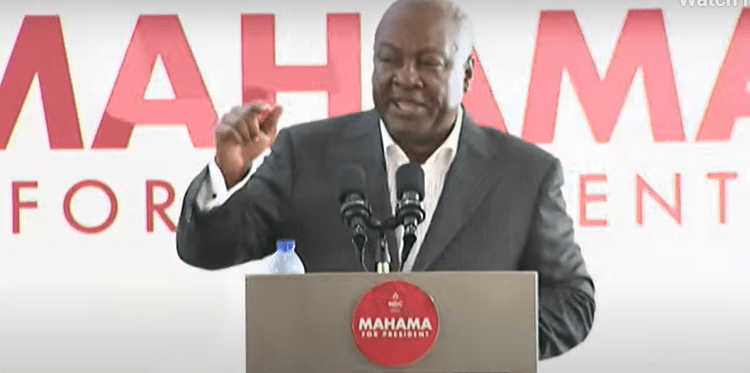

The National Democratic Congress (NDC) National Communications Officer, Sammy Gyamfi Esq. has outlined a series of ambitious social interventions and tax reforms in the party’s 2024 manifesto.

Lawyer Sammy Gyamfi began by highlighting five key social interventions policies in the party’s Manifesto designed to provide significant relief to various segments of the population.

“In line with our objective to alleviate hardships and cushion suffering Ghanaians, the next NDC/Mahama government will..”, Lawyer Sammy Gyamfi stated.

The first policy according to Lawyer Sammy Gyamfi is the No-Academic-Fee Policy for First-Year Students.

He stated that under the “No-Fees-Stress” initiative, the next NDC government would introduce a ‘No-Academic-Fee’ policy for all first-year students in public tertiary institutions.

This policy, he noted will cover universities, technical universities, polytechnics, colleges of education, nursing training institutions, and other public tertiary institutions.

Lawyer Sammy Gyamfi stressed that the policy aims to relieve students and their families from the financial burdens associated with tertiary education and will be implemented within the first 90 days of the NDC assuming office.

To further support the financing of education, the NDC plans to reintroduce and redeploy the Student Loan Trust Fund Plus (SLTF Plus) for continuing students in public tertiary institutions.

The National Communications Officer of the opposition NDC strongly asserted that the initiative is also part of the “No-Fees-Stress” policy and is aimed at reducing the financial stress on students already enrolled in these institutions.

Furthermore, Lawyer Sammy Gyamfi affirmed the NDC’s commitment to implement Free Tertiary Education for Persons With Disabilities in a move to promote inclusivity and support persons with disabilities.

This policy, he stated underscores the party’s commitment to ensuring that every Ghanaian, regardless of their physical condition, has access to quality education.

Additionally, Lawyer Sammy Gyamfi mentioned the NDC’s plans to establish the Ghana Medical Care Trust, also known as “MahamaCares,” to provide financial support for healthcare costs associated with chronic diseases.

The initiative according to him will cover conditions such as kidney failure (including dialysis), cancers, sickle cell disease, diabetes, hypertension, and other heart diseases to reduce the financial burden of healthcare on individuals and families affected by these chronic conditions.

Highlighting the challenges faced by female students, particularly in basic and secondary schools, Lawyer Sammy Gyamfi indicated that NDC will provide free sanitary pads to these students.

This initiative, he ndicated is designed to promote menstrual hygiene, reduce absenteeism, and ensure that no female student misses school due to a lack of sanitary products.

Key Tax Reforms in NDC’s 2024 Manifesto

In addition to these social interventions, the NDC National Communications Officer also outlined a series of tax reforms aimed at easing the high cost of living and doing business in Ghana.

According to Lawyer Sammy Gyamfi, the NDC plans to scrap several “draconian” taxes within the first 90 days of assuming office.

These include the Electronic Transactions Levy (E-Levy), which has been widely criticized for its impact on electronic transactions and the broader economy and the removal of the COVID Levy introduced during the pandemic to support government expenditure.

Again, Lawyer Sammy Gyamfi indicated that the National Democratic Congress when elected into power would abolish the 10% Levy on Bet Winnings and the elimination of Emissions Levy.

To further ease hardships, Lawyer Sammy Gyamfi announced NDC’s plans to review import duties on vehicles and equipment imported for industrial and agricultural purposes, aiming to boost these sectors and create more jobs.

He also stated that the NDC will utilize the Price Stabilization and Recovery Levy to cushion consumers against fluctuations in fuel prices and equally, rationalize Fees and charges at Ghana’s ports to reduce the financial burden on importers and the general public.

Among several tax measures, Lawyer Sammy Gyamfi revealed the NDC’s plans to undertake a comprehensive reform of Ghana’s Value Added Tax (VAT) regime to provide relief to households and businesses.

This will include reversing the decoupling of the Ghana Education Trust Fund (GETFund) and National Health Insurance Levy (NHIL) from VAT and adjusting the VAT registration threshold upward to exempt micro and small businesses.

Others include repealing the law imposing VAT on domestic electricity consumption and reversing the VAT flat rate regime.

To enhance revenue mobilization, the NDC National Communications Officer announced that the next NDC government will broaden the tax base and plug leakages in tax collections, ensuring a fair and efficient tax system, and in addition review the tax exemption regime to promote transparency, economic growth, technology transfer, and job creation.

The NDC’s 2024 manifesto, as outlined by Sammy Gyamfi, reflects the party’s commitment to addressing the pressing needs of Ghanaians through bold social interventions and comprehensive tax reforms.

These initiatives are designed to provide relief to individuals and businesses, promote economic growth, and ensure a more equitable distribution of resources across the country.

READ ALSO: War-Torn Sudan Faces Second Deadly Cholera Outbreak