China’s healthcare market will remain substantially developed than sub-Saharan Africa’s (SSA’s) top 11 healthcare markets combined in the long-term, according to Fitch Solutions.

China’s economic transformation from a manufacturing focus towards a more service-based model, has necessitated increased priority on health care provision. Dwelling on quality and coverage, China is significantly ahead of SSA with its flagship universal health insurance scheme which reached over 1.3 billion citizens nationwide since 2016.

In contrast, SSA’s top markets, listed in order of health care spending: South Africa, Nigeria, Côte d’Ivoire, Senegal, Kenya, Ghana, Cameroon, Tanzania, Uganda, Ethiopia and Sudan, have remained slower in momentum towards achieving universal healthcare.

“We believe that this is mainly due to funding issues as most government budgets in the region remain constrained. This is reflected in the low healthcare spending levels, with China spending almost 8 times higher on healthcare than the SSA average.”

Fitch Solutions

Healthcare Reforms needed to drive growth in healthcare in the region

Fitch Solutions advocates for African governments to implement some healthcare reforms to make SSA’s healthcare market more competitive. Within the last two decades, China has benefited from large scale reforms in the fields of medical infrastructure and insurance as well as the opening up of its healthcare market.

According to Fitch Solutions, focus has not only been centred on urban areas, “but also continuously making healthcare more accessible in rural China… increasing the number of hospitals, doctors and medical equipment.”

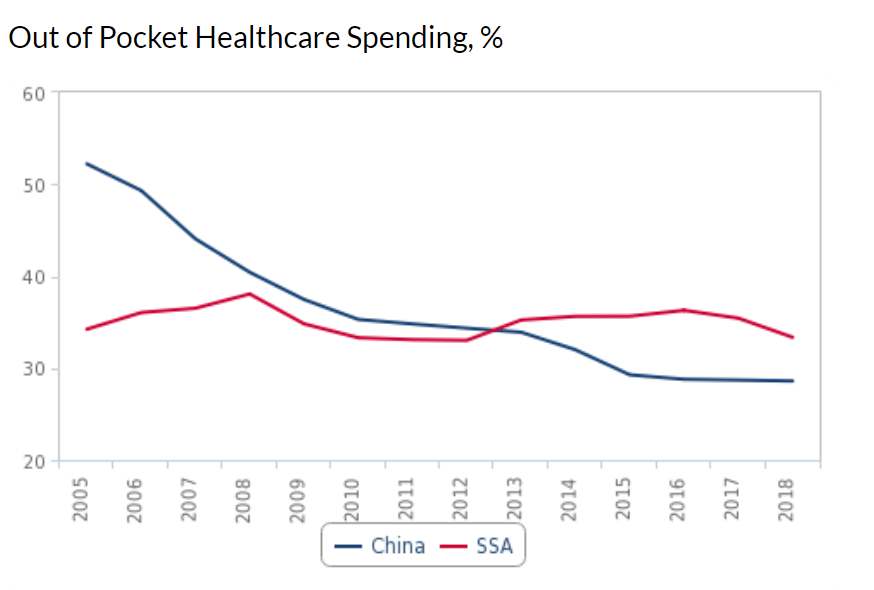

Also, in China, out-of-pocket expenditure has reduced significantly over the period of 2008 to 2018, attributed to the reforms in healthcare systems. Higher public spending has helped to reduce investment risk and created a more attractive environment for services and products of multinational companies.

Out-of-Pocket Spending higher in SSA than China

Comparatively, Out-of-Pocket spending in SSA has remained flat over recent years. Whilst many countries in the region have long-term ambitions to reduce spending and achieve universal healthcare, progress towards these remain slow.

For instance, in Senegal, its NHIS programme after launch in 2013 was said to have a target of 75 per cent coverage as at 2017. However, at the end of June 2019, it was reported that only an estimated 45.4 per cent of the Senegalese population was covered.

Also, Côte D’Ivoire which has plans to implement universal healthcare by 2030, it is estimated that less than 7 per cent of its population was enrolled in its national healthcare scheme in 2019.

Over the next five years, Fitch projects that government healthcare spending in SSA will not register rapid growth in the top African markets. “We expect government healthcare expenditure to grow by a CAGR of 4.4 per cent, which is low compared to China” with expected health care spending growth of around 12.6 per cent within same period.

Furthermore, Fitch noted that, it expects wealth disparity between China and SSA to persist over the long term. Over the next ten years, Fitch believes GDP in SSA will average around 3.1 per cent compared to 5.2 per cent in China.

The growth forecast is, however, associated with a bumpy and uneven economic performance: high unemployment, limited fiscal space and rising unrest. These downside risks to growth will weigh on the economic outlook of the region’s largest economies such as South Africa and Nigeria, Fitch indicated.

READ ALSO: Google: US$1 billion Africa Investment to Take Advantage of Favourable Demographics