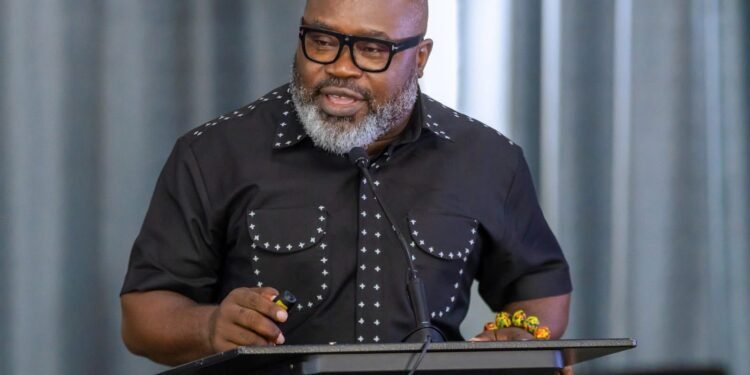

The Member of Parliament for Ajumako Enyan Essiam Constituency and Minister of Finance Designate, Hon. Dr. Cassiel Ato Forson, has articulated a bold vision for enhancing Ghana’s tax revenue collection during his vetting by Parliament’s Appointment Committee.

In his address, he emphasized the country’s potential to significantly improve tax mobilization without necessarily increasing tax rates, while promising transparency and equity in taxation policies.

“Ghana currently collects approximately 13.8% of GDP in terms of tax revenue according to the latest data cited as part of the transition. It is obvious that we can do better.

“I’ve studied the Ghana economy for some time, and I can say without mentioning a word that Ghana has huge potential when it comes to tax revenue mobilization. You don’t necessarily have to increase taxes before you rake in revenue.”

Dr Cassiel Ato Forson, MP for Ajumako Enyan Essiam and Minister of Finance Designate

Dr Ato Forson further pointed out that Ghana has untapped potential in tax mobilization, stressing that improved compliance rather than tax rate hikes would be his administration’s focus if approved.

Dr. Forson outlined his vision to raise tax revenue to between 16% and 18% of GDP in the medium term, bringing Ghana closer to the levels of its economic peers. “What we need to do is improve compliance. I will work with the GRA and the tax policy unit of the Ministry of Finance to ensure that we raise revenue as much as we can,” he stated.

Responding to concerns from Hon. Afenyo-Markin about the possibility of raising taxes, Dr. Forson clarified, “We do not necessarily have to raise tax revenue by increasing the tax rate. Some of the taxes out there are not bringing in the revenue we need.”

Citing the example of the betting tax, which generates less than GHS 50 million annually, he labeled it a “nuisance tax,” suggesting its removal would have negligible impact on the economy.

Reforming Tax Exemptions, Balancing Revenue and Expenditure

On tax exemptions, Dr. Forson criticized the lack of transparency in the previous administration’s policies, specifically targeting the One District, One Factory (1D1F) initiative. He maintained that exemptions should be equitable and codified into law.

“My concern, particularly with the 1D1F tax exemption, is the opaque manner in which it has been done. Certain individuals should not be privileged to receive exemptions while others doing the same thing are excluded.”

Dr Cassiel Ato Forson, MP for Ajumako Enyan Essiam and Minister of Finance Designate

Dr. Forson proposed that exemptions under initiatives like 1D1F should be legislated to ensure fairness and transparency. Addressing questions from Hon. Abena Osei Asare, Dr Forson stressed the importance of balancing revenue with expenditure.

“’I’m also aware that between the 30th to 31st, we saw the controller paying out about GHS 18,000,000,000 as against the 400 that you gained. That’s a deficit. And so let’s wait for the end-of-year data, I don’t want to speculate. I’ll wait for end-of-year data numbers, and then I’ll present so if approved to parliament.”

Dr Cassiel Ato Forson, MP for Ajumako Enyan Essiam and Minister of Finance Designate

He cautioned against speculation about Ghana’s fiscal health, noting that any premature statements could destabilize the market. “Whatever we say here has implications, and it’s very sensitive to the market. Let’s wait for the end-of-year data,” he advised.

Quoting former President Akufo-Addo’s popular phrase, “Sika mpɛ dede” (money dislikes noise), Dr Forson pledged to present a true picture of the economy in due course.

Throughout his responses, Dr. Forson underscored his commitment to responsible fiscal management, fairness in tax policy, and avoiding undue burdens on citizens.

While reiterating the government’s intent to scrap certain taxes, he reassured the committee that revenue mobilization would remain a priority through improved efficiency and compliance.

With the nation facing significant economic challenges, Dr Forson’s performance at the vetting offered insights into his strategic approach to finance and governance.

His emphasis on transparency, equity, and economic prudence has set the stage for what could be a transformative tenure should his nomination be approved.

READ ALSO: OPEC Chief Advocates Balanced Approach to Energy Transition