The volume of Mobile Money Interoperability (MMI) transactions spiked over 444% in the first six months of this year in comparison to the same time last year.

According to the Half Year Performance report of the Ghana Interbank Payment and Settlement Systems (GhIPSS), MMI transactions from January to June reached 13.8 million compared to 2.5 million recorded in the same period last year.

The skyrocketing in the MMI volume could be ascribed to heightened awareness that funds can now be moved across wallets of different telecommunications networks.

This is as a result of sustained campaigns in the media that GhIPSS together with its partners have been running.

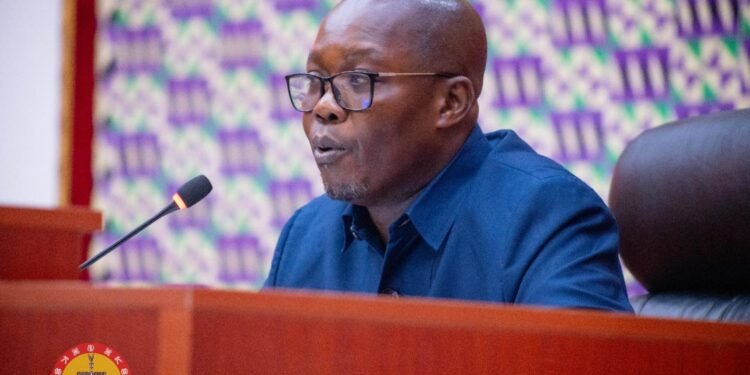

“The flexibility that MMI has introduced into the Ghanaian payment system has made movement of funds very easy and this has been extremely crucial in the face of the coronavirus pandemic.”

Mr Archie Hesse, the Chief Executive of GhIPSS

MMI as an addition to Ghana’s financial sector has increased mobile money transactions in the country.

The introduction of MMI have been received by many financial institutions since their customers can pay them regardless of the network they subscribe to.

Albeit the majority of MMI transactions involving funds transfers from one mobile money wallet to another, the Half Year Performance report also show the use of the MMI platform to transfer money from bank accounts to mobile money wallet and vice versa.

However, the number of transfers from bank accounts to wallets was recorded to be more than 2.1 million transactions whereas mobile money wallet transfers to bank accounts was almost 380,000 transactions.

According to Mr Hesse, the growth in the level of electronic payment transactions depict that, Ghanaians appreciate its benefits over cash transactions.

He added that, GhIPSS and its partners, would continue to sustain the public education to encourage increase in the usage of MMI.

He said key FinTechs and other players in the technology space which have not been engaged will be exposed to the myriad opportunities that MMI presents in the electronic payment space.

MMI and the GhIPSS Instant Pay (GIP) are two electronic payment channels that experts say could significantly deepen financial inclusion in Ghana.

Both products continue to record very high growth rates. While MMI saw a growth of over 444 percent in volume, GIP saw close to 600 percent growth in volume in the first half of this year.

This increasing performance has not been without any controversy in the operations recently.

On March 19, this year the Bank of Ghana announced some measures including the waiving of fees on some digital payment options including mobile money aimed at reducing cash transactions and boosting digital payments.

This led GhIPSS to announce a waiver of transaction fees across three platforms namely: GhIPSS Instant Pay (GIP), Mobile Money Interoperability (MMI), and ACH Direct Credit.

On May 23, 2020, GhiPSS directed financial institutions to end the fee waiver granted to customers.

However, the Ghana Association of Bankers kicked against the decision by the Ghana Interbank Payments and Settlements Systems (GhIPPS) to end fee waivers granted to customers.

In a letter signed by the Association’s CEO, Daniel K. Mensah, the banks indicated that they could not honour the directive by GhIPPs.