A ranking Member on Parliament’s Finance Committee, Cassiel Ato Forson, has disclosed that the electronic transaction levy captured in the 2022 budget is bound to erase the cashless economy in the country.

According to him, the move is counter-productive to plans aimed at making the Ghanaian economy cashless. This, Dr Forson explained, would coerce Ghanaians to carry out transactions using physical cash.

“This budget is going to erase the cashless economy we are talking about. People are now going to keep their monies at home. People are now going to trade with cash because any transaction you engage in with the bank, you are going to pay a digital tax. The government will charge an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient. Today, we are confronted with the situation that the very thing we are doing to help the cashless economy, today, we are erasing all of that. I am sad as a Ghanaian”.

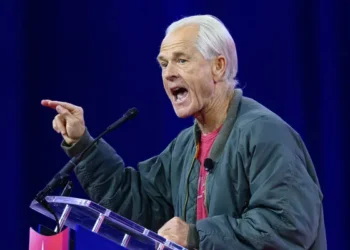

Dr Cassiel Ato Forson

The Finance Minister,Ken Ofori Atta in his presentation of the 2022 Budget Statement and Economic Policy to Parliament on Wednesday, November 17, 2021, announced that the introduction of an Electronic Transaction Levy will increase tax revenues for the country. Following the statement, Dr Forson insisted that the move by government to introduce the levy will have a ripple effect on businesses as well and will not support the growth of the banking sector.

The former deputy finance minister noted that the e-levy captured in the ‘Agyenkwa’ budget will only make businesses in the country suffer. Dr Forson explained that the government only seeks to reverse all gains made in the banking sector through the e-levy.

Electronic transaction charges on remittances

Based on introduction of the levy, government’s charge of an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances shall be borne by the sender except inward remittances, which will be borne by the recipient.

Commenting on this, Dr Forson revealed that the Minority have said that they are “not going to accept” this because it will not help the banking sector. He described it as insensitive to Ghanaians as a result of the inclusions of remittances which he reckons are equivalent to taxes on savings.

“The next item on the same e-transaction levy has to do with remittances… Can you look at the faces of the constituents to tell them that the old lady in the village whose son and daughter is living abroad sending that person some small money for medical expenses, school fees you are saying that you are going to tax and take 1.75% from this meagre money! What insensitivity is this? How can you be this wicked?”

Dr Cassiel Ato Forson

Dr Forson revealed that if government isn’t cautious, “black marketing” will boom in the economy because people will go underground. The remittances that come through the banking system, he insisted, that helps “show our reserves” if care is not taken, “will go underground”.

On his part, the Chairman of Parliament’s Finance Committee, Kwaku Kwarteng stated that Dr Forson’s prediction of a worsening scenario is farfetched. He revealed that it is not appropriate that Dr Forson is “in opposition” and hope that these government policies will have the worst consequences possible.

Mr Kwarteng advised Ghanaians not to conclude on the issue but instead, be patient to see the legislation that would be brought on board by the Finance Ministry in the policy activation.

Read Also: Government Abolishes Road Tolls- Finance Minister Announces