Zenith Bank Ghana, Headquartered in Lagos, Nigeria, has recorded an impressive performance in the 2022 financial year with substantial growth in assets and other critical areas.

However, though Zenith Bank Ghana’s financial performance in 2022 was remarkable with strong growth in operating income and deposits, the the government of Ghana’s Domestic Debt Exchange Programme (DDEP) has an impact on the bank’s profitability.

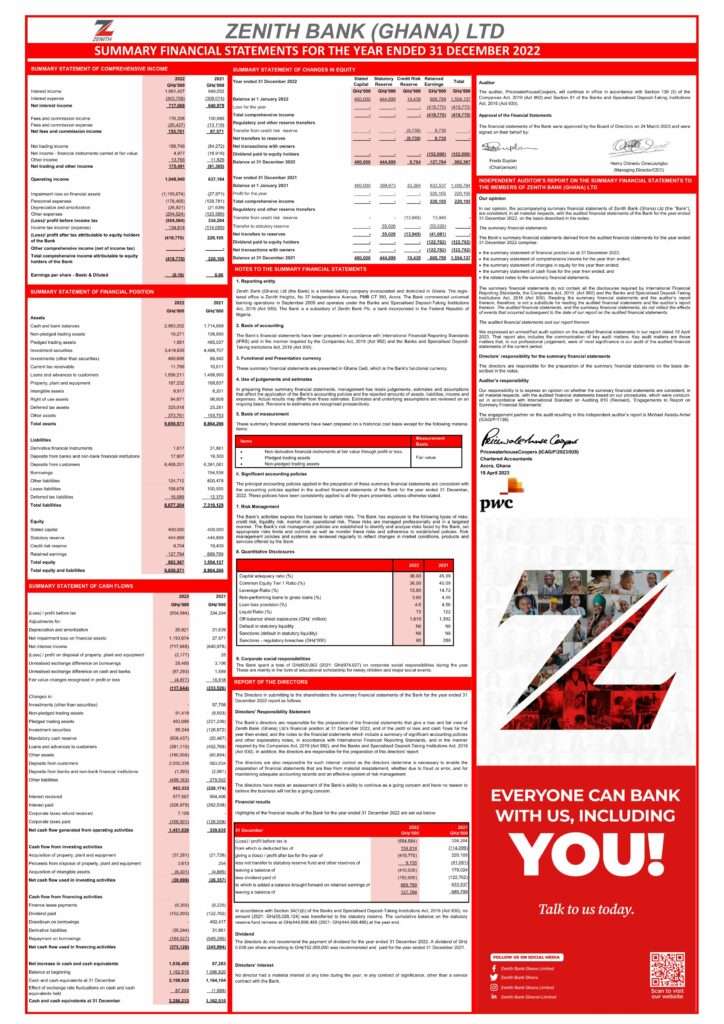

The Bank witnessed a substantial increase in total non-interest income and a high Capital Adequacy Ratio. This means that the bank remains well-capitalized, with a capital of GH¢982 million at the end of 2022. This strong capital position means that the bank is not required to inject additional capital and can continue to operate and grow with confidence.

Growth in Total Non-interest Income

The growth in total non-interest income is particularly noteworthy, rising from a loss of GH¢3.8 million in 2021 to GH¢331million in 2022.

This reflects the bank’s ability to generate revenue from sources other than interest income, such as fees, commissions, and other income-generating activities. This is a positive sign for the bank’s future profitability and sustainability, as it diversifies its sources of income and reduces its reliance on interest income.

Another positive factor is the bank’s Capital Adequacy Ratio of 36%, which remains higher than the regulatory limit and industry average in 2022 financial year.

This indicates that the bank has a strong capital base, which provides a cushion against unexpected losses and allows the bank to absorb any potential financial shocks.

Furthermore, the bank’s efforts to manage credit risk is reflected in a reduction in the NPL ratio from 4.4 percent in 2021 to 3.8 percent in 2022. This suggests that the bank has been successful in managing its loan portfolio and minimizing the number of non-performing loans, which reduces credit risk and enhances the bank’s financial stability.

Despite the positive developments, the financial statement shows some net loss which is as a result of the DDEP which has affected the banking sector in Ghana. However, it is clear that the bank remains well-capitalized and is in a strong position to weather any potential financial difficulties.

The DDEP Is being done to help protect the economy and enhance our capacity to service our public debts effectively. The alternative of not executing the DDEP would have brought grave disorder in the servicing of our national debt and exacerbated the current economic crisis.

READ ALSO: At Least 16 People Dead After Russian Missiles Hit Ukraine