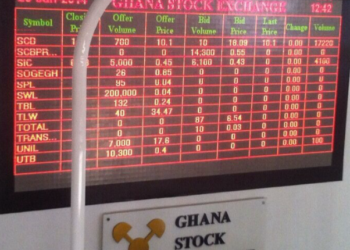

The Ghana Stock Exchange (GSE) closed Thursday’s trading session with a notable surge in activity, despite little to no movement in stock prices.

A total of 670,196 shares exchanged hands, representing a market value of GHS 3,078,727.93. This marks a significant 484% increase in trading volume and a 9% rise in turnover compared to the previous session on Wednesday, April 9.

This sharp uptick in trading activity suggests increased investor participation and growing market interest. However, the heightened trading levels did not translate into broad-based price changes, resulting in a market session that was active but flat in terms of equity performance.

Out of the 14 listed equities that participated in the day’s trading, only the NewGold ETF saw a positive price movement. The ETF appreciated by 2.25%, standing alone as the session’s sole gainer. No equity recorded a price decline, meaning the day ended without any losers.

The lack of widespread price changes suggests that many of the transactions occurred within existing price bands. While this may be interpreted as market stagnation, it can also be seen as a sign of consolidation and stability following recent gains.

Indices Remain Steady Despite Strong Activity

The benchmark GSE Composite Index (GSE-CI) closed unchanged at 6,099.60 points. Despite the lack of day-to-day movement, the index has shown consistent performance in recent weeks. It recorded a 1-week gain of 0.56%, a 4-week gain of 0.62%, and a robust year-to-date gain of 24.77%.

Similarly, the GSE Financial Stocks Index (GSE-FSI), which monitors the performance of financial sector stocks, held steady at 3,060.79 points. The index showed a minor weekly loss of 0.08% but remains strong overall, with a 4-week gain of 5.74% and an impressive year-to-date return of 28.56%.

Top Traded Equities: MTN Ghana and GCB Bank Lead

Telecom and banking stocks dominated trading volumes during the session. MTN Ghana recorded the highest trading volume of 346,659 shares, reinforcing its reputation as one of the most liquid and attractive stocks on the exchange. GCB Bank followed with 268,983 shares traded, while Ecobank Transnational Incorporated (ETI) and CalBank registered 36,988 and 16,857 shares respectively.

The concentration of trades among these blue-chip stocks points to their continued appeal among both retail and institutional investors. Their strong fundamentals and market leadership positions make them reliable options, especially in times of market uncertainty or flat performance.

The total market capitalization of the Ghana Stock Exchange remains firm at GHS 135.6 billion. This reflects investor confidence in the broader market and suggests a level of resilience, even on days where there’s little directional movement in stock prices.

The ability of the market to absorb a high trading volume without volatility is a positive signal. It demonstrates liquidity depth and investor confidence, particularly in an environment where global and regional markets continue to grapple with economic uncertainties.

While Thursday’s session may appear uneventful on the surface due to the absence of major price movements, the sharp rise in volume and turnover tells a different story — one of increased investor engagement. The session may be viewed as a period of market consolidation, where investors reposition their portfolios and await fresh catalysts.

In all, the GSE’s flat trading session amidst a spike in activity reflects a mature and stable market, poised for future movement as investor confidence continues to build.

READ ALSO: VEPEAG Calls for Urgent Reforms to Boost Intra-African Trade