The Ghanaian cedi has staged a strong recovery after experiencing a marginal depreciation against the US dollar previous weeks.

The local currency began the week trading at GH¢15.40 to one US dollar on the retail market, marking a rebound that has caught the attention of both analysts and market observers.

The cedi’s resurgence follows a mixed performance in the previous trading sessions, where it lost 0.32% to the dollar, gained 0.31% against the euro, and depreciated 0.26% to the British pound.

Despite these fluctuations, the local currency now appears to be stabilizing, with market analyst Ms. Gifty Annor-Sika Asantewah, a Financial Market Expert and President of Women in Forex Ghana, in an interview with the Vaultz News, indicating that she is expecting a more balanced trajectory in the coming weeks.

Bank of Ghana’s Support and Corporate Demand

Ms Annor-Sika noted that one of the key drivers of the cedi’s volatility in the previous weeks was a combination of reduced foreign exchange supply and increased corporate demand for the dollar.

“The depreciation was further fueled by investor sentiment favoring the American greenback as a safe-haven currency due to global economic uncertainties, including concerns over potential trade policies in the United States.

“However, the recent recovery suggests that the Bank of Ghana (BoG) has intensified its foreign exchange support, helping to stabilize the market. The central bank has been actively intervening in the forex market through dollar auctions and direct liquidity injections to cushion the cedi against excessive depreciation.”

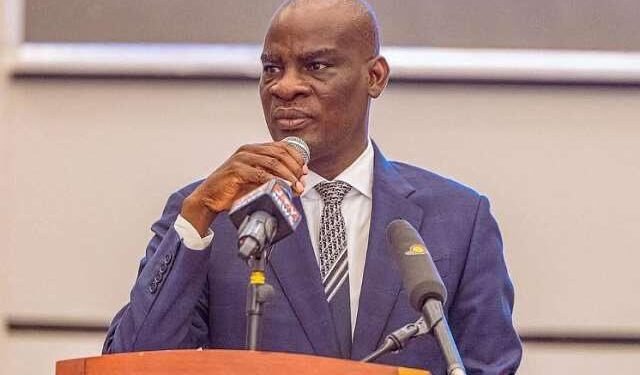

Ms. Gifty Annor-Sika Asantewah

The analyst believes that BoG’s continuous efforts, alongside improving forex inflows, could further bolster the cedi’s strength in the short to medium term.

“The anticipated disbursement of external funding and growing investor confidence in Ghana’s macroeconomic recovery could also contribute to sustaining the local currency’s gains.”

Ms. Gifty Annor-Sika Asantewah

Impact of Global Market Trends

While the cedi’s recent rebound is a positive development, Ms Annor-Sika cautioned that external factors continue to pose risks.

“The global forex market remains uncertain, with shifting investor sentiment towards the US dollar as a result of geopolitical developments and economic policies in the United States.

“Notably, concerns surrounding potential trade tariffs under a possible Trump administration have heightened demand for the US dollar, as investors seek safer assets amid policy uncertainties. Additionally, the US Federal Reserve’s monetary stance remains a critical factor in determining the direction of emerging market currencies, including the cedi.”

Ms. Gifty Annor-Sika Asantewah

Ms Annor-Sika explained that a stronger US dollar globally often translates to depreciation pressures on weaker currencies, particularly those in emerging markets like Ghana. “As such, while the cedi has shown resilience, its future stability will depend on how these global dynamics evolve in the coming months.”

Year-to-Date Performance and Outlook

Despite the recent recovery, the cedi’s year-to-date depreciation stands at -1.27%, a relatively stable position compared to the sharp declines seen in previous years. Last week, the local currency closed at GH¢15.41 per dollar, pushing the year-to-date loss to 1.74% before bouncing back this week.

Ms Annor-Sika noted that further forex drawdowns for buffer buildups, alongside increased portfolio inflows, could help sustain the cedi’s recovery.

“The expectation is that if external inflows remain steady, and the BoG continues its forex interventions, the local unit may experience less volatility in the coming weeks.”

Ms. Gifty Annor-Sika Asantewah

However, the market analyst warned that corporate demand for forex could still pose short-term pressures, particularly as businesses seek foreign currency to settle external obligations. The effectiveness of BoG’s interventions and Ghana’s broader economic policies will be crucial in determining whether the cedi’s rebound is sustained.

Bank of Ghana’s Strategic Interventions

The Bank of Ghana (BoG) has played a crucial role in the cedi’s recovery through strategic foreign exchange interventions. Over the past few weeks, the central bank has injected additional liquidity into the forex market, helping to stabilize the exchange rate and cushion the local unit against excessive depreciation. These interventions have included forex auctions, direct sales to commercial banks, and enhanced monetary policy measures aimed at managing liquidity in the system.

BoG’s efforts have been particularly critical in countering the rising corporate demand for dollars, which had put downward pressure on the cedi. Businesses and importers typically require significant forex inflows to settle external obligations, and without the central bank’s interventions, the local currency would have faced a steeper depreciation.

Moreover, the BoG has also been closely monitoring external financial inflows, such as foreign direct investments, remittances, and external credit support, to ensure that Ghana’s foreign reserves remain robust. These measures have provided a much-needed buffer, allowing the central bank to continue its intervention without rapidly depleting its foreign exchange reserves.

In the short term, Ms Annor-Sika believes that the BoG will maintain its cautious approach, adjusting its interventions in response to market dynamics. If forex inflows remain steady and corporate demand stabilizes, the cedi could experience more sustained stability in the coming weeks.

Outlook for the Cedi in the Coming Weeks

Ms Annor-Sika noted that while the cedi’s recent rebound is encouraging, its future stability will depend on both domestic policies and external economic trends. One of the key factors to watch will be global investor sentiment towards the US dollar, as this directly impacts emerging market currencies, including the cedi.

She further noted that the US Federal Reserve’s monetary policy stance will play a major role in determining the strength of the dollar. If the Fed maintains high interest rates or signals further rate hikes, investors may continue flocking to the US dollar as a safe-haven asset. This could, in turn, put renewed pressure on the cedi and other African currencies, she added.

“Domestically, Ghana’s foreign exchange supply and fiscal policies will be critical in ensuring that the cedi remains stable. The government’s ability to attract foreign investment, sustain remittance inflows, and manage public debt levels will influence confidence in the local currency.

“Moreover, seasonal forex demand trends will also play a role. With businesses increasing forex purchases for imports and external obligations, there could be short-term fluctuations in the cedi’s value. However, continued BoG support and strong external inflows could help mitigate these pressures and ensure that the cedi does not experience sharp volatility.”

Ms. Gifty Annor-Sika Asantewah

Overall, while risks remain, the analyst is optimistic that the cedi’s recent resilience could be sustained, provided that market fundamentals remain favorable. The coming weeks will be crucial in determining whether the local currency can hold onto its gains or face renewed pressure in the face of global economic uncertainties.

In all, the cedi’s sharp recovery after initial depreciation underscores the resilience of Ghana’s forex market amid external and internal pressures. The intervention of the Bank of Ghana, improving forex inflows, and shifting demand dynamics have all played a role in stabilizing the local currency.

While the cedi’s performance remains tied to global economic trends, analysts believe that continued policy support and a favorable external environment could help sustain its newfound strength. Moving forward, stakeholders will be closely watching foreign exchange supply, corporate demand, and global market trends to assess the cedi’s trajectory.

For now, the local currency’s rebound is a welcome development for businesses and consumers, offering a glimmer of hope for exchange rate stability in Ghana’s financial markets.

READ ALSO: Ghana’s Patronage Politics: A Cycle of Hypocrisy and Waste