The SanlamAllianz Group is pleased to announce that it has received the final “no objection” from the National Insurance Commission (NIC) to proceed with the highly anticipated merger between Sanlam Life Insurance Ghana LTD and Allianz Life Insurance Ghana LTD, as well as Sanlam General Insurance Ghana LTD and Allianz Insurance Ghana LTD.

This merger follows the announcement made in September 2023 regarding the SanlamAllianz joint venture, which spans 27 countries across Africa and represents a combined enterprise value of nearly US$ 2 billion. This strategic partnership is set to revolutionize the insurance landscape in Ghana, leveraging the strengths and expertise of two global financial services giants.

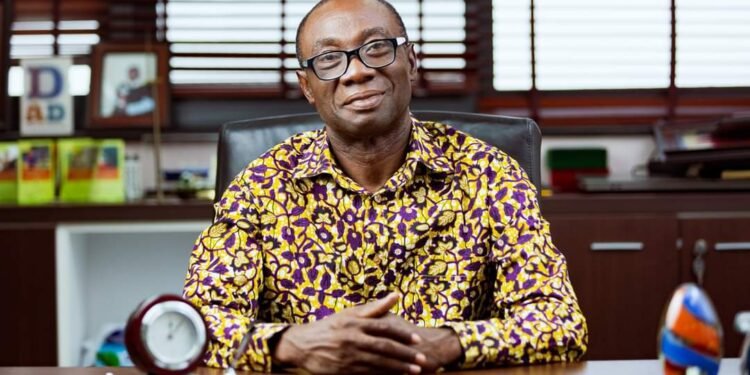

Heinie Werth, CEO of SanlamAllianz noted that the union of Sanlam and Allianz promises to bring significant benefits to the Ghanaian market, combining over 200 years of experience in Africa and beyond.

“We are confident that our merged businesses in Ghana will create significant value for our clients, shareholders, and other stakeholders. The combined expertise and resources of our respective companies will enable us to provide innovative solutions and services to meet the ever-evolving needs of our clients.”

Heinie Werth

The Sanlam Life Insurance Ghana is focused on providing specialist life insurance services leveraging on the capacity, expertise, experience, exposure and the financial strength of the biggest non-banking financial services Group on the African continent.

Sanlam General Insurance Ghana offers innovative insurance solutions, which cut across all segments of the economy. These include Motor Insurance, Asset All Risks, Marine Insurance, Home Insurance, SME Insurance, Fire & Other Perils among others.

Allianz Ghana, made up of Allianz Life Insurance Ghana LTD and Allianz Insurance Ghana Limited are subsidiaries of the Allianz Group. The Allianz Group is one of the world’s leading insurers and asset managers with around 125 million* private and corporate customers in nearly 70 countries.

Having launched its operations in 2018, Allianz Life Ghana LTD is currently a Top 9 life insurance on the market, offering various life insurance solutions for retail, corporate, SME, banks, and partners such as MTN and Société Generale Ghana.

Allianz Insurance, the general insurance provider, offers solutions and services in Motor, Home, Travel, Injury, and Disability Insurance to the Ghanaian market.

In addition, it underwrites SME, Public Liability, Asset, Construction, Transport, and Cyber Crime Insurance. Allianz Insurance has bancassurance partnerships with Société Generale Ghana, Ecobank Ghana, Consolidated Bank Ghana, and United Bank Africa.

Impact on the Ghanaian Insurance Market

The merger is expected to have a transformative impact on the Ghanaian insurance sector. By integrating the operations and resources of both companies, the SanlamAllianz Group aims to introduce an innovative range of products and services tailored to various market segments.

This strategic consolidation is poised to enhance the overall development of the insurance market in Ghana, making it more robust and competitive.

The merger aligns with SanlamAllianz Group’s growth strategy and diversified financial services capabilities. The newly combined entity in Ghana will explore numerous opportunities for operational synergies, which are anticipated to create substantial value for all stakeholders involved.

This includes clients, agents, brokers, partners, and employees, all of whom stand to benefit from the enhanced capabilities and expanded service offerings of the merged company.

As Sanlam and Allianz move forward with their merger in Ghana, the market can look forward to a new era of insurance services characterized by innovation, expertise, and comprehensive solutions. The final approval from the NIC marks the beginning of an exciting journey that will undoubtedly contribute to the growth and development of the Ghanaian insurance industry.

READ ALSO: Minors’ Registration Ruins Ghana’s Limited Voter Registration Exercise