The Director of Strategy and Business Operations at Dalex Finance, Joe Jackson, has said that, we must be concerned about the Finance Minister’s silence on taxation during the 2020 Mid-year budget review presentation.

During his presentation, the Finance Minister indicated that, the twofold impact of the pandemic and a global economic recession, have caused the country’s revenue to decrease by GH¢13.6 billion and has also forced government to unexpectedly increase expenditure by approximately GH¢11.7 billion.

According to him, even though government planned to spend GH¢41,554 million representing 10.8 percent of GDP, the country’s total expenditures in the first half of the year amounted to GH¢46,352 million or 12.0 percent of GDP. As a result of this, he requested for GH¢11. 8 billion to supplement government’s expenditure for the rest of the year towards the implementation of various initiatives to strengthen the economy.

To cushion Ghanaians from the economic impact of COVID-19, the Minister announced new measures such as reduction in the Communication Service tax from 9 to 5 percent. The government also decided to extend the provision of free water to Ghanaians for the next three months and free electricity supply to lifeline consumers for the rest of the year.

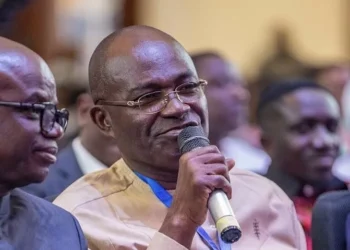

However, lauding the provision of these supports to Ghanaians, Mr. Joe Jackson in an interview said that, weighing the enormous drop in government’s revenue and the challenges businesses are facing in the country, it would have been prudent for government to announce some steps to boost domestic revenue collection.

He, therefore thinks that, the decreasing of some taxes coupled with the increasing of expenditures without any mentioning of taxing is because of the impending general elections.

“There is no innovative tax. There was a deafening silence about taxes, so in effect, that is what the election year effect has been that we are ready to increase expenditure, we expect revenue to drop, and yet there was a deafening silence about tax schemes.”

Many sectors of the economy were anticipating some form of tax reliefs in the budget to insulate them against the impact of the coronavirus pandemic on their businesses.

For instance, the Ghana Union of Traders Association (GUTA) had wanted government to broaden the country’s tax net to rope in more businesses to boost revenue generation. The President of the Association, Dr Joseph Obeng in a near rage outburst, demanded the Ghana Revenue Authority to focus on e-commerce activities. He believed many online businesses were eluding taxes and this attention could captured them into the tax net.

With concerns coming from different quarters in the country about government’s planned expenditures, Parliament has indicated that, it will take the request from government for a supplementary budget through three days of scrutiny before approval.

“Deliberations will begin on Monday 27th of July, 2020, and conclude on Tuesday, 28th July, 2020. If there is enough space, we will wind up with deliberations on Wednesday 29th July. The House may have to sit for longer next week to arrive at a conclusion”.

Majority Leader, Osei Kyei Mensah-Bonsu

An economist, Dr. Adu Owusu Sarkodie has also pointed out that, government must be prudent in its spending because that will determine how the economy recovers.

He however, made the case that, no economy at this crucial moment can be propped up without spending.

“I have not seen any economy that has been revived without spending. Every country must spend to revive its economy, it’s a must. Now, it’s time for us to spend to revive Ghana’s economy”