The entertainment world is often seen as glamorous and lucrative, where artists and entertainers enjoy fame, fortune, and a lifestyle many only dream of.

However, beneath the surface lies a harsh reality that many artists face: financial instability and, in some cases, complete financial ruin. A significant factor contributing to this phenomenon is the lack of future planning.

One of the primary reasons artists find themselves in financial trouble is the misconception of stability in their careers.

Many believe that a successful album, a hit single, or a blockbuster film guarantees long-term financial security. However, the entertainment industry is notoriously unpredictable.

Trends shift rapidly, and what is popular today is forgotten tomorrow. This transient nature leads to a false sense of security, prompting artists to spend lavishly without considering the long-term implications.

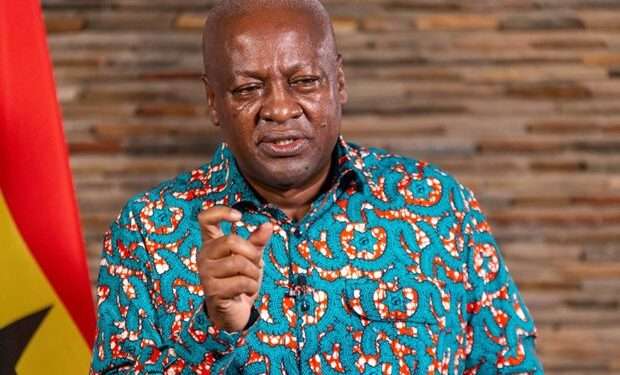

Popular Nigerian DJ, DJ Neptune, has shared his thoughts on the lifestyle choices of some Nigerian artists, particularly those who fail to plan for their future during their peak years in the industry.

He stressed the importance of financial responsibility and the dangers of excessive spending without foresight.

“Artists feel fame is forever; that’s why some of them, while they are at their peak, don’t save up their money, they don’t invest. I was with somebody the other day, and the person was saying these artists that collect advance payments, they collect it and go and buy Benz. Is that not your future you are driving?”

DJ Neptune

The entertainment industry pressures artists to maintain a certain lifestyle and public image. This often leads to extravagant spending on luxury items, designer clothing, cars, and high-end living conditions.

Social media exacerbates this issue, as artists feel compelled to showcase their wealth and success to their followers. The desire to appear successful leads to financial decisions that prioritize immediate gratification over long-term stability.

The DJ who also has songs he has recorded with artists like Burna Boy, Rema, and others reflected on the statement, calling it “deep” and a reality check for many in the industry.

He emphasized that fame is often fleeting, and without proper financial planning, many could face challenges when their popularity wanes.

“That’s why I tell some of my colleagues, while you are on top, invest your money. If it’s properties you want to do, just have a side income,” he advised.

Many artists enter the industry at a young age, often without a solid understanding of financial management. While they are talented in their craft, they frequently lack the knowledge to manage their finances effectively.

This gap in financial literacy leads to poor investment choices, excessive spending, and a failure to save for the future. Without proper guidance, many artists find themselves overwhelmed by their financial responsibilities, leading to debt and eventual bankruptcy.

The Impact of Lifestyle Choices

The lifestyle choices of artists significantly impact their financial stability. Many artists indulge in expensive habits, such as frequent travel, dining at high-end restaurants, and hosting lavish parties.

While these activities seem harmless at the moment, they quickly deplete savings and lead to financial strain. Furthermore, the pressure to maintain such a lifestyle leads to a cycle of overspending, where artists continue to spend beyond their means to keep up appearances.

DJ Neptune acknowledged that only a few artists have the grace to sustain their careers beyond a decade, making it even more crucial to plan for the future.

“It is only a few of us that have the grace to be in the game for more than five, ten years. You are appealing to a certain age group, and if you don’t know how to tone down and switch, you might have missed your way.”

DJ Neptune

To avoid the pitfalls of financial instability, artists must prioritize long-term financial planning.

Understanding the basics of budgeting, saving, and investing is crucial. Artists should seek financial literacy resources or work with financial advisors who prioritize education.

Artists should be encouraged to invest their earnings in a diversified portfolio, which provides growth over time and helps them build wealth.

The financial downfall of many artists is often traced back to a lack of future planning and financial literacy. While the entertainment industry offers substantial rewards, it also carries significant risks.

Ultimately, success in the entertainment industry requires not only talent but also the foresight to manage one’s finances wisely.

READ ALSO: E/R Minster Bemoans Difficulty in the Fight Against Illegal Miners