A banking consultant, Dr Richmond Atuahene, has predicted capital adequacy challenges in the years ahead.

According to him, if government is going to implement debt restructuring, 2023 is going to be very tough. He revealed that should government apply the haircut or carry out debt reprofiling, debt scheduling or conduct market to market evaluation, they all have costs and it will affect people’s funds.

“That is why government was saying yesterday, they were talking about liquidity support; yes they have to think about liquidity support because some banks are going to have a serious liquidity support [challenge] and if you apply the IFRS in the debt valuation, then some are even going to have capital losses and there will be capital adequacy challenges in the years ahead. So, the banking scene for the years ahead and years to come doesn’t look, to me, very good at all.”

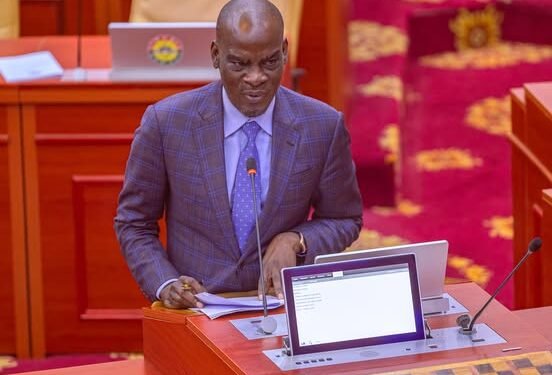

Richmond Atuahene

Dr Atuahene indicated that crowding out of the private sector is imminent and not good for businesses. He explained that he made a presentation some years back and the rate at which government was borrowing portends crowding out of the private sector, which is going to get worse.

“Because if policy rate has gone to 27%, no bank is going to give you credit less than the policy rate. They have to put their margins on it and risk premiums… It’s not going to help the industries and if industries output is not good, then domestic revenue generation will be difficult.”

Richmond Atuahene

Impact of debt restructuring on banking sector

The banking consultant stated that it is likely the debt restructuring will be effected and once that happens, “it is even going to curtail the banks’ ability” to give monies to people.

“Because if you have whatever you use, whether it’s a haircut, debt restructuring, debt swap, debt reprofiling, at the end of it all, there will be cost in it and the cost will be borne by those bond holders and if those bond holders are going to face problems without getting all their money, it is going to [be bad] …”

Richmond Atuahene

Commenting on the VAT increment by government, Dr Atuahene painted a bleak picture of the coming year. He indicated that “the poorest is going to get poorer” and things will get hard in the coming year due to the upsurge in charges.

“Things are not going to get better at all and it’s going to be tough for the average Ghanaian especially with inflation trajectory. Looking a bit ahead, inflation is not going to come down. So, if you have inflation of about 40% as at now and it shoots up to about 54%, it’s not going to get better…”

Richmond Atuahene

Dr Atuahene noted that positive steps of the budget has to do with the cost measures put in place by government. Nonetheless, he emphasized the need for the cost measures to go further than what government has proposed.

“Literature has proven that if you want to do debt restructuring, especially domestic debt restructuring, you should always pay attention to your cost reduction, because if your cost reduction is very high and you do the debt [restructuring], it goes contrary to the issues. So, in other jurisdictions, what they do is that they ensure that the cost reduction is effective…”

Richmond Atuahene

READ ALSO: The Cedi Tanked Because Foreign Investors Lost Confidence- Joe Jackson