Mr. Kwabena Nyarko, a Financial Market Analyst and CEO of Pipliquidator Fx in an interview with the Vaultz News noted that anticipated monetary policy rate changes and decline in inflation will propel the fixed-income growth in the country.

According to the financial market analyst, as the global economy continues its gradual recovery, 2025 presents a promising horizon for fixed-income markets.

“Key factors such as easing inflation and a shift towards more dovish monetary policies are expected to play a significant role in shaping the trajectory of these markets. These anticipated changes have sparked optimism among investors, setting the stage for a year of renewed opportunities in the fixed-income space in Ghana.”

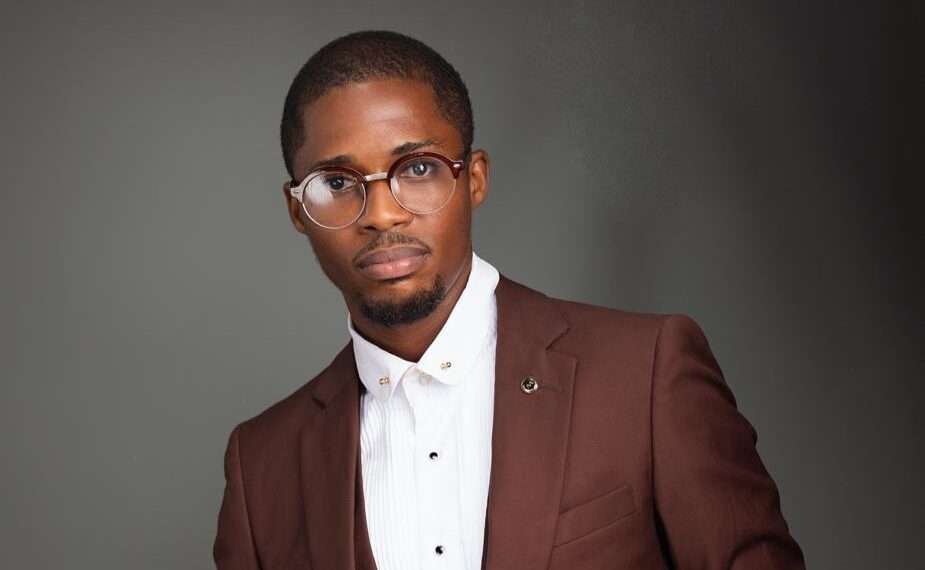

Mr. Kwabena Nyarko

Mr Nyarko explained that inflation has long been a critical determinant of fixed-income market performance. “When inflation rises, it erodes the purchasing power of fixed-income securities, leading to a decline in their value,” he added.

“Over the past few years, elevated inflation rates across many economies have posed challenges to investors, forcing central banks to adopt hawkish monetary policies to rein in inflationary pressures.

“However, recent data suggests that inflationary trends are beginning to ease. Factors such as stabilized supply chains, declining energy prices, and subdued global demand have contributed to this decline.”

Mr Nyarko opined that central banks worldwide are expected to adopt a more accommodative stance in 2025 as inflationary pressures subside.

“Over the past two years, aggressive rate hikes aimed at curbing inflation have led to higher borrowing costs, dampening economic activity. With inflation easing, central banks now have the leeway to shift towards dovish policies, characterized by lower interest rates and supportive measures to stimulate growth.”

Mr. Kwabena Nyarko

This shift, he explained that is particularly beneficial for fixed-income markets. Lower interest rates reduce the yield on newly issued securities, increasing the attractiveness of existing bonds with higher yields. Additionally, he noted that reduced borrowing costs encourage businesses to issue bonds, providing investors with a wider array of investment options.

Compression of Treasury Bill Yields

Mr Nyarko noted that another key factor poised to influence the fixed-income market in 2025 is the expected compression of Treasury bill yields. Treasury bills, considered low-risk investments, have traditionally attracted conservative investors seeking stability. However, he said the high yields on Treasury bills in recent years, driven by inflation and aggressive monetary tightening, have diverted investor attention away from other fixed-income instruments.

“As central banks ease monetary policy, the yields on Treasury bills are likely to compress, narrowing the spread between short-term and long-term yields. This compression is expected to shift investor focus towards corporate bonds, and other higher-yielding fixed-income securities, thereby diversifying the fixed-income market.”

Mr. Kwabena Nyarko

While highlighting the opportunities available for Investors in 2025, Mr Nyarko noted that the combination of easing inflation, dovish monetary policies, and compressed Treasury yields presents significant opportunities for fixed-income investors in 2025.

“One of such opportunities can be found in corporate bonds. With lower borrowing costs, corporations are expected to increase bond issuance, creating opportunities for investors to diversify their portfolios. Corporate bonds, particularly those issued by high-quality companies, are likely to offer attractive risk-adjusted returns.”

Mr. Kwabena Nyarko

Mr Nyarko noted that easing inflation in emerging economies like that of Ghana is expected to enhance the appeal of their fixed-income securities. Investors seeking higher yields may find opportunities in emerging market bonds, which offer the potential for strong returns with managed risks.

“While inflation is projected to ease, unexpected shocks could still occur. Inflation-linked bonds, which adjust payouts based on inflation, provide a hedge against such risks, ensuring steady returns in uncertain conditions.”

Mr. Kwabena Nyarko

Challenges and Risks

On the challenges and risks, Mr Nyarko noted that while the outlook for fixed-income markets in 2025 is positive, investors must remain vigilant.

“Potential risks such as geopolitical tensions, unexpected economic shocks, and policy missteps could impact market dynamics. Additionally, the pace of inflation decline and the timing of monetary policy adjustments may vary across regions, necessitating a more careful approach to investments.”

Mr. Kwabena Nyarko

Mr Nyarko was reacting to economists projection that inflation will approach central bank targets in 2025, creating a more favorable environment for fixed-income assets.

In all, 2025 promises to be a crucial year for fixed-income markets, driven by anticipated policy changes and the easing of inflation. For investors, this environment offers a unique opportunity to rebalance portfolios, capitalize on emerging trends, and secure stable returns. However, a cautious approach, underpinned by robust research and diversification, will be essential to navigating the complexities of the market.

READ ALSO: Prof. Bokpin Affirms Rationale for a Lean Government Structure