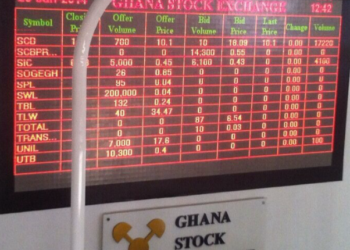

The Ghana Stock Exchange (GSE) witnessed a stellar performance in its mid-week trading session, with bulls dominating the day and pushing market capitalization to new heights.

Investors were treated to a surprising and impressive display, as the market saw gains across multiple equities. By the end of the trading session, the GSE’s total market capitalization surged by GHS300 million, climbing to an impressive GHS 99.5 billion.

This bullish trend marked a significant shift for the GSE, which had experienced relatively quiet trading sessions in previous weeks. The strong performance of listed equities, particularly Fan Milk Plc, Ecobank Transnational Incorporated (ETI), NewGold ETF, and TotalEnergies Marketing Ghana, contributed to this surge in market capitalization. Meanwhile, only one equity, Atlantic Lithium Ltd, recorded a marginal decline, showcasing the overall strength of the market.

Bullish Performance and Key Gainers

Fan Milk Plc (FML) emerged as the star of the trading session, recording a 5.71% increase in its share price, closing the day at GHS 3.70 per share. This marked a 20-pesewa gain from its previous closing price of GHS 3.50.

The significant rise in Fan Milk’s stock value was one of the key contributors to the overall market growth. The dairy and beverage giant’s performance reflects growing investor confidence in the company, driven by expectations of continued revenue growth in Ghana’s expanding food and beverage sector.

Ecobank Transnational Incorporated (ETI) was another major gainer in the session, registering a 5.56% increase to close at GHS 0.19 per share, up from GHS 0.18.

Although the 1-pesewa gain might seem modest, it represents a steady recovery for the financial institution, which has been navigating a challenging operating environment marked by fluctuating financial markets across the continent. ETI’s gain demonstrates renewed optimism about the bank’s prospects in the face of Ghana’s broader economic recovery.

The NewGold Exchange-Traded Fund (ETF), which tracks the price of gold, also saw a significant rise in value, increasing by 1.35% to close at GHS 432.00 per share, up from GHS 426.23. The ETF’s performance reflects investor interest in gold as a safe-haven asset amid global economic uncertainties.

This increase in the price of gold on the GSE mirrors the global trend, as investors hedge against inflationary pressures and currency volatility.

TotalEnergies Marketing Ghana (TOTAL) also joined the list of gainers, posting a modest 0.32% rise in its share price to close at GHS 12.70, up from GHS 12.66. The energy company’s gain was supported by stable oil prices and improved operational efficiency, reinforcing investor confidence in its long-term outlook.

The Lone Loser: Atlantic Lithium

While most equities saw gains, Atlantic Lithium Ltd (ALLGH) was the only equity that recorded a loss during the session. Its share price dropped by a mere 0.16%, closing at GHS 6.14, down from GHS 6.15. Despite this slight decline, the loss was marginal and did little to dampen the overall bullish sentiment on the market.

The bullish momentum also reflected in the GSE’s benchmark indices. The GSE Composite Index (GSE-CI), which tracks the performance of all listed companies, inched up by 8.29 points, representing a 0.19% gain to close at 4,368.80 points.

This marks a 1-week gain of 0.49%, though the index has seen a 4-week loss of 0.86%. However, on a year-to-date basis, the GSE-CI has posted an impressive gain of 39.57%, highlighting the market’s overall positive trajectory in 2024.

Similarly, the GSE Financial Stocks Index (GSE-FSI), which focuses on the performance of financial institutions, also saw an increase of 0.39%, closing at 2,215.22 points. The GSE-FSI recorded a 1-week gain of 0.54%, a 4-week gain of 0.69%, and a year-to-date gain of 16.49%. The index’s performance reflects renewed investor confidence in Ghana’s financial sector as the country continues to navigate post-pandemic economic recovery efforts.

Despite the strong gains in market capitalization, trading volume on the day was relatively subdued. A total of 159,038 shares, worth GHS 412,420.63, were traded during the session.

This marked a significant decline in both volume and turnover compared to the previous day’s trading activity. Specifically, the market experienced a 63% drop in volume and a 76% decline in turnover compared to the trading session on October 22.

Among the most actively traded equities, CalBank recorded the highest volume of traded shares, with 109,113 shares changing hands. Fan Milk followed with 23,020 shares, while MTN Ghana and TotalEnergies Marketing Ghana saw 17,032 and 2,170 shares traded, respectively.

As the year progresses, investors will be keenly watching whether the GSE can maintain its bullish momentum, with market fundamentals suggesting a promising outlook for the rest of 2024.

READ ALSO: Ghanaian Media Urged to Pay More Attention to Artists Residing Abroad