In recent years, Ghana’s economic landscape has been shaped by three persistent and interrelated issues: soaring inflation, rising interest rates, and the depreciation of the cedi or forex rate.

These factors collectively cast a long shadow over the daily lives of Ghanaians, particularly the business community, which finds itself grappling with the harsh realities of an unstable economic environment.

“Consistently, the issue of the economy manifests specifically three things under that, inflation, interest rate or cost of borrowing, and the cedi or forex rate. [This is] because practically everything that happens to people living within the country, especially the business community.”

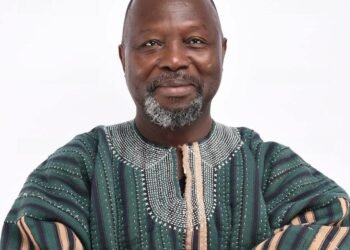

Dr. Theo Achempong, Economics and Political Risk Analyst

These issues—inflation, interest rates (or the cost of borrowing), and the depreciation of the Cedi against major global currencies—are interwoven threads that have become the defining characteristics of the current economic climate.

The Cedi’s depreciation against major foreign currencies has been a cause for concern in Ghana. The weakening of the local currency has negatively impacted businesses that rely heavily on imported raw materials and equipment. With the cedi losing its value, the cost of imports has surged, putting immense pressure on the working capital of these businesses.

Moreover, the depreciation of the cedi has inadvertently affected investor confidence in the country. Uncertainty surrounding the exchange rate makes it difficult for businesses to plan for the future, hindering their ability to make strategic decisions and investments. This has created a vicious cycle, further exacerbating the challenges faced by Ghanaian businesses.

“Within six months, businesses have lost over 56% of their working capital without doing any other business. It is not that they ran into a bad deal, but it is because of the current economic situation. So, the first thing that affects us when the Cedi depreciates is capital depletion.”

Charles Kusi Appiah Kubi, Head of the Business and Economic Bureau at GUTA

The Cedi continued to give grounds to the US dollar with the year-to-date depreciation at 17.88%. It is presently going for GH¢14.80 to a dollar on the retail forex market.

In addition to the depreciation of the cedi, Ghana is grappling with persistently high inflation rates. The rising cost of goods and services has made it increasingly difficult for businesses to maintain their profit margins. As prices escalate, the purchasing power of both businesses and consumers diminishes, leading to reduced demand and subsequently lower revenue for businesses.

On inflation, the Head of the Business and Economic Bureau at GUTA, Charles Kusi Appiah Kubi noted that the economy has become stagnant since consumers are cutting back on spending and businesses are experiencing a sharp decline in sales.

In tandem with inflation, high interest rates present a formidable challenge. The Bank of Ghana’s monetary policy, aimed at controlling inflation, often results in elevated interest rates. For businesses, this translates to higher costs of borrowing, which stifles investment and expansion. Entrepreneurs find it increasingly difficult to secure affordable financing, limiting their ability to innovate and grow. This creates a vicious cycle where limited business growth leads to fewer job opportunities and reduced economic dynamism.

Implications for the Business Community

For the business community, these economic challenges create an environment of uncertainty and risk. The combination of inflation, high interest rates, and a weakening cedi means that planning for the future becomes a guessing game.

Profit margins are squeezed, and the cost of doing business rises, making it difficult for companies to remain competitive. The informal sector, which constitutes a significant portion of the Ghanaian economy, is particularly hard hit, as it lacks the financial resilience to weather such economic storms.

“The moment inflation goes that high, the purchasing power of the consumer also starts diminishing. So, as a business, we’d pass on the cost, but the consumer doesn’t have the purchasing power to absorb the extra cost, so they are not buying. So right now, there is economic stagnation,”

Charles Kusi Appiah Kubi, Head of the Business and Economic Bureau at GUTA

The trifecta of inflation, high interest rates, and cedi depreciation present significant challenges for Ghana’s economy. The impact on the daily lives of Ghanaians and the business community underscores the urgent need for comprehensive economic reforms. Only through coordinated and sustained efforts can the country navigate these turbulent economic waters and achieve a more stable and prosperous future.

READ ALSO: Islamic Jihad Lambasts Arabs For Silence On Israeli ‘Desecration’ Of Jerusalem