Ghana’s treasury bill market (T-Bill) experienced a setback as the government missed its auction target for the first time in 2025, recording an 18% under-subscription.

The shortfall indicates a potential shift in investor sentiment toward the short-term debt market, raising concerns about liquidity and demand for government securities.

According to auction results from the Bank of Ghana, the government sought to raise GH¢6.142 billion from treasury bills but secured only GH¢4.99 billion from investors. Of this amount, the government accepted GH¢3.31 billion, leaving a significant gap in its short-term borrowing plans.

A substantial portion of the bids came from the 91-day treasury bill, which received GH¢3.63 billion in tenders, representing 72.7% of total bids. However, the government accepted GH¢2.34 billion from this segment. The 182-day bill saw bids amounting to GH¢741.38 million, with GH¢574.49 million accepted, while the 364-day bill recorded bids worth GH¢622.07 million, out of which GH¢406.07 million were accepted.

Mr Isaac Kwesi Mensah, a Corporate Finance Research Analyst at SIC Brokerage, in an interview with the Vaultz News, noted that the under-subscription signals a shift in market conditions, with investors possibly reevaluating their appetite for government securities. “It also raises concerns about the government’s ability to meet its short-term financing needs through treasury bills,” he said.

Interest Rates Remain Relatively Stable

Despite the under-subscription, interest rates on treasury bills showed little movement, indicating that investor demand remains steady even though the overall subscription levels fell short.

The yield on the 91-day bill declined slightly by 12 basis points to 15.85%, while the 182-day bill’s yield remained unchanged at 16.92%. The rate on the 364-day bill saw a marginal decline from 18.96% in the previous auction to 18.84%.

Mr Isaac Kwesi Mensah stated that this stability in rates suggests that while investor participation in the auction was lower than expected, those who participated did not demand significantly higher yields.

“However, the government’s decision to accept only GH¢3.31 billion instead of the entire GH¢4.99 billion tendered may indicate a preference to avoid paying higher interest rates.”

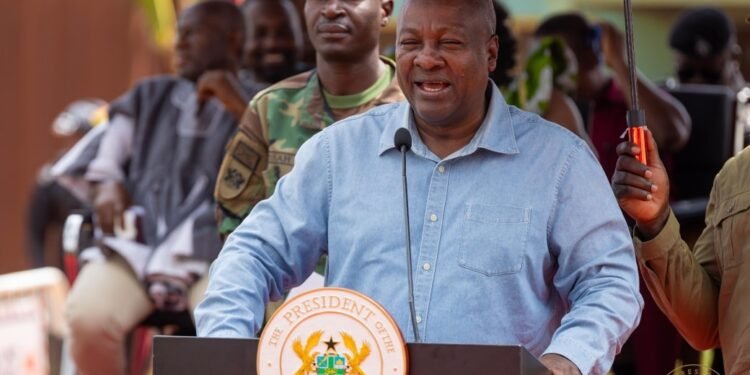

Mr Isaac Kwesi Mensah

Possible Reasons for the Under-Subscription

On the possible reasons for the undersubscription, Mr. Isaac Kwesi Mensah indicated that several factors could have contributed to the shortfall in the latest T-bill auction.

“One key reason could be investor liquidity constraints. The lower demand for treasury bills may reflect limited liquidity in the financial system. If banks and institutional investors face cash flow challenges, their ability to invest in government securities could be affected. This situation may arise from tightened monetary conditions, unexpected financial obligations, or a general slowdown in economic activity, leading investors to prioritize liquidity over investment.”

Mr Isaac Kwesi Mensah

Another factor he stated is that it could be shifting investment preferences. Investors may be exploring alternative options with potentially higher returns. With a relatively stable interest rate environment, some market participants may prefer to allocate funds to higher-yielding assets such as corporate bonds, equities, or foreign currency-denominated investments. “This shift in preference suggests that investors are actively seeking opportunities that align with their risk appetite and return expectations”.

“Expectations of further rate declines may also have contributed to the undersubscription. The marginal declines in treasury bill rates indicate that investors might anticipate further reductions in yields. If they believe that rates will drop in the coming weeks, they may delay participation in T-bill auctions to lock in better returns later. Such expectations could lead to a temporary reduction in demand as investors wait for more favorable conditions before making long-term commitments.”

Mr Isaac Kwesi Mensah

Mr Kwesi Mensah opined that macroeconomic concerns further compound the situation. Broader economic issues such as inflationary pressures, exchange rate volatility, and government debt sustainability may influence investor sentiment.

“If investors perceive risks in the macroeconomic environment, they may reduce their exposure to government securities to avoid potential losses. Uncertainty regarding fiscal policies and economic stability can lead investors to adopt a cautious approach, ultimately affecting the level of subscription in treasury bill auctions.”

Mr Isaac Kwesi Mensah

Implications for Government Financing

The analyst noted that the under-subscription raises concerns about the government’s ability to finance its short-term obligations through treasury bills. He noted that a sustained decline in investor interest could force the government to either increase rates to attract more buyers or explore alternative funding sources.

“If treasury bill auctions continue to record shortfalls, the government may need to adjust its debt strategy, possibly shifting toward longer-term bonds or external borrowing. Additionally, persistent under-subscription could signal difficulties in managing the country’s debt servicing obligations.”

Mr Isaac Kwesi Mensah

Meanwhile, while this is the first T-bill auction shortfall in 2025, it remains to be seen whether this trend will continue. The government may need to reassess its borrowing strategy, taking into account market dynamics and investor sentiment.

Moving forward, the Bank of Ghana and the Ministry of Finance may need to engage with investors to understand their concerns and implement policies that boost confidence in government securities. Ensuring a stable macroeconomic environment and maintaining fiscal discipline will be crucial in sustaining investor interest in T-bills.

For now, the treasury bill market appears to be wobbling, but whether this signals a temporary shift or a more concerning trend remains to be seen.

READ ALSO: Politicians To Stay Out Of Security Operations- Richard Kumadoe