Ranking Member on Parliament’s Finance Committee, Dr Cassiel Ato Forson, has disclosed the reasons for the current economic meltdown experienced by both government and Ghanaians in the country.

According to him, the size of government is one of the reasons for the current state of the economy. He indicated that the incumbent NPP has the “largest size of government” in the history of Ghana, counting some 125 ministers at a point in the party’s governance.

“I know some of you might still be wondering how we got into this economic mess! Here are a few reasons… The number of spokespersons at various MDA’s paid above the pay of Directors! The number of CEOs at various State-owned Enterprises (SOEs) and their pay packages! Many of these SOEs now employ 3 or 4 deputy CEOs with fat conditions of service!”

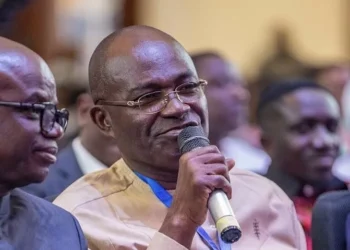

Dr Cassiel Ato Forson

Dr Forson noted that another reason is that the government has over 1000 presidential staffers paid as article 71 office holders at the jubilee House. He equally explained that the appointment of “so many special assistants to ministers with emoluments” close to that of deputy ministers at the various MDA’s has done little to resuscitate the economy.

Taking into consideration, the impact of the over 50 new agencies such as CODA, NADA, MBDA, free SHS secretariat, 1D1F secretariat, petroleum hub development authority, Ghana cares secretariat, among others, Dr Forson stated that these agencies have zero output.

State of the economy in the country

Additionally, Dr Forson disclosed that the “unconscionable decision” to send over 100 Databank staff to the finance ministry as special assistants and paid as customs commissioners on GRA’s payroll is another blot on the current government’s book.

Prior to this, the ranking member on Parliament’s finance committee revealed that he expects the Ghana cedi to depreciate further from January to June this year before a possible IMF Board approval in the second quarter of 2023. He indicated that Ghana’s economy will record one of the worst non-oil GDP growths due to the impact of the debt restructuring measures of the government and other harsh fiscal and monetary policies.

Dr Forson further explained that the haircut on domestic bonds and Eurobond by government is expected to adversely impact the health of the banking sector, local businesses, and individuals. Also, he stated that bilateral debt restructuring will lead to government’s foreign-financed projects being abandoned.

Furthermore, he noted that unemployment will worsen due to the freeze on employment, debt restructuring, poor business climate, and massive austerity. Ghana, he emphasized, will default in the payment of interest and principal on domestic bonds, Eurobonds, and most of its bilateral loans in 2023.

Commenting the ripple effect of the debt restructuring, Dr Forson indicated that the events will be compounded by expected lay-offs from the financial sector and expected lay-offs from government foreign-financed projects.

He also indicated that the complete reversal of discount on import values of goods and vehicles coupled with the introduction of the 2.5 % increase in VAT and other taxes on businesses will keep prices of goods and services “high, and, in some cases, higher than the current prices”.

Additionally, he explained that the government’s policy of automatic adjustment of electricity tariffs will exacerbate the high cost of living in 2023, even as inflation is expected to be above 30% for the most part of 2023.

READ ALSO: Growing Indiscipline In Secondary Schools Means Stakeholders Including GES Have Failed- Amaliba