The Oliver twist syndrome

$14 billion have been waived by the Group of 20 leading economies for the world’s poorest countries.The lender has disbursed $10.1 billion through emergency facilities or augmented existing arrangements to 29 sub-Saharan African countries.

Africa is reluctant to sever the umbilical cord of Foreign loan. According to the International Monetary Fund, $44 billion has not been financed yet even after several countries have taken up emergency loans and debt-service relief initiatives.

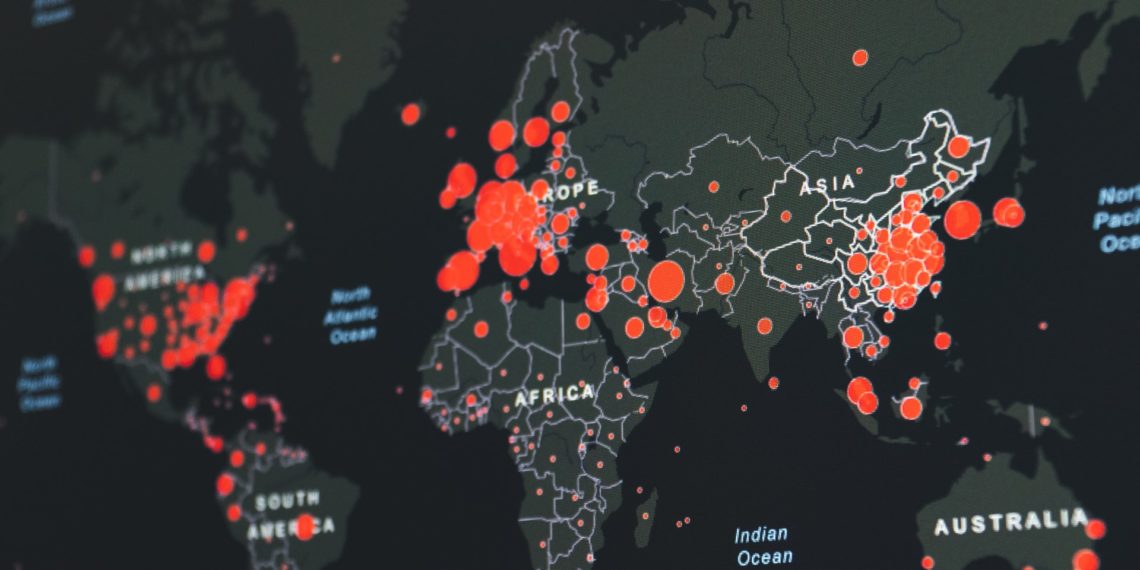

Sub-Saharan Africa will need more $110 billion in additional funding to contain the spread of COVID-19 this year.

The funding needs persist despite the IMF approving debt-service relief for 21 sub-Saharan African countries for an initial six-month phase ending mid-October and a Debt Service Suspension Initiative by the Group of 20 leading economies that waived up to $14 billion in payments for the world’s poorest countries — most of them in Africa — until December, the lender said Monday in a regional economic outlook update.

The lender has disbursed $10.1 billion through emergency facilities or augmented existing arrangements to 29 sub-Saharan African countries, it said. More international support is urgently required for the region to overcome the crisis and return to sustainable growth, according to the IMF.

“This crisis is unprecedented, Our efforts today will have significant consequences down the road, not only in helping our members offset the immediate tragedy of the crisis, but also in ensuring that peoples’ lives and livelihoods are not destroyed forever.”

Abebe Aemro Selassie, the director of the IMF’s African department

Real GDP per capita forecast to contract by 5.4% to a level last seen around 2010

Sub-Saharan Africa’s economy is forecast to contract by 3.2% in 2020, double the IMF’s April estimate. The lender cut gross domestic product forecasts for 37 of the region’s 45 economies, with the largest downward revisions in tourism-dependent Comoros and Mauritius. The forecasts for the change in GDP in oil-exporting countries was cut by 2.1 percentage points, the IMF said.The decline in regional output is likely to erase nearly a decade of progress in development, with real GDP per capita forecast to contract by 5.4% to a level last seen around 2010, the lender said. The pandemic is likely to increase global poverty levels for the first time since the Asian crisis in 1998, with 26 million to 39 million more people at risk of extreme poverty in sub-Saharan Africa alone, the IMF said, citing World Bank estimates.

Support packages in sub-Saharan Africa will impact growth rate

While economic growth in the region is projected to rebound to 3.4% in 2021, it’ll be shallower than the expected world growth rate because support packages in sub-Saharan Africa are “considerably smaller” than those implemented in many other economies, the IMF said.

“Downside risks could materialize if health systems are overwhelmed, given that many economies have reopened before the infection has peaked,” the IMF said. “However, with the easing of global financial conditions and a rebound in oil and other commodity prices, the projected downturn could be less pronounced.”