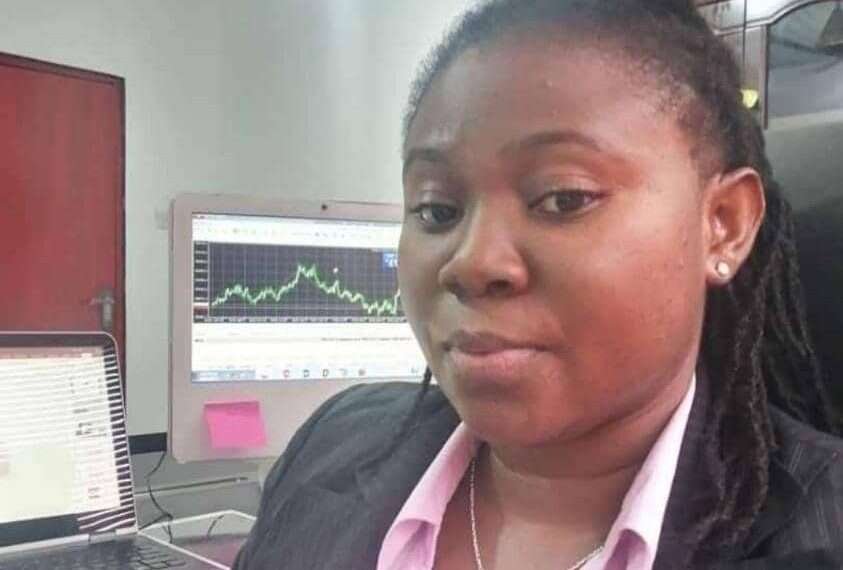

Mrs Ruth Ofori, a financial analyst and the Chief Executive Officer (CEO) of Lolyfx LTD in an interview with the Vaultz News has predicted a surge in MTN Ghana’s stock in the second quarter of 2025.

Ms Ruth’s projections came at the back of MTN Ghana’s release of 2024 audited financial report. The company’s audited financial report for the year revealed a substantial profit of GH¢5.028 billion, representing a 26.3% year-on-year growth despite Ghana’s challenging macroeconomic conditions.

“MTN Ghana’s robust financial performance is expected to trigger a surge in investor demand for its shares, ultimately driving up the stock price in the second quarter of 2025. Historically, positive earnings reports and attractive dividends have been strong catalysts for stock appreciation, as they indicate a company’s profitability and stability.

“This impressive performance, coupled with a generous dividend payout of GH¢3.176 billion, has positioned MTN as an attractive investment, which is enough to spark increased investor demand and a potential surge in its stock price.”

Mrs Ruth Ofori

The analyst averred that the substantial dividend will likely attract both existing and new investors seeking profitable returns, reinforcing MTN Ghana’s reputation as a lucrative stock on the Ghana Stock Exchange (GSE).

Meanwhile, Mrs Ruth Ofori iterated that MTN Ghana’s ability to achieve a GH¢5.028 billion profit in 2024 amid economic headwinds underscores its resilience and strategic efficiency.

“The company’s 26.3% profit growth is particularly notable given the inflationary pressures, exchange rate volatility, and high operational costs that businesses in Ghana faced throughout the year. This growth signals that MTN Ghana has successfully navigated these challenges through prudent financial management, innovative product offerings, and strong market positioning.”

Mrs Ruth Ofori

The analyst noted that the strong earnings and dividend payout indicate that the company remains committed to rewarding shareholders, further enhancing investor confidence.

Other Key Factors Likely to Drive MTN Stock Price

The market analyst noted that the anticipated stock price increase for MTN Ghana is expected to be driven by several key factors. One major contributor, according to her is the growing interest from both institutional and retail investors.

“The company’s impressive profit figures and strong dividend payout make its stock more appealing to mutual funds, pension funds, and individual investors seeking stable and rewarding investments. As more investors recognize MTN Ghana’s financial strength, demand for its shares is likely to rise, pushing the stock price higher.”

Mrs Ruth Ofori

She added that market sentiment and speculative trading will also play a significant role in influencing the stock’s upward trajectory. Positive perceptions of MTN Ghana’s strong financial position will attract speculative traders who aim to benefit from the expected price increase.

“As news of the company’s profitability spreads, investors looking for short-term gains may drive further buying activity, leading to increased volatility and upward pressure on the stock price.”

Mrs Ruth Ofori

Additionally, Mrs Ruth Ofori noted that MTN Ghana’s strong dividend yield will serve as a catalyst for the stock’s appreciation. A substantial dividend payout enhances the attractiveness of the company’s shares, making them more desirable to income-focused investors. “The higher the dividend yield, the greater the demand for MTN Ghana’s stock, ultimately contributing to an increase in its market value.”

Macroeconomic Factors Supporting MTN Ghana’s Growth

Beyond the company’s internal strengths, several macroeconomic factors could further support its stock appreciation in the second quarter of 2025, the analyst disclosed.

“Improved economic stability will play a crucial role in boosting investor confidence in MTN Ghana’s stock. If Ghana experiences lower inflation and a stronger cedi, the overall business environment will become more favorable for investments.”

Mrs Ruth Ofori

She explained that a stable economy reassures both local and foreign investors, leading to increased participation in the stock market, including heightened interest in MTN Ghana’s shares. As economic conditions improve, businesses and consumers will have greater financial stability, further supporting the company’s growth.

Moreover, Ms Ruth Ofori noted that the expansion of digital and telecom services presents a significant opportunity for MTN Ghana’s long-term revenue growth. “The increasing demand for digital financial services, mobile money, and internet connectivity continues to drive the company’s market presence.”

A stable regulatory environment is also essential for MTN Ghana’s continued expansion. Predictable and supportive regulations will allow the company to operate efficiently without significant disruptions. When regulatory policies are clear and consistent, MTN Ghana can focus on enhancing its services and increasing market penetration. This stability ensures reliable revenue streams, reinforcing investor confidence in the company’s financial prospects.

Potential Risks and Challenges

While MTN Ghana’s stock is positioned for an upward trend, certain risks could moderate its growth trajectory. One major factor, according to Mrs Ruth Ofori is the potential impact of regulatory and taxation policies.

“Changes in government policies, such as increased taxation on telecom services or stricter regulatory measures, could affect MTN Ghana’s profitability. If the government imposes higher levies or enforces new compliance requirements, the company may face increased operational costs, which could reduce investor confidence and limit stock price growth.”

Mrs Ruth Ofori

Another key concern she stated is currency depreciation, particularly the persistent weakening of the Ghanaian cedi. She explained that since MTN Ghana incurs foreign currency-denominated expenses for equipment, network expansion, and other operational costs, a depreciating cedi could lead to higher costs and lower profit margins.

She explained that if the local currency continues to weaken, it may erode the company’s earnings and affect its ability to maintain strong financial performance. “These factors, while not necessarily halting MTN Ghana’s stock growth, could introduce volatility and moderate its upward trajectory.”

In all, MTN Ghana’s record-breaking GH¢5.028 billion profit and GH¢3.176 billion dividend payout have set the stage for a potential stock price increase in the second quarter of 2025. With strong investor interest, favorable market sentiment, and robust financial performance, the company is well-positioned to experience an uptick in its stock price. As investors closely monitor MTN Ghana’s trajectory, the second quarter of 2025 could mark a significant milestone in the company’s stock market performance.

READ ALSO: Fidelity Bank Ghana Recognized for Excellence in SME Banking