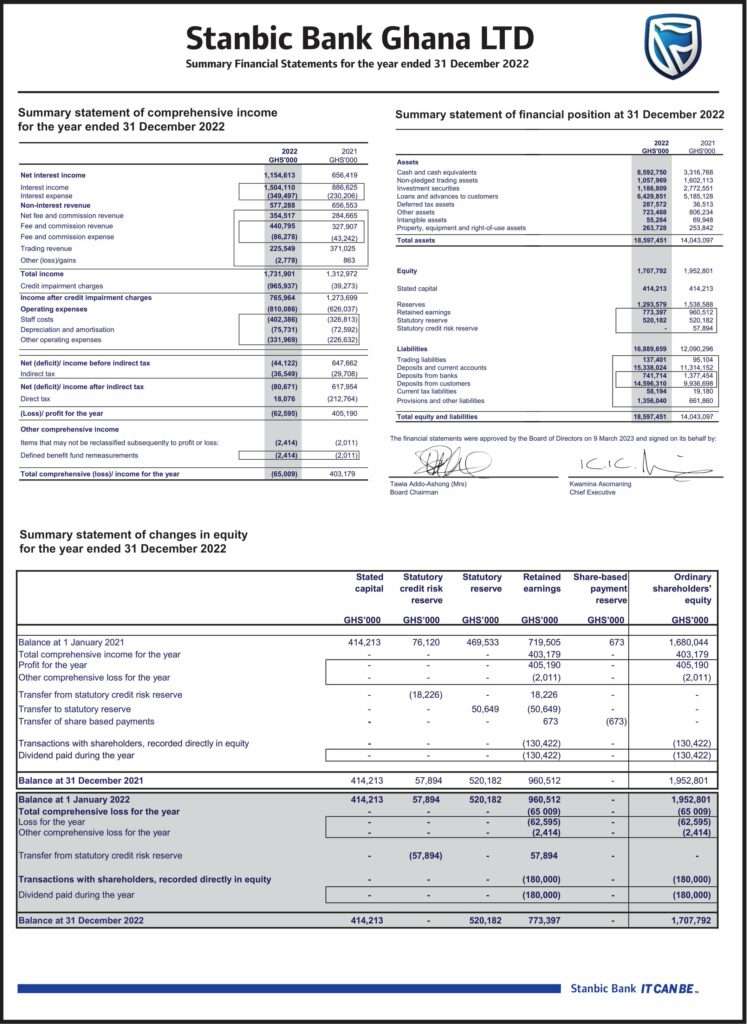

In the 2022 financial statement released by Stanbic Bank Ghana, the bank disclosed that its assets value has recorded an impressive increment, jumping to GHS 4.5 billion in the just ended financial year.

This marks a notable improvement from the bank’s total assets value of GHS 14bn recorded at the end of December 2021. The growth in assets value was mainly driven by a significant increase in Stanbic Bank’s cash and cash equivalents from GHS 3.3bn in 2021 to GHS 8.5bn in 2022.

Despite the impressive growth in assets value, Stanbic Bank did record losses on bond assets held by the bank as a result of the government’s domestic debt exchange programme. In all, the bank recorded a loss of GHS 62.5 million at end of December 2022, compared to a profit position of GHS 405 million previously.

Asset Value Hrows

However, the bank’s asset value growth is a testament to the bank’s strong financial position and ability to navigate challenges. The bank has been able to grow its assets value despite the impact of the domestic debt exchange programme and related losses.

The growth in assets value was also accompanied by a significant increase in liabilities. The bank’s liabilities grew from GHS 12bn in 2021 to GHS 16.8bn in 2022, largely driven by deposits, which amounted to GHS 15.3bn at the end of December 2022.

The bank’s non-performing loans (NPLs) ratio worsened from 6.7% in 2021 to 8.9% in 2022. This is a cause for concern for the bank and will require the attention of the management team to reduce the level of NPLs.

Furthermore, the bank’s capital adequacy ratio declined from 19.2% in 2021 to 12.3% in 2022. This decline in capital adequacy ratio suggests that the bank’s capital position has weakened, and may be unable to meet regulatory requirements.

Stanbic Bank Ghana has recorded impressive growth in assets value despite challenges faced by the banking industry. However, the bank must address the rise in non-performing loans and the decline in capital adequacy ratio to ensure it remains in good financial health.

Meanwhile, Stanbic bank is not alone in making losses in the just ended financial year as Standard Chartered Bank Ghana also recorded a loss of GHS 299 million for the period ended December 2022, compared to a profit of GHS 436 million for the same period in 2021. In the same vein, the decline in profitability can be attributed to the domestic debt restructuring programme undertaken by the government.

Similarly, despite the significant decline in profitability, the bank’s total assets value also increased just like the Stanbic, rising from GHS 10.1 billion in 2021 to GHS 10.3 billion in 2022.

READ ALSO: If You Don’t Appreciate My Work, Don’t Destroy Me Unnecessarily – Agyemang Manu Retorts Mahama