A 1 trillion Ghana Cedi economy may be a headline-grabbing figure, but according to most economists, like Dr. Theo Acheampong, its significance diminishes when inflation exceeds 30%.

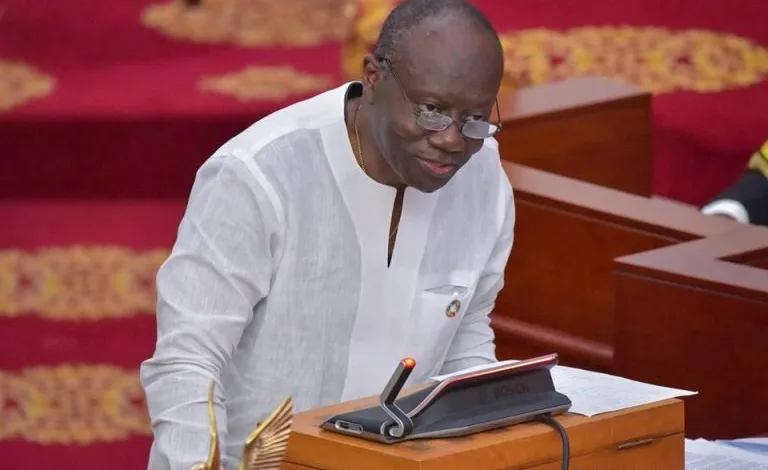

The assertion, amidst many other similar ones, follows Finance Minister Ken Ofori-Atta’s proclamation to Parliament that Ghana’s economy, under the Akufo-Addo administration, has surpassed One Trillion Cedis.

Ofori-Atta contrasted this with the GHc219.5 billion inherited from the Mahama administration in 2016.

While Ofori-Atta exuded confidence in the government’s economic trajectory, emphasizing the need to maintain growth, currency stability, and disinflation over the medium term, Dr. Theo Acheampong has expressed skepticism in a tweet.

“It’s just $83bn at a current exchange rate of USD 1 to GHS12. The finance minister should rather be talking about Gross National Income (total GNI or per capita or growth rate) as one of the better macro indicators of our economic prosperity. I get worried when we ‘abuse’ such indicators in the name of grandstanding.”

Dr. Theo Acheampong

During the presentation of the 2024 budget statement on November 15, Ofori-Atta underscored the historic nature of the occasion, emphasizing that the 2024 budget marks the first time Ghana’s Gross Domestic Product (GDP) has exceeded the one trillion Cedi milestone.

Looking ahead, he projected that by 2025, the economy, under President Akufo-Addo’s final year in office, would be valued at over One Trillion Cedis.

However, Dr. Theo Acheampong contended that a trillion Ghana Cedi economy loses its luster when inflation is rampant, noting that, at the current exchange rate of USD 1 to GHS12, it equates to just $83 billion. Dr. Acheampong advocated for a more nuanced discussion, urging the Finance Minister to focus on indicators such as Gross National Income (GNI), per capita income, or growth rates for a more comprehensive understanding of economic prosperity.

Ofori-Atta, in his budget presentation, outlined the government’s commitment to sustaining current economic growth, citing the importance of maintaining currency stability and achieving disinflation over the medium term. He referred to the 2024 budget as a “victory budget” that would pave the way for job creation and wealth generation. The Finance Minister highlighted the government’s success in completing the first review of the 3-year, 3 billion International Monetary Fund External Credit Facility (IMF-ECF) program, signaling a positive turning point in addressing economic challenges.

Addressing concerns about inflation, Ofori-Atta pointed out a decline from 54.1 in December to 35.2 in October 2023, emphasizing the government’s commitment to stability and growth. He assured Parliament that the economic recovery was real and enduring.

The ensuing discourse reflects the complexities inherent in economic assessments, particularly the potential divergence in interpretations of key indicators. While Ofori-Atta celebrates the milestone target of a trillion Cedi economy, Dr. Acheampong and some others call for a broader perspective, urging policymakers to consider a range of indicators beyond GDP for a more comprehensive understanding of economic health.

The Interplay Of GDP Growth, Inflation And Depreciating Currencies

The steady increase in the average cost of goods and services, or inflation, has a major impact on the GDP growth of a nation. While moderate inflation is considered a normal feature of a healthy economy, high inflation or hyperinflation can be harmful.

The primary effect of inflation on GDP growth is the erosion of buying power. As prices rise, consumers’ actual income falls, restricting their ability to spend, which is a crucial driver of economic activity. As a result, businesses have diminished demand for goods and services, which has a negative impact on the whole economy. Inflation, in addition to reducing purchasing power, creates uncertainty in the business climate.

Businesses find it difficult to plan ahead and make wise judgments when prices are volatile, which discourages them from investing in long-term projects. This hesitation stifles capital generation and economic growth.

Furthermore, inflation affects interest rates, which are a critical component in the GDP growth equation. In order to cool the economy, central banks frequently raise interest rates in response to inflation. While this approach is meant to contain inflation, it also raises borrowing rates for firms and consumers, thus discouraging investment and decreasing economic growth.

This interplay impact on the local industries ability to produce competitively. As a result, the economy relies greatly on imports and consequently drives foreign exchange higher. The ripple effect continues to run down the spine of the economy causing aches for the ordinary consumer whose purchasing power has already been hurt.

This suggests that a GHS 1 Trillion economy may not be necessarily an economic indicator for a thriving economy.

READ ALSO: 2024 Budget: Calls For More Details