The Social Security and National Insurance Trust (SSNIT) has announced a temporary halt in the negotiations for selling a 60 percent stake in six of its hotels.

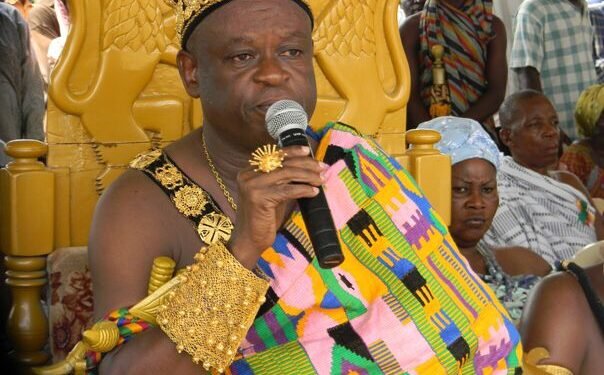

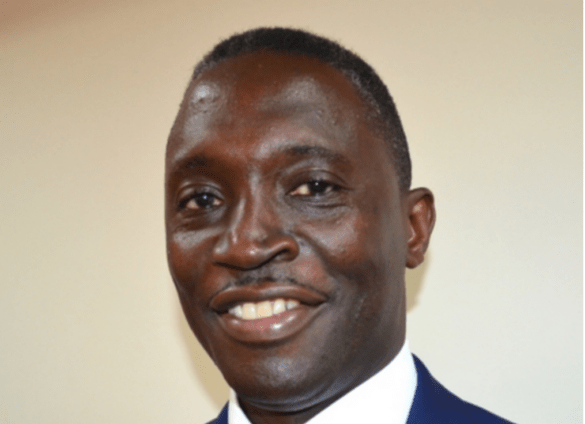

This decision follows a directive from the National Pensions Regulatory Authority (NPRA). The Director General of SSNIT, Kofi Bosompem Osafo-Maafo, shared this update during a recent media engagement about the operations of the State Pension Trust.

Osafo-Maafo emphasized the need for extensive stakeholder engagement to help partners understand the rationale behind reducing SSNIT’s interest in these hotels. He highlighted that the negotiations were initially stalled due to concerns over the payment model and other issues, even before the NPRA’s directive.

The Director General, meanwhile, insisted that these negotiations were conducted in good faith to ensure the best possible outcome for SSNIT’s assets.

When asked whether SSNIT would have pursued the same route despite the current challenges, Osafo-Maafo responded that more engagement with interested parties could have helped avoid these issues. He maintained that when assets are underperforming, decisions must be made to optimize returns, including selling interests if a beneficial offer arises.

NPRA’s Directive to Suspend the Process

The NPRA’s directive to suspend the sale came as a surprise to SSNIT, especially since there had been prior engagements with the authority on these issues. The last meeting with the NPRA was inconclusive due to the need for further stakeholder engagement with the presidency and unions.

The NPRA’s letter instructed SSNIT to halt the sale negotiations with Rock City, a company owned by the Minister of Food and Agriculture, Bryan Acheampong. The NPRA is also engaging with the Minister for Employment on this matter and other developments. Organized labor had previously raised objections to the sale process, prompting further discussions with the government.

Osafo-Maafo justified the sale, stating that some of the hotels had consistently failed to pay dividends or had been incurring losses. He cited La Palm Hotel as an example, which had recorded losses in 11 of the past 15 years. The decision to sell interests in these hotels aimed to share the risk with a strategic investor.

Procurement and Selection Process

The process to identify a strategic investor began in 2018 when SSNIT’s board set up a steering committee. This committee included board chairpersons of the various hotels, three board members, and some management staff from SSNIT.

The selection of SEM Capital to carry out the valuation was done through International Competitive Tendering (ICT) processes, as prescribed by the Public Procurement Act, 2003 (ACT 663), amended by ACT 914.

Advertisements for a Transaction Advisor were published in the Daily Graphic and the Ghanaian Times in November 2018, leading to fifteen firms expressing interest by the January 2019 deadline. Approval from the Central Tender Review Committee (CTRC) was granted in December 2019 for the selection of a Transaction Advisor.

Further advertisements for an Expression of Interest (EOI) for a Strategic Partner for SSNIT Hotels were published in February 2022 in the Daily Graphic, Ghanaian Times, and the Economist Magazine. Nine companies responded to these advertisements by the March 2022 deadline.

The Entity Tender Committee (ETC) then evaluated the EOI and invited six firms to submit Technical and Financial Proposals for Private Participation in SSNIT-Owned Hotels. These firms included Rock City Hotel Limited, Yaw Addo Development, Spartan-Ives, Temple Investments, Westridge Developers Ghana Limited, and Luxor Hotels Limited. The bidding process focused heavily on Labadi Beach and La Palm Hotel.

Concerns of Interference and Political Exposure

Osafo-Maafo rejected allegations of undue pressure to sell interests in some hotels to Rock City, asserting that all proper procedures were followed. He also addressed claims that Rock City had not been issued a tax certificate by the Ghana Revenue Authority at the time of bid submission.

Additionally, he acknowledged that issues of political exposure regarding this strategic investor might have contributed to the current opposition from the public and some trade unions.

The Director General also refuted claims by former New Patriotic Party Chairman, Freddie Blay, that Spartan-Ives offered $200 million for the hotels. Osafo-Maafo clarified that Blay’s bid was actually $150 million.

SSNIT, meanwhile, iterated it remains committed to ensuring that any decision regarding its assets is made in the best interest of the institution and its stakeholders. The Trust will continue to engage with all relevant parties to find the most beneficial solution.

READ ALSO: GSE Poised for Significant Gains Amid Global Gold Rush- Analyst