As the economies on the continent continue to reel under economic mismanagement, camouflaged by the COVID-19 pandemic and the situation in Ukraine, traders said Ghana’s cedi, Kenya’s shilling, Uganda’s shilling and Zambia’s kwacha are expected to weaken against the dollar, while Tanzania’s and Nigeria’s currencies are forecast to hold steady.

Ghana’s cedi is expected to remain under pressure if the central bank does not step up against increased corporate demand and reduced U.S. dollar supplies.

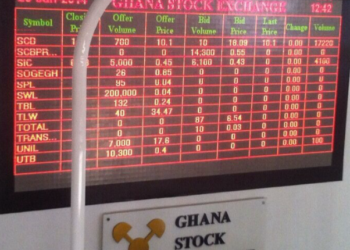

Refinitiv data showed the cedi trading at GHS12.6500 to the dollar this week, up from 12.0000 at last week.

“Cedi lost further ground this week amid increased corporate demand and reduced USD supply. We expect the cedi to remain under pressure barring any strong intervention from the central bank,” said Chris Nettey, a trader at Stanbic Bank.

Absa Ghana said in a note that the USD/GHS bid offer spread narrowed on improved liquidity. However, the bank added that the Central bank has provided minimal support to the spot market by selling roughly $1 million.

Kenya

Kenya’s shilling is also expected to weaken further, hurt by increased demand for dollars from the energy and manufacturing sectors.

Commercial banks quoted the shilling at 126.15/35 per dollar, compared with last week’s close of 125.70/90 per dollar.

Earlier in the week, the shilling, which is down 2.4% so far this year, touched a fresh low of 126.50/70 per dollar before regaining some of its losses, Refinitiv data showed.

“We see the shilling remaining under a lot of pressure. There is a lot of demand coming from across all sectors, and mainly from the energy and manufacturing (sectors),” a trader at one commercial bank.

Uganda

The Ugandan shilling is seen weakening as a pick-up in appetite for dollars from both merchandise importers and commercial banks exerts pressure on the local unit.

Commercial banks quoted the shilling at 3,730/3,740, compared to last week’s close of 3,665/3,675.

“We’re seeing quite substantial (dollar) appetite from importers in various sectors,” said one trader at a commercial bank in the capital Kampala. The heightened demand was meeting with tight inflows, the trader said.

Zambia

The kwacha is likely to remain under pressure against the dollar next week as demand for hard currency continues to exceed supply. This week, commercial banks quoted the currency of Africa’s second-largest copper producer at 19.8400 per dollar from a close of 19.6100 a week ago. “The kwacha is projected to follow a downward trajectory in the short term due to lack of dollar inflows and rising demand for hard currency,” Access Bank said in a note.

Tanzania

Tanzania’s shilling is expected to hold steady next week with inflows from foreign direct investments offsetting demand of the U.S. dollar from most sectors.

Commercial banks quoted the shilling at an average of 2,336/2,346 this week, compared to 2,332/2,342 recorded at last week’s close.

“Tanzania’s government this week gave the green light to construction of a $3.5bn oil pipeline transporting crude from Uganda to the port of Tanga for export in the face of opposition over its potential environmental impact,” AZA Finance said in a note. “We expect the shilling to continue trading around current levels near term,” it added.

Nigeria Naira to Remain Stable

As millions of Nigerian electorates queue up to cast their ballots today, 25th February, traders predict that Nigeria’s naira will be holding at current levels next week until the shortage of local notes is resolved.

The naira has been marginally firmer on the parallel market due to a shortage of banknotes as the central bank implemented its cashless policy before today’s Presidential vote.

The naira Is quoted at 755 to the dollar on the parallel market, compared with 756 at last week close. However, it traded within a range of 460 to 462 on the official market .

“Resolving the cash shortage has become more significant for the naira outlook than the election results, with the rate likely to hold around current levels until naira supplies recover,” currency trading firm AZA Finance said in a note.

READ ALSO: Nigeria Elections 2023: Voting Commences