K.T. Hammond, the Minister for Trade and Industry, has suggested a new business approach that aims to streamline the implementation of businesses in Ghana.

The ministry anticipates that this strategy, once fully enacted, will enhance the growth initiatives of both the public and private sectors.

This announcement was made by the sector Minister, K.T. Hammond, during the Ghana Mutual Prosperity Dialogues event in Accra, themed ‘Investment, Growth, and Jobs’.

“We have realized in the country that we are complicated. That is why we have tried to demystify our business environment. Very soon, our ministry, with the help of the Ministry of Finance, is going to roll out a name and a similar form of business revenue strategy. Because we are aware that businesses and your businesses are only as good as the institutional and regulatory framework that underpins them.”

K.T. Hammond

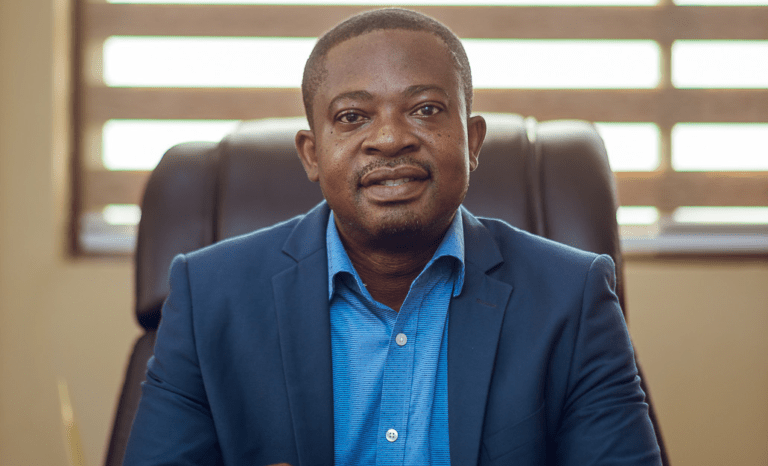

Speaking on behalf of the business community, the Chief Executive Officer of the Association of Ghana Industries (AGI), Seth Twum Akwaboah, impressed upon the government to ensure that businesses continue to enjoy a congenial environment.

“Our private sector and, for that matter, investments in Ghana need a politically stable environment, which is critical for any serious long-term plan. In this regard, we expect the government to create a business environment for businesses to thrive.”

Seth Twum Akwaboah

Mr. Twum Akwaboah assured the government the support of the business community to offer expertise on the problems faced in the private sector.

“We will continue to offer our expert advice on some of the challenges we face as a country. The private sector and investments in Ghana must enjoy a politically stable environment, which is critical for any serious long-term economy. To this end, we expect the government to create an enabling, resilient environment for businesses to survive. In creating that environment, we don’t expect to see several layers of regulations that only add to the cost of doing business.

“What we think is lacking is the enforcement of some of the business regulations to ensure fair trade practices. For example, we continue to see a multiplicity of taxes and attempts to show up in our domestic revenue.”

Seth Twum Akwaboah

Ghana Mutual Prosperity Dialogues

The framework of the Ghana Mutual Prosperity Dialogues functions as a collaboration between the public and private sectors, to draw in foreign and local investments and promote collective growth within the nation.

The primary goal of the GMPD is to recognize hurdles in the investment landscape and offer remedies to establish a favorable environment for stakeholders. Additionally, it seeks to gain deeper insights into the requirements of the private sector and effectively eliminate obstacles that impede the ease of conducting business within the country.

By actively involving the private sector at the industry level, the government strives to formulate robust policies that harmonize with the aspirations of various sectors.

Presently, numerous companies lament the influx of substandard products into Ghanaian markets, often evading proper duties and taxes, thereby unfairly competing with local producers. Therefore, Seth Twum Akwaboah furthered that what all businesses truly require is the strict enforcement of existing tax policies and the closure of revenue loopholes within the organization.

The participating businesses indicated their eagerness to witness investments that foster the development of local production capabilities, enabling the production of essential goods that meet the country’s consumption needs. Across the globe, almost every nation is implementing some form of economic growth strategy.

Also, according to the recent KPMG Budget Survey, businesses in Ghana are urging for the abolition of various taxes that are hindering their operations, including the E-levy and COVID-19 taxes, in the upcoming 2024 Budget.

The survey findings highlighted that 76% of respondents found the E-levy burdensome, while 68% considered COVID-19 taxes problematic. Additionally, concerns were raised regarding import tariffs, the petroleum levy, and the growth and sustainability levy. Alongside these tax-related issues, businesses emphasized the need for streamlined business registration procedures to enhance operational efficiency.

READ ALSO: Businesses In Ghana Want Free SHS Reviewed