A recent forecast by Fitch Solutions suggests that the Bank of Ghana (BoG) will embark on a gradual monetary easing cycle beginning in the second half of 2025.

The forecast predicts a cumulative 500 basis point cut in the policy rate—from the current 28% to 23%—by the end of 2026.

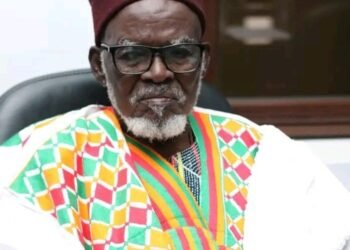

Market analyst and corporate finance expert, Mr. Isaac Kwesi Mensah of SIC Brokerage, in an interview with Vaultz News, shared his perspective on how this anticipated policy shift could impact investor sentiment and trading activity on the Ghana Stock Exchange (GSE). He noted that while the forecast reflects improving macroeconomic fundamentals, the real question is whether the capital market—particularly equities—will respond positively to this outlook.

“Fitch’s projection is not far-fetched. We are likely to see a gradual return to easing only if the current disinflation trend continues and the cedi’s relative stability holds. But inflation in Ghana has historically shown a tendency to spring back due to food supply shocks, exchange rate pressures, and fiscal slippages.”

Mr. Isaac Kwesi Mensah

According to Mr. Mensah, the relationship between monetary policy and the stock market is well established. “A lower policy rate typically reduces the cost of capital, increases corporate profitability, and makes equity investments more attractive relative to fixed income instruments,” he explained. “So, in theory, this forecasted rate cut should stimulate investor interest in equities on the GSE.”

However, he warns that the response of the local market may not be as automatic or robust as seen in more developed markets.

“The Ghanaian stock market has been relatively shallow and dominated by a few blue-chip stocks. For the broader market to react, we’ll need more than a rate cut—we need consistent macro stability, enhanced investor confidence, and deeper market participation.”

Mr. Isaac Kwesi Mensah

Market Performance in a High-Interest Environment

The Ghana Stock Exchange has been under pressure in recent years, primarily due to macroeconomic instability, high inflation, currency depreciation, and an aggressive tightening cycle. The composite index witnessed limited growth as investor funds were redirected towards high-yielding Treasury securities.

“With a 91-day Treasury bill rate hovering around 27–30% for much of the past two years, equities struggled to compete,” Mr. Mensah explained. “Why would an investor take on the risk of equities when government securities are offering such high returns with virtually no risk?”

He noted that the elevated policy rate has not only stifled investor appetite for stocks but has also increased borrowing costs for listed companies, affecting their margins and ability to expand. “Lower corporate earnings have made valuations unattractive to both local and foreign investors. This is where a shift in monetary policy can begin to change the narrative.”

How a 5% Rate Cut Could Impact GSE Dynamics

If the BoG follows Fitch’s projected trajectory and begins easing the policy rate in H2 2025, the analyst indicated that market participants could gradually shift from fixed-income investments to equities, especially if inflation continues to trend downward.

Mr. Mensah forecasts a slow but positive momentum for the GSE if the easing cycle materializes. “A reduction to 26% by end-2025 and further to 23% in 2026 will gradually compress Treasury yields. This will trigger a reallocation of capital, particularly from institutional investors, towards undervalued stocks.”

He believes the banking, manufacturing, and consumer goods sectors on the GSE could be the primary beneficiaries. “Banks will benefit from lower cost of funds and an increase in private sector credit, while manufacturing firms will see improved margins due to cheaper borrowing.”

While the policy rate forecast is promising, Mr. Mensah is quick to remind stakeholders that the GSE’s performance will also depend on external macroeconomic factors and policy consistency. The outlook for gold, oil, and global interest rates will continue to play a key role in shaping capital flows and investor behavior.

“Fitch expects gold prices to average $3,100 per ounce in 2025, which should support Ghana’s export earnings and build reserves. A stable cedi, backed by strong forex buffers, will further strengthen investor confidence in Ghana’s financial system.”

Mr. Isaac Kwesi Mensah

Furthermore, the anticipated rise in foreign exchange reserves—from $6.4 billion to $11.5 billion—will offer the central bank enough firepower to support the cedi and mitigate capital flight risks.

Policy Stability is Key

Despite the promising projections, Mr. Mensah emphasizes the importance of policy consistency and fiscal discipline. “The stock market thrives on predictability. If investors sense any fiscal indiscipline or abrupt policy reversals, confidence will evaporate.”

He also called for a stronger regulatory push to deepen market participation, including tax incentives for equity investments, SME listings, and increased public education on capital markets.

As Ghana navigates a potential monetary easing phase, the Ghana Stock Exchange could finally regain its shine as a viable investment destination. The anticipated policy rate cuts, if matched with stable inflation, fiscal prudence, and supportive external conditions, could set the stage for a medium-term equity market recovery.

“Now is the time for both policymakers and market players to act,” Mr. Mensah concluded. “The groundwork is being laid for a stock market revival. But without sustained reforms and investor engagement, this opportunity could be lost.”

READ ALSO: Finance Ministry Inaugurates Boards for Insurance, Cocoa Sectors