The latest scandal involving allegations of financial misconduct in the Ghana Revenue Authority’s (GRA) Tax Refund Account is another example of the entrenched culture of impunity that threatens the country’s progress.

Corruption within Ghana’s public institutions continues to fester, eroding trust, draining national resources, and undermining economic stability.

Renowned legal scholar and anti-corruption advocate Professor Stephen Kwaku Asare has warned about what he described as a “direct theft of public funds, a betrayal of trust, and a deliberate sabotage of Ghana’s economic integrity.”

His statement reflects growing concerns about whether tax refunds—intended to reimburse deserving taxpayers—have instead been hijacked by corrupt officials for illicit personal gain.

In a scathing critique of the alleged mismanagement, Professor Asare posed some hard-hitting questions that demanded immediate answers.

“We Demand Information! Who has been receiving tax refunds? Are legitimate taxpayers benefiting, or is this a conduit for fraud? How much public money has been corruptly siphoned through refunds? Are ghost beneficiaries being paid? How was this scheme orchestrated? Who designed it, who facilitated it, and who profited from it? Is this corruption still ongoing?

“Or has it quietly evolved into a more sophisticated operation? Have there been any interdictions, arrests, or detentions? Or are the perpetrators still enjoying impunity? Are there any audit reports exposing these irregularities? If so, why haven’t they led to swift action?”

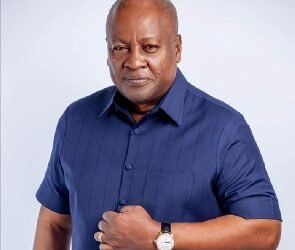

Professor Stephen Kwaku Asare, D&D Fellow in Public Law and Justice at the Centre for Democratic Development

The Cost of Corruption: Who Pays the Price?

Professor Asare emphasized that the funds in question do not belong to the government but to the Ghanaian people.

He argued that “every cedi lost to corruption in the tax system is a cedi stolen from public services, infrastructure, and national development.” This sentiment resonates with many Ghanaians who are grappling with economic hardships, high taxation, and a growing demand for improved social services.

Tax revenue forms the backbone of national development as it is what enables governments to build roads, provide water, pay public servants, and fund essential programs.

Yet, when corruption infiltrates the very institutions responsible for revenue collection and disbursement, the entire system collapses under the weight of mismanagement and dishonesty.

Corruption at the GRA also has implications for investor confidence. Ghana’s business community relies on a fair and transparent tax system to ensure equitable economic participation.

If tax refund fraud is widespread, it could discourage compliance and weaken the country’s ability to generate domestic revenue.

The GRA, as the nation’s foremost tax administration body, plays a crucial role in revenue mobilization. However, these latest allegations threaten to undermine public confidence in the institution.

Professor Stephen Kwaku Asare’s bold statement serves as a rallying cry for all Ghanaians to demand accountability. It is no longer enough to simply express outrage whenever corruption scandals emerge.

Taxpayers expect the GRA to uphold the highest standards of financial accountability and integrity. If confirmed, these fraudulent activities would mark yet another failure in Ghana’s fight against systemic corruption.

Previous reports on financial irregularities in Ghana’s tax system have often been met with weak enforcement and delayed responses.

Many fear that, without sustained public pressure, the latest revelations could be swept under the carpet, allowing culprits to evade justice while financial losses continue to mount.

Ghanaians deserve a full-scale audit of the Tax Refund Account, with clear findings made available to the public. Any official found to have facilitated or benefited from fraudulent tax refunds must face legal consequences.

The era of financial impunity must end, and it must end with a clear commitment to justice and accountability. Citizens must actively hold leaders accountable, demand transparency, and insist that the institutions responsible for safeguarding public funds do their jobs.

READ ALSO: WTO Chief Urges Africa to Tap Internal Resources for Sustainable Growth