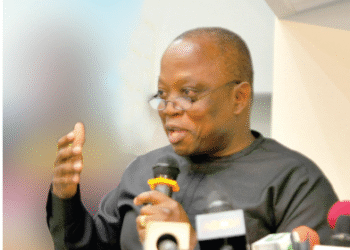

Acting Managing Director of the Precious Minerals Marketing Company (PMMC), Sammy Gyamfi, has provided clarity on the structure and purpose of Gold Board (GoldBod), emphasizing its similarities and differences with Ghana Cocoa Board (COCOBOD) and potential to revolutionize Ghana’s mining sector.

According to Sammy Gyamfi, GoldBod will serve as the central agency responsible for the trading of gold from small-scale miners and, to some extent, large-scale mining companies.

While its structure mirrors that of COCOBOD, there are key differences in their operations.

“The GoldBod model is not exactly the same as the COCOBOD model, even though there are striking similarities. But, you know, gold is not the same as cocoa”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

He pointed out that COCOBOD sets the price at which cocoa farmers are paid, often at less than 70 percent of the international market price, and justifies this through various support initiatives for farmers.

However, this approach cannot be replicated for gold, given the nature of the global gold trade.

“It is not possible,” he stated. While GoldBod will provide support to small-scale miners, its expenditures will not be as heavy as those of COCOBOD.

The key similarity lies in GoldBod’s role as the primary buyer of gold from small-scale miners through licensed agents.

“All gold produced by small-scale miners in Ghana will be purchased by licensed agents of the GoldBod.”

The Structure of GoldBod

GoldBod’s trading framework will involve multiple layers of licensed agents who will be responsible for purchasing gold from small-scale miners.

“These agents are in categories. We have licensed aggregators, then we have licensed buyers, who deal directly with the miners. And even at that level, there are two tiers. There are those who buy smaller weights of gold from miners directly, and there are those who have bigger capacities”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

These licensed agents will operate with funds advanced by GoldBod, although they can also supplement with their own capital.

This model closely mirrors COCOBOD’s system, where licensed buying companies receive seed money from the state agency to purchase cocoa from farmers.

Beyond small-scale mining, GoldBod will also have the right to purchase a portion or all of the gold produced by large-scale mining companies through negotiations under the government’s pre-emption rights.

Government as the Sole Gold Buyer

A significant shift under the new framework is that GoldBod will become the sole exporter of gold from the small-scale mining sector. This change has implications for existing bullion traders and exporters, who will now have to work within GoldBod’s structure.

“The licensed bullion traders cannot export directly. The Gold Board is going to be the sole exporter of all the gold from the small-scale sector”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

These traders will have the option to become licensed buyers or aggregators under GoldBod, allowing them to continue purchasing gold under the agency’s buying policies.

“Their export license allows them to buy gold from the local market and to export. They can continue to buy, safe to say that this time around they must buy based on the buying policy of the Gold Board and fall in on behalf of the GoldBod”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

While exporters will no longer be able to directly ship gold, they can still channel their international transactions through GoldBod.

“If an exporter says, ‘I have an off-taker in India or Dubai or in Europe who is ready to give me a hundred dollars to buy gold and export,’ they can channel that money through the GoldBod. We will receive the money, give them the cedi equivalent, they buy for the GoldBod, and the GoldBod will export the gold to their off-takers”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

This policy is aimed at tracking foreign exchange earnings from gold exports and ensuring full repatriation of funds into the Ghanaian economy.

Addressing Smuggling and Value Addition

Gold smuggling has been a persistent challenge in Ghana, with illegal channels diverting significant amounts of gold from the formal economy. GoldBod aims to reduce smuggling through improved liquidity, fair pricing, and regulatory enforcement.

“No one can totally eliminate smuggling, it’s like any other crime, you can’t eliminate crime. But with the right systems and policies, you can mitigate it”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

A key measure is ensuring that GoldBod has enough capital to buy all the gold produced by small-scale miners.

“If the government says GoldBod is responsible for buying all the gold from small-scale miners but doesn’t have enough money to buy the gold, the miner doesn’t have a choice. He wants his money, so he will sell to whoever has money”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

Ensuring competitive pricing will also deter miners from selling to smugglers.

“If the price at which you are buying the gold from the miners is not fair, if it is not reasonable, they will give the gold to smugglers because smugglers will offer them better prices.”

GoldBod will also play a crucial role in adding value to Ghana’s gold industry by promoting local refining and jewelry production.

“It is sad that, as a country that was once known as the Gold Coast, a country that is currently the lead exporter of gold in Africa, we can’t sell gold from small-scale miners to LBMA. We only sell the gold in India and Dubai”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

With GoldBod in place, the government will pursue deliberate policies to support local gold fabrication, ensuring that Ghana benefits from value-added products such as jewelry, coins, and gold-plated items.

Strengthening Oversight and Compliance

To enforce compliance, GoldBod will deploy inspectors with the authority to regulate gold purchases and prevent unauthorized transactions.

“We are gonna have GoldBod inspectors. They have powers of seizure, entry, search, and all that. They have powers like police officers who will be recruited and assigned to the various regions, and mining areas to ensure that everybody buying gold is licensed”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

This regulatory oversight will help prevent abuse by licensed agents and root out illegal operators. Additionally, strict measures will be put in place to prevent foreigners from directly purchasing gold from Ghanaian miners.

“No foreigner, and I repeat, no foreigner, be it an Indian or Chinese, will after the GoldBod commences business have the right to go and buy gold from a miner. No way. We are canceling that regime”

Sammy Gyamfi, Acting Managing Director of the Precious Minerals Marketing Company (PMMC)

The establishment of the GoldBod has raised questions about its role in Ghana’s gold trade, with many drawing comparisons to the COCOBOD.

With its structured trading model, centralized export mechanism, and enhanced regulatory oversight, GoldBod is expected to transform Ghana’s gold industry, ensuring better returns for miners while strengthening the country’s gold value chain.

READ MORE: GIPC Strengthens Investment Strategy Under AfCFTA Framework