The Ghana Stock Exchange (GSE) has experienced a remarkable surge in 2024, capturing the attention of investors and analysts alike.

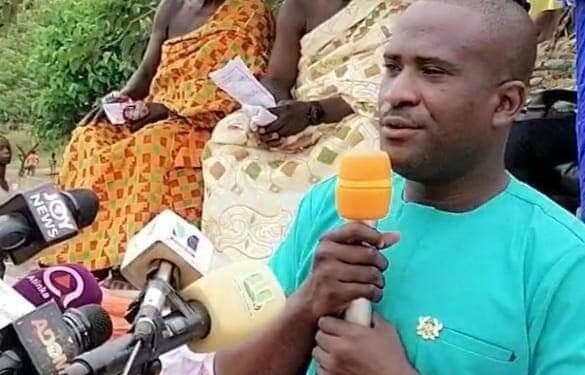

Mr. Isaac Kwasi Mensah, a Financial Analyst and Portfolio Manager at SIC Financial Services Limited, in an interview with the Vaultz News, predicts a vibrant future for the GSE, highlighting its potential to drive economic expansion and investment in Ghana. “This extraordinary performance is expected to continue into 2025, with projections of sustained growth fueled by favorable market conditions and strong corporate earnings,” he said.

The numbers from the Ghana Stock Exchange for 2024 tell a compelling story of growth and resilience. By the end of November, the value of shares traded reached nearly GH¢2 billion (GH¢1.996 billion), marking an impressive 165.44 percent increase over the GH¢752 million recorded in the same period in 2023. This achievement underscores a surge in market activity and investor interest, further reflected in the 71.29 percent increase in traded volumes to 952.72 million shares.

This activity has propelled the GSE’s market capitalization to GH¢108.4 billion, compared to GH¢74.2 billion in the previous year. According to Mr. Mensah, this extraordinary performance signals growing confidence in Ghana’s equities market and positions the GSE as a beacon of opportunity for investors.

Drivers of Market Momentum

According to the analyst, several factors have contributed to the GSE’s exceptional performance in 2024.

“A slowdown in the debt market has played a critical role, redirecting investor interest to equities, which now offer more attractive returns. At the same time, financial sector stocks have staged a strong comeback, supported by improving earnings and undervalued prices.

“Sectoral diversification has also contributed significantly. Telecommunications companies such as MTN Ghana and consumer goods firms like Unilever Ghana Plc have posted strong gains, reinforcing the GSE’s status as a diverse and dynamic marketplace.”

Mr. Isaac Kwasi Mensah

November was another strong month for the GSE, with the Composite Index closing at 4,694.37 points – a 49.97 percent year-to-date gain compared to 29.71 percent for the same period in 2023. The Financial Stock Index also saw a notable 23.64 percent increase.

However, trading activities during the month experienced a sharp decline compared to November 2023. Only 9.35 million shares valued at GH¢27.84 million were traded, representing a 92.9 percent drop in volume and an 83.85 percent decrease in value. “Despite this short-term slowdown, the overall year-to-date performance remained robust, reflecting the market’s underlying strength,” he added.

Top Performers Drive Market Growth

The GSE’s growth in 2024 has been underpinned by strong performances from several equities. Ecobank Transnational Incorporated Plc emerged as a standout performer with a 45 percent price gain, while Cal Bank Plc posted a 31 percent increase. Other notable gainers included Camelot Ghana Plc (17 percent), Access Bank Ghana Plc (10 percent), and MTN Ghana (10 percent).

These gains highlight the broad-based nature of the market’s growth, with contributions from sectors ranging from banking to telecommunications and consumer goods.

On the outlook, Mr. Mensah is optimistic about the GSE’s prospects for 2025. He forecasts the Composite Index to close the year at approximately 6,850 points, representing annual growth of 40 to 50 percent. This optimism is rooted in improved market conditions, stronger corporate earnings, and continued investor interest in equities.

“The GSE is well-positioned to sustain its momentum. I expect significant contributions from the banking, telecommunications, and consumer goods sectors, which continue to show resilience and growth potential.”

Mr. Isaac Kwasi Mensah

Mr Mensah indicated that despite the promising outlook, certain challenges could temper the market’s growth. Global economic uncertainties, such as fluctuations in commodity prices and exchange rates, may affect investor sentiment. “Liquidity concerns also remain a critical issue, as evidenced by the sharp decline in trading volumes in November,” he said.

“Additionally, some sectors may face operational challenges that could limit their contributions to overall growth. For instance, the energy sector and manufacturing industries may need targeted interventions to overcome structural inefficiencies.”

Mr. Isaac Kwasi Mensah

A Call for Strategic Action

To ensure sustained growth, Mr. Mensah emphasizes the need for proactive measures from market regulators and policymakers. Expanding market access by encouraging more companies to list on the GSE, enhancing investor education to attract retail participation, and strengthening corporate governance practices are key strategies to bolster market performance.

“These efforts will not only increase market liquidity but also enhance the GSE’s appeal to both local and international investors,” Mr. Mensah stated.

The Ghana Stock Exchange’s remarkable performance in 2024 has set the stage for continued growth in 2025. Analysts, led by Mr. Isaac Kwasi Mensah, remain confident that the equities market will maintain its upward trajectory, driven by strong corporate fundamentals and favorable market dynamics. By addressing existing challenges and capitalizing on emerging opportunities, the GSE is poised to play an increasingly key role in Ghana’s economic development.

READ ALSO: Kofi Asare Backs NDC’s Plan to Reform CSSPS for Merit