Assistant Commissioner of Ghana Revenue Authority (GRA), Dominic Naab, has blamed government’s failure to make enough revenue via taxes on the cash economy being operated in the country.

According to him, as a result of the nature of a cash economy, the populace are able to effortlessly evade questions about monies received.

Mr Naab explained that when individuals receive gifts in the form of cash, the Authority is unable to trace this kind of act. This, he explained, makes it impossible to receive the part of money intended to be taxed.

“In Ghana, we are operating a cash economy. If you are operating a cash economy, it is very difficult (to collect taxes). If somebody gives you a gift and it is in the form of cash, how am I able to determine that you have actually collected cash? Therefore, you have to pay tax on it”.

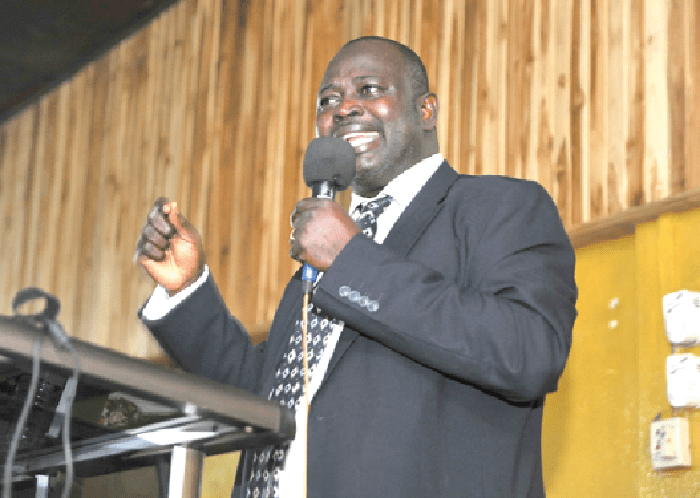

Mr Dominic Naab

Yaw Appiah Lartey, a partner and financial advisory leader at Deloitte Ghana, on his part expressed concern over the loss of monies to the state. He noted this happens due to the fact that carpenters, masons, doctors among others receive pay through physical transactions.

“We operate a cash economy where you pay some of these professionals in cash. So if someone provides accounting services for you, you pay the person in cash. If you go to see some doctors, you pay in cash. So if you do all of that, it is so easy for people to get away with this.

“Your usual masons, carpenters, they are the bigger chunk that are also outside the bracket and we haven’t found a way to bring them into the tax net. That is because of the same problem, that is, we are operating a cash society where most of our transactions are through cash payment”.

Mr Yaw Appiah Lartey

Cashless initiative by GRA

Touching on the cashless drive by government, Mr Dominic Naab, disclosed that GRA is undertaking a cashless initiative to fix the loopholes which lead to the state losing millions of Ghana cedis.

“What we have done is that GRA is a major player in the ecosystem. We have gone cashless because there is a clarion call by government to actually create cash lite or cashless economy. So GRA has taken the lead to actually ensure that we go cashless. We are trying to do that to ensure we are able to block the loopholes within the system to ensure we are able to mobilize the needed revenue.”

Mr Dominic Naab

There have been various calls by concerned stakeholders on the evasion of taxes by lawyers and other professionals in the country. Earlier, Professor Kwaku Asare, had petitioned President Akufo-Addo and the Attorney General, Godfred Yeboah Dame, to arrest and prosecute lawyers found culpable of evading taxes.

According to him, the President and the Attorney General must refrain from issuing warnings and advice to lawyers but rather ensure they face the law.

Professor Asare in a Facebook post noted that “if lawyers, or other professionals, are not paying taxes, arrest and prosecute them”.

Read Also: Develop innovative ideas to promote trade- Akwasi Gyan