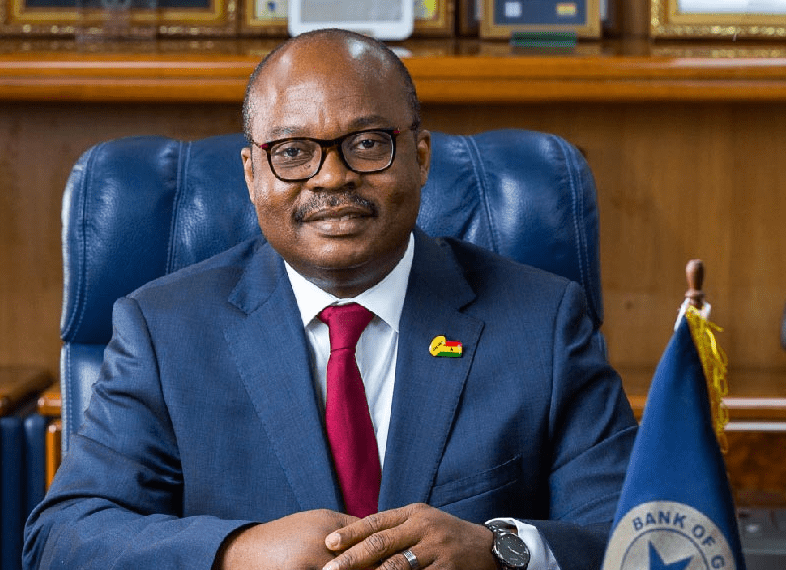

The Central Bank of Ghana (BoG) is considering yet another hike in its monetary policy rate to help bring down inflation rates in the country.

The central bank has been grappling with soaring inflation for the past year, and it believes that tighter monetary policy will help to stabilize prices.

The current inflation rate, according to BoG, remains significantly above the medium-term target, warranting that tight stance is maintained going forward, and adding that “inflation rates have dropped from 53.6 percent in January 2023 to 52.8 percent in February, and 45 percent in March.”

However, these figures are still significantly higher than the BoG’s medium-term target, which is why it is looking to further tighten its monetary policy.

At its last meeting in March 2023, the Monetary Policy Committee of the BoG increased the policy rate by 150 basis points to 29.5 percent. This was the latest in a series of hikes that have seen the bank more than double its policy rate since November 2021, adding 16 percentage points to its key rate.

Despite these efforts, inflationary pressures persist, with the Economist Intelligence Unit (EIU) projecting that inflation and currency pressures will remain elevated until at least mid-2023. The EIU attributed this partly to high global commodity prices and debt-restructuring uncertainties.

EIU Projected Policy Rate To Hit 31.5%

It can be recalled that the Economist Intelligence Unit (EIU) projected a 100 basis points increase in the policy rate at the next meeting of the committee.

This, as predicted by EIU, would result in the policy rate hitting 30.5 percent if the forecast comes true.

The EIU projected its expectation for a stability to return only once debt-restructuring terms are agreed, and the IMF’s Executive Board approves the proposed $3 billion program.

The EIU expects this to happen in mid-2023, although downside risks loom large.

To curb these inflationary pressures, the BoG has stated that it will use all available tools at its disposal, including upward adjustments in the cash reserve ratio to address liquidity in the system. The Central bank believes that these tools have helped to stabilize prices over the past year.

However, some business associations and groups are concerned about the impact of the policy rate hikes on the cost of credit. They worry about how commercial banks might react to this move by the BoG, potentially making it harder for businesses to access affordable credit.

Read also: DDEP: IBF, IBHAG Secures GHS 1.77bn For Its Members