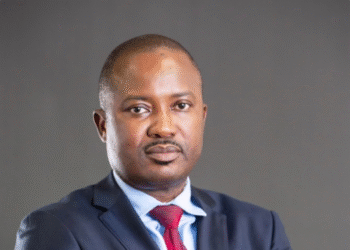

Dr. Benjamin Amoah, a banking and finance analyst, has commended government’s loan facility to establish a new national bank. According to him, the bank is capable of catering to small and medium enterprises who desire funding.

His comments follow government securing a €170 million facility for the establishment of the new national bank. Commenting on whether the country needs a new bank currently, Dr. Amoah insists that it will augur well for the country.

“We definitely need a development bank at this stage of our development because we have tried it in the past. We tried it with ADB [and] NIB and we know that over time, ADB and NIB have repositioned themselves as commercial banks now, [though] access to medium-term, long-term funds, especially for the SMEs have become a challenge. So, if we are having new establishment in the form of developing financial institutions, that would then attend to this sector of the economy.

“If we are talking about revamping and transforming the economy and we want the small and medium enterprises to lead, then we need to have dedicated financial services to provide the needed support. So, from that point, yes, I will say we need it and that we need development bank that will solely be looking at this aspect of our economy”.

Financial sector clean-up justifies national bank

Justifying the need for a development while the country struggles with debt, Dr. Amoah averred that, the financial sector clean-up occasioned the need for a national bank.

He revealed that, one has to “look for the business case for the development bank” and why we need the money.

Additionally, the banking analyst noted that, once government wants to transform the economy, they will need “governance system in place”. This is to ensure that the funds are used and utilized well to transform the economy.

“If you have been monitoring the financial sector space for some time, you’ll realize that, when the banking sector clean-up started, we spent about 21 billion and we are still counting. We had to force merge five banks that failed to mobilise 400 million each, that became consolidated bank. We also had to force GCB to take up UT and Capital Bank.

“Clearly, having considered all these factors, you realize that along the trajectory, the ministry of finance made it clear that we needed a development bank. So, last year, we had the development financial institutions Acts 2020, Acts 10(32), that clearly spelt out the regulatory framework for developing financial institutions. So, clearly, there has been a lot of background work including the World Bank to lead this initiative. It has come at a good time, it is good”.

Merger between NIB and ADB

Commenting on whether a merger between NIB and ADB would have rectified the problem, Dr. Amoah responded otherwise. According to him, these banks are bedevilled with their own issues, rendering them incapable of any help.

“It is a good argument to make. However, if you look at NIB and ADB, these are banks that have not posited good and appreciable results overtime. Again, these banks have a lot of overhangs on themselves that they have to deal with. You don’t want to start an initiative with institutions that have a lot of issues [in] them. You need to have that new kid on the block, free to establish and have new relationship businesses than to pump in a whole lot of money into setups that do have challenge currently. So, if you are going to have a new setup to start new relationships, it gives us a clean slate to start on”.

Read Also: EC to Institute all-year round Voter’s Registration Exercis