As Ghana’s economy continues to grow, it is crucial for the government to prioritize promoting investment and retirement planning among young people. With a young and vibrant population, it is imperative to equip them with the necessary knowledge and skills to secure their financial future.

Speaking at the Maxwell Investment Group Business Forum in Accra, Mr. Godfred Amewu, a lecturer at the Department of Finance at the University of Ghana Business School urged the government to give greater attention to promoting awareness of investments and retirement planning among young people.

“We are not deliberate about creating awareness about this to the younger people and I am very happy this team is bringing that to the table. I am hoping that this discussion will move on so that we can have all the stakeholders on board to see how we can get institutions to deliberately include this in academia and their educational curriculum to ensure students are well-informed before graduation.”

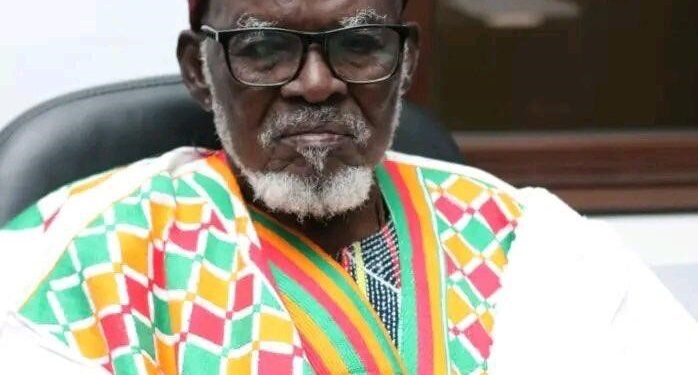

Mr. Godfred Amewu, a lecturer at the Department of Finance at the University of Ghana Business School

Encouraging investment and retirement planning at a young age allows individuals to build a strong foundation for financial independence. By educating young Ghanaians about the importance of saving and investing early, the government can help them establish healthy financial habits that will serve them throughout their lives. This includes teaching them about the various investment options available, such as stocks, bonds, mutual funds, and real estate.

Ghana, like many other countries, faces a significant pension gap as its population ages. The current pension system may not be sufficient to support retirees adequately. By promoting awareness of retirement planning among the youth, the government can mitigate this gap by encouraging individuals to start saving for retirement early. This will reduce the burden on the pension system and ensure individuals have enough funds to support themselves in their later years.

Mr. Godfred Amewu noted that an informed and financially secure population is vital for economic growth. By encouraging young Ghanaians to invest and save for retirement, the government can foster a culture of entrepreneurship and financial responsibility. Increased investment will not only provide individuals with a sense of security but also stimulate economic activities, leading to job creation and overall economic growth.

According to Mr. Godfred Amewu, promoting investment and retirement planning among young people can help address the issue of financial illiteracy. Many young Ghanaians lack knowledge about basic financial concepts, such as budgeting, saving, and investing. By incorporating financial education into the school curriculum and conducting awareness campaigns, the government can empower young individuals to make sound financial decisions, thereby reducing the risk of falling into debt or making poor investment choices.

Mr. Godfred Amewu further revealed that investment and retirement planning instill a sense of discipline and foresight in individuals. By encouraging young people to think long-term, the government can help them set goals, plan for major life events, and invest wisely. This will not only benefit individuals but also strengthen Ghana’s financial system by promoting stability and resilience.

Mr. Amewu also commended initiatives like the MIG Business Forum for their efforts in raising awareness and assisting youth in making financially sound decisions that contribute to economic growth.

The government of Ghana should play a crucial role in promoting investment and retirement planning among young people. Mr. Amewu said, “Prioritizing financial education, providing accessible resources, and raising awareness about the importance of investing and saving for retirement, Ghana can empower its youth to secure their financial future.”

This proactive approach will not only benefit individuals but also contribute to the overall economic growth and stability of the nation. It is time for the government to take action and equip the younger generation with the necessary tools to thrive in an increasingly complex financial world.

READ ALSO: Ghana’s Debt Woes Deepen As External Bond Restructuring Talks Hit Another Roadblock