The Honorary Vice President of IMANI Centre for Policy and Education, Bright Simons has challenged Ghana’s tax authorities’ decision to preserve the unpopular electronic levy (e-levy) on fintech services, including mobile money transactions.

The renowned and seasoned civil activist, in a strongly-worded analysis, argued that this approach, which seems focused primarily on revenue collection, neglects the broader economic impacts and risks costing the government far more in lost revenue than it gains.

“Tax officials are reportedly intent on retaining the e-levy to meet their targets, they have hovered between GHS 600 million and GHS 1 billion annually.

“Yes, e-levy does bring some money even if it is less than 5% of what the government projected and exactly in the range that CSOs projected. However, one also has to look at the potential revenue that it has wiped off due to its other impacts.”

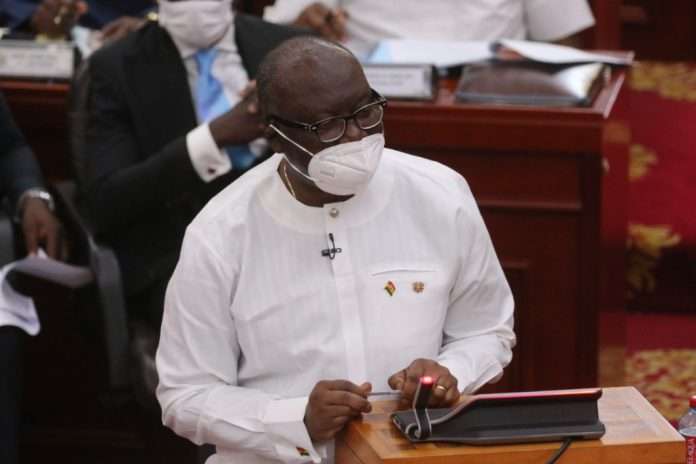

Bright Simons, Honorary Vice President of IMANI Centre for Policy and Education

Strategic Shortsightedness

Bright Simons pointed out that this narrow focus represents a “strategic shortsightedness” among public sector bureaucrats, highlighting the need for the government to consider all repercussions of such a revenue strategy.

He also underscored how a failure to conduct comprehensive cost-benefit analyses is costing the country dearly. In his critique, Bright Simons referred to 2022 figures revealing a net loss of GHS 1.4 billion in government revenue attributed to the e-levy, a stark contrast to the government’s initial expectations.

This finding, he argued, corroborates the warnings issued by the civil society community before the tax’s implementation, stressing that such losses would arise if the e-levy deterred digital and mobile transactions.

He went on to highlight specific areas where these negative effects are already visible. “General telco taxes (CST), for instance, have fallen from about $100 million in 2018 to barely $45 million in recent times, and it is still falling,” he observed, illustrating a significant drop in telecom sector contributions.

In Bright Simons’ view, this outcome is predictable when tax policies are applied without a holistic analysis of their consequences, especially in an era where digital services are supposed to be central to economic growth.

Ghana, a High Tax Destination

Moreover, the IMANI’s Honorary Vice President disclosed that Ghana’s high taxation on mobile devices is now the second-highest on the continent according to a recent study, which has compounded the problem.

With ICT contributions to GDP stagnating despite the government’s “digitalisation” agenda, Bright Simons believes that policymakers need a more informed understanding of taxation principles.

“I doubt I have ever met a tax bureaucrat who can draw a Laffer curve,” Bright Simons quipped, alluding to the famous economic concept which illustrates the counterproductive effect of high taxes on revenue generation.

His critique emphasized that Ghana’s revenue strategy should not be limited to simply meeting annual targets.

Instead, he urged the country’s tax authorities to approach policies like the e-levy with a view of the broader economic impact, factoring in possible long-term costs such as lost investment, diminished consumer spending, and the resulting hit to other revenue channels.

“Bureaucrats need to look at all columns in the cost-benefit ledger when doubling down on their pet policies,” he advised, underscoring the need for more nuanced fiscal planning.

This view, he noted is increasingly shared by stakeholders across sectors, who argue that a review of the e-levy may be necessary to protect Ghana’s digital economy from further harm.

He emphasized that as calls for digitalisation grow louder within government circles, the government must evaluate tax policies that may undermine these objectives, shedding light on the importance of balancing immediate revenue gains with longer-term economic growth.

READ ALSO: Gold Fields Gains 100% Ownership of Windfall Project in $1.39 Billion Osisko Deal