Mr Isaac Kwesi Mensah, a Corporate Finance Research Analyst at SIC Brokerage, has given an insight into the possible reasons behind the poor showing of the Ghana Stock Exchange (GSE) in the first quarter, noting that investors now prefer the money market to that of the capital market.

Mr Isaac Kwesi Mensah made this known in an exclusive interview with the Vaultz News. According to the Researcher, the money market is now looking like a safe place to be for investors. As such, he intimated that new waves of buying engulfed the Treasury market in the first quarter, roiling investors and analysts who have been trying to predict just how high yields will go and the effect of the situation on the equities market. The analyst explained that buy-off in the money market has been stoked by investors steadily ratcheting up expectations for a further rate hikes this year by the Monetary Policy Committee (MPC), despite a persistent rift about how far it will ultimately go.

“The poor performance of local bourse is hugely due to the shift from the capital market to the money. Activity on both the primary and secondary bond markets are booming. Market participants are moving to the money market because there is a sure avenue to make good and cheap money with time with no difficult analysis.”

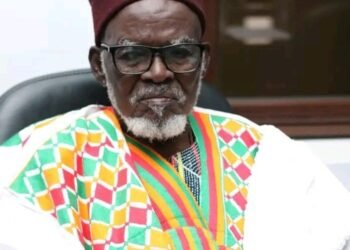

Mr Isaac Kwesi Mensah

Mr Isaac Kwesi Mensah stressed that in as much as investors are trying to be rational in their decision making, it is natural for them to go in for the less riskier market in favor of the equity market which requires high analytical skills.

“Moreover, the uncertainty on the money market is relatively lesser as compared to the huge uncertainty on the capital market. This makes many investors to abandon the stock market, thereby causing the market to record that poor performance in the first quarter.”

Mr Isaac Kwesi Mensah

The Research Analyst emphasized that the unstable economic conditions due to rising inflation, policy rate hike and depreciation of the local currency are some factors that are affecting the stock market’s performance.

Hope for Recovery

However, Mr. Kwesi Mensah averred that despite the poor showing by the local bourse in the first quarter, there is hope for recovery. He thus, stated that the stock market is bouncing back and so investors must be hopeful.

“It is just a matter of time. Market participants will appreciate the need to return to the stock market for good return… This will be quicker when players like stock brokerage firms and their research team put out good market research analysis report and coverage initiations for investors consideration.”

Mr Isaac Kwesi Mensah

In the intervening time, the Researcher made a plea asking institutional investors to invest more in equities to help limit short-term market fluctuations while contributing to economic restructuring.

For the domestic market to be able to recover from the poor form and match last year’s performance, Mr Kwesi Mensah called for endorsement of aggressive actions to curb inflation and depreciation.

The financial analyst’s comment came on the back of the first Quarter Report which indicated that the Ghana Stock Exchange ends 1st Quarter as 14th best performing Exchange In Africa in dollar terms out of 15 best ranked Exchanges on the continent. The Ghana Stock Exchange Composite Index (GSE-CI) ended the first quarter of 2022 with a loss of 1.67 percent.

READ ALSO: Expert Admonishes Parties Not To Downplay EIU Report