Sampson Asaki Awingobit, Executive Secretary of the Importers and Exporters Association of Ghana, vehemently criticized Vice President Dr. Mahamudu Bawumia’s proposed flat tax system, dismissing it as a complete sham.

He challenged the economic rationale behind the proposal, cautioning that it would have a disproportionate impact on specific segments of society, potentially exacerbating existing economic inequalities and placing an undue burden on vulnerable groups, which could have far-reaching and devastating consequences.

Mr. Awingobit accused Dr. Bawumia of prioritizing political expediency over sound economic policy, suggesting that the Vice President’s announcement of a flat tax plan during his visit to Kumasi was a calculated move designed to garner political support rather than a genuine attempt to reform the tax system.

“This is not the first time the Vice President has made sweet statements, coming from the Vice President I think it is a total scam. He just wants to sway us. There is no way he is going to do anything to reduce revenue for the government”.

Sampson Asaki Awingobit

He contended that the proposed flat tax system is unfeasible, given Ghana’s commitments to the ECOWAS Common External Tariff (CET) and the IMF program, which impose specific fiscal and tariff obligations that cannot be reconciled with the sweeping changes entailed in a flat tax regime.

Awingobit pointed out that alternative solutions exist to alleviate the tax burden on importers, but Dr. Bawumia has inexplicably overlooked these viable options, instead opting for a blanket flat tax proposal that fails to address the nuances of Ghana’s complex tax landscape.

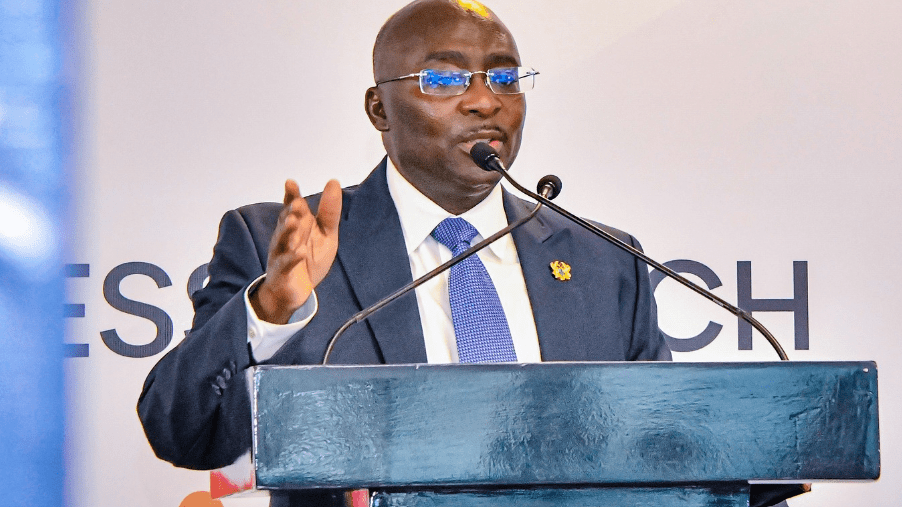

This development follows Dr. Mahamudu Bawumia’s reiteration of his pledge to introduce a flat tax system while on his campaign tour of the Ashanti region, specifically during a stop at Suame Magazine in Kumasi, where the Vice President and flagbearer of the New Patriotic Party (NPP) sought to woo voters with his controversial tax reform proposal.

Ghana’s Economic Future At Risk With Flat Tax

Meanwhile, Geoffrey Ocansey, a tax policy analyst, offered a nuanced view, acknowledging that while the flat tax system may yield short-term gains, its implementation could have far-reaching and potentially detrimental consequences for Ghana’s economic landscape in the long run.

“It is a regressive an approach to your economy, you are flooding your market with foreign products, your local industry will be crippled then people will lose their jobs, and government revenue will eventually shrink”.

Geoffrey Ocansey

He further argued that the flat tax policy represents a regressive form of taxation, which would disproportionately burden certain importers, exacerbate existing inequalities, and create market distortions that could have far-reaching and damaging consequences for the economy.

Dr. Bawumia, speaking to spare parts dealers, sympathized with their concerns, acknowledging that Ghana’s tax system is indeed flawed and in need of reform, and announced his plans to introduce a new tax system, aimed at addressing the current challenges and creating a more equitable and efficient tax environment.

He explained that the new tax system, known as the flat tax system, is modeled after the principles of tithing, where everyone contributes a fixed percentage, without exceptions or tiered rates.

He illustrated this point by noting that if the flat tax rate is set at 10%, it would apply uniformly to all individuals and businesses, eliminating disparities and complexities in the current tax code.

“So, by 2025, we are going to begin the implementation of a new flat tax system for Ghana.” – Dr. Mahamudu Bawumia

He announced that his government plans to implement a tax amnesty in 2025, effectively wiping the slate clean for all taxpayers.

This, Dr. Bawumia indicated, means that all taxes owed to the Ghana Revenue Authority (GRA) would be forgiven, allowing businesses to start fresh, free from any accumulated tax liabilities, and providing a clean slate for all taxpayers to comply with the new flat tax system.

READ ALSO: Putin Claims World At A “Point Of No Return”