The Ghanaian government’s plea for a staggering US$449,446,247.95 in tax exemptions for various companies presented to Parliament has ignited a fierce debate among legislators.

The Minority has therefore pledged to vehemently resist the current tax waiver applications and called for transparency in the process.

The Minority Leader in Parliament, Dr. Ato Forson, declared that the Minority would only support these requests if the companies seeking tax exemptions agree to cede a commensurate equity stake in their projects or businesses to the state, in accordance with the Exemptions Act, 2022 (Act 1083).

“We in the Minority are serving notice that we shall resist these tax waiver applications fiercely! In their current forms, we shall resist each and every one of the tax waiver applications with all the tools and strategies at our disposal.

“This government is simply robbing Peter to pay Paul by exacting taxes from Ghanaians, only to dole out huge tax exemptions to their cronies for kickbacks. It is for this reason that we call on all Ghanaians to join us in this fight.”

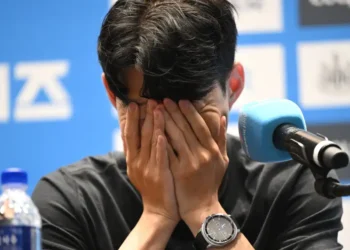

Dr. Cassel Ato Forson

In addition, Member of Parliament for South Dayi, Rockson-Nelson Dafeamekpor took to his X-account (formerly Twitter) to express his dismay.

“No wonder the Minority Leader calls it the New Kickback Scheme. It’s obscene; the kinds of figures being exempted.”

Hon. Rockson-Nelson Dafeamekpor

The Minority Leader, Dr. Cassiel Ato Forson, re-echoed this concerns among others, signaling the minority’s intent to resist these proposed tax exemptions.

Minority’s Concerns Over Tax Exemptions

The list of companies seeking tax exemptions included 45 entities presented to Parliament, encompassing those designated as One-District-One-Factory companies and strategic investors under the Ghana Investment Promotion Centre (GIPC).

Dr. Ato Forson, in the statement accused the Akufo-Addo government of turning its attention to tax revenues to satisfy their “insatiable greed.”

In the press release, the Minority expressed concerns about the potential negative impact of these tax exemptions on the country’s economy, especially considering the challenging economic times. They argued that the government’s focus on tax exemptions is diverting attention from critical issues, such as the need for domestic revenue to prevent further economic decline.

The Minority Leader questioned the rapid escalation in the number of companies seeking tax exemptions under the current administration, terming the situation frightening. He disclosed that the government is seeking tax exemptions amounting to USD 449,446,247.95 for the 45 companies, equivalent to over 5.5 billion Ghana cedis. Additionally, he claimed that there are 118 more companies in the pipeline for tax exemption consideration, with a total value of exemptions reaching about seven billion Ghana cedis.

“Ladies and gentlemen, the phenomenon of tax exemption as an avenue for corruption is a frightening development that threatens the domestic revenue reforms that the state is currently undertaking. As we speak, government is seeking to rake in some GHS11 billion from a plethora of new tax measures it has outlined in the 2024 budget. The effect of these new taxes will result in the poor becoming poorer, suffocating industry and businesses and further increasing the hardships Ghanaians are already experiencing.”

Dr. Cassel Ato Forson

Dr. Ato Forson emphasized that the Minority in Parliament views these requests as “unconscionable, inordinate, and bearing all the trappings of organized crime.” He referred to the incident on July 28, 2023, when Minister of Trade and Industry K.T Hammond, along with Carlos Ahenkorah, accused Chairman of Parliament’s Finance Committee, Kweku Kwarteng, of obstructing certain tax waivers.

With these concerns, the Minority further raised worry over the haste in processing these exemptions without adequate parliamentary scrutiny.

READ ALSO: Opportunistic Middlemen Plague Food Prices Along Supply Chain