Mr. Isaac Adongo, Member of Parliament for Bolgatanga Central has highlighted on certain repercussions in line with government’s debt exchange program initiatives.

Mr Isaac Adongo during a press briefing at Parliament stated that, the current debt restructuring as initiated by the government is not being properly structured and pursued as expected.

According to Mr. Adongo, he bemoaned that, the domestic debt restructuring programme announced by the Minister of Finance, Ken Ofori-Atta, will destroy funds of investors far in excess of the US$3 billion support government is seeking from the International Monetary Fund (IMF)

“We cannot in the search for US$3 billion from IMF to destroy over US$100 billion of Ghanaian resources; that will not happen. And I want to serve warning that investors, the banks, the Pension Funds and the fund managers should know that the Bank of Ghana is not their friend.”

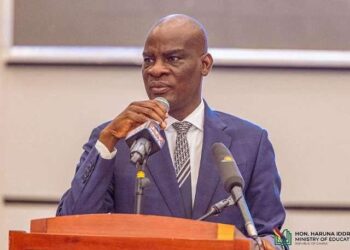

Mr. Isaac Adongo

Mr. Adongo further stressed on the fact that, it is assumed other financial regulatory bodies like the Securities and Exchange Commission (SEC), the National Pensions Regulatory Association (NPRA), Special deposit-taking institutions (SDIs) and National Insurance Commission (NIC) were all in agreement with government to destroy shareholders’ and individual investors resources (funds).

Not limited to that, he further stated that, the Minority in Parliament was urging stakeholders to rise up and seek to reclaim their positions and their investments.

“We agree that Ghana needs restructuring but not an illegal, unilateral and arrogant misappropriation of people’s resources. This is the time to call on those activist investment lawyers, those vigilante lawyers to step up and claim their place in the fight to rescue this country.”

Mr Isaac Adongo

Consider The Pain of Individual Investors

Mr. Isaac Adongo indicated that, Ghana is currently facing economic headwinds with a domestic debt programme facing opposition from stakeholders, largely from institutional bondholders.

According to him, large institutions which are affected by the haircut use investment purchased by the individual citizens to buy the bonds, hence, implementing hair cut on bonds purchased by institutions turns around to adversely reduce the principal of individuals whose monies were used to purchase the bonds by companies

Mr. Isaac Adongo in conclusion advised that, regardless the fact that Government is hoping to close a deal on debt restructuring at home in order to be able to access an International Monetary Fund (IMF), facility to support the failing economy, it should also take into consideration certain impact its initiatives has on its citizens.

Read Also : SMEs Urged To Build Strong Brand Reputation To Stay Competitive