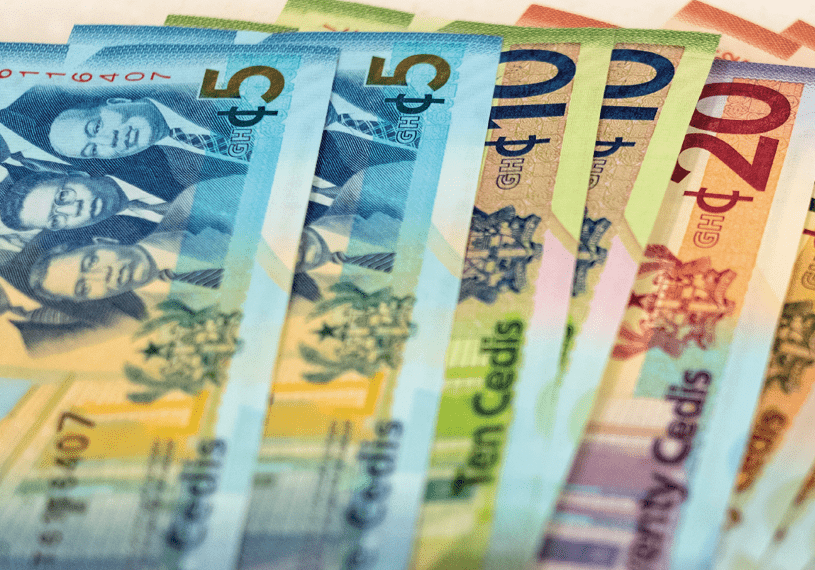

The Ghana cedi has strengthened in value against the dollar days after the government launched the Debt Exchange Programme, effectively halting the recent rapid depreciation of the cedi against the American dollar.

The local currency also improved in value against the other major foreign currencies, the pound and the euro.

Currently, the cedi is being sold by forex bureaus at an average of GH¢13.70 to the American ‘greenback’. It is also going for GH¢14 to the euro and ¢16.70 to the pound.

Currently, it is unclear why the cedi has gained value against these major international currencies. However, some market watchers and analysts have attributed it to the Debt Exchange Programme as the government defined the parameters of the programme to pave way for a programme from the International Monetary Fund.

The local currency has enjoyed some relative stability, particularly to the dollar in recent weeks. It recorded a week-on-week appreciation of 3.12 per cent against the dollar, 0.88 per cent to the pound and 3.79 per cent versus the euro on the retail market.

It has however depreciated by a little over 50 per cent since the beginning of the year. Recently, the World Bank ranked the Ghana cedi as the worst-performing currency in Africa since the beginning of the year.

Again, the cedi slumped to become the world’s worst-performing currency this year as investors continued to squeeze foreign capital to the west African country before a deal with the International Monetary Fund is completed.

Meanwhile, some analysts giving reasons for the depreciation of the cedi indicated that the depreciation of the cedi has always been seasonal. It’s at its worst between February to March. This is the period during which Ghana-based multinationals repatriate profits. Also, local businesses that had imported goods on credit ahead of the Christmas season settle their debts.

The exchange rate was quite stable, especially during the peak of the COVID-19 period (2020-2021), because imports slowed due to border closures by most countries.

The second reason is the country’s inability to borrow from the international capital market. Because Ghana isn’t able to generate enough foreign exchange through exports, successive governments have tried to manage the depreciation of the cedi through borrowing from the international capital market, issuing dollar-denominated domestic bonds, and depleting the country’s foreign exchange reserves. These are the major causes of the cedi depreciation.

READ ALSO: US Donates Supplies To Help Prosecute Perpetrators Of Gender-Based Violence